VAT in France

The French term for value-added tax is “Taxe sur la valeur ajoutée” – TVA for short. The EU founding member was the first country to have a value-added tax. VAT was introduced in France as early as 1954 and was extended to the entire economy in 1968. Since then, the various tax rates have been adjusted again and again.

VAT rates in France

Taux normal de TVA (standard tax rate): It is 20% and applies to most sales of goods and services. This rate applies to all products and services that are not regulated by specific VAT rates.

Taux réduit de TVA (reduced tax rates)

- Reduced rate of 10%

This intermediate rate applies to passenger transport, accommodation, furnished rental properties or classified campsites, particular renovation and maintenance work on dwellings, restaurants, non-refundable medicines, entrance fees to cinemas, fairs, museums, zoos, cultural sites, exhibitions, etc. - Reduced rate of 5.5%

The reduced rate applies to foodstuffs, the supply of building land to non-profit housing associations, the supply of new social housing, equipment and services for the disabled, gas and electricity subscriptions, the supply of heat from renewable energy sources, books (including digital), live performances, social housing and works to improve the energy quality of housing, the supply of works of art by their author or his successor in title.

Taux particulier (special tax rate): This is 2.1%. It concerns medicines reimbursed by social security, television licence fees, sales of live animals for slaughter and sausages to individuals not subject to this tax, premieres of theatrical performances or classical works restaged, and specific circus performances involving only original creations.

- French tax rates: economie.gouv.fr/particuliers/tva-taux-quotidien

- Information from the French administration on the “Taxe sur la valeur ajoutée”: service-public.fr/professionnels-entreprises/vosdroits/N1344

- Information, forms, etc. are also available in English: service-public.fr/professionalsentreprises/vosroits/N1344. — partly also available in English: economie.gouv.fr/particuliers/tva

Input VAT refund

Mainly when companies operate across borders, they also have to pay VAT. Then, of course, the question of input tax deduction arises.

If a company from Germany registers for VAT in France and has also paid French VAT based on invoices from companies in France, the input tax can be claimed accordingly in the VAT assessment in France.

If a company from Germany has paid VAT in France and is not registered there, the input tax refund procedure comes into consideration for reimbursement. Detailed information on the procedure and further information from the French administration can be found here.

Declaration obligations in France

Only in a few cases, it is not necessary to file a VAT return in France. Special VAT rules apply to various supplies of goods and services, e.g. for small entrepreneurs, flat-rate farmers, tax-exempt individuals, certain other services according to § 3a paragraph 3, transport services (§ 3b UStG) and restaurant services (§ 3e UStG).

As a general rule, if VAT has to be paid in France, the business that owes the tax must also register there unless it participates in the One-Stop-Shop.

By the way: France also grants VAT exemptions, flat-rate taxation and relief for small businesses.

Services to a company in France (B2B)

The so-called reverse-charge procedure (French: autoliquidation) applies to other services to an entrepreneur according to § 3a paragraph 2 UStG. The German company, therefore, does not show any VAT but must refer to the change of tax liability in the invoice and indicate both its VAT identification number and the VAT identification number of the company in France.

Attention: In this context, recapitulative statements (ZM) to the Federal Central Tax Office (BZSt) should be remembered.

Supply of goods to companies in France (B2B)

If there is an intra-Community supply of goods (§ 6a UStG) from a company in Germany to a company in France, the German company does not have to pay VAT. The company in France must pay tax on the acquisition. The prerequisite is that the goods are delivered or dispatched to France. The recipient is an entrepreneur liable for VAT in France, and uses a valid VAT identification number vis-à-vis the company in Germany.

Supply of goods to private individuals (non-entrepreneurs) in France (B2C)

For deliveries of goods to private customers in France, VAT must always be shown and paid in France. Then the company must register accordingly in France. However, suppose only a small amount is supplied to private individuals in France. In that case, there is a simplification: Since 1 July 2021, an EU-wide supply threshold of EUR 10,000 applies here (until 30/6/2021, the de minimis threshold for France was EUR 35,000). If this threshold is not exceeded, taxation takes place in Germany. This threshold also applies to other services according to § 3a paragraph 5 UStG – i.e. electronic services, telecommunications, radio, and television services. However, the entrepreneur may waive the application of the supply threshold (§ 3c para. 4 UStG).

Services to private individuals (non-entrepreneurs) in France (B2C)

If a company from Germany provides other services to private customers in France, German VAT must generally be shown (§ 3a para. 1 UStG). However, in the case of telecommunications, radio and television services as well as electronic services (§ 3a paragraph 5 UStG), the country of destination principle applies – i.e. taxation in France theoretically (note: delivery threshold EUR 10,000, see the following explanations). Theoretically, the reverse-charge procedure does not apply to private customers.

Warehousing in France

If a merchant with a registered office outside France accesses a warehouse in France, some regulations must be observed.

Many merchants offer their products via Amazon FBA. As part of the fight against fraud, the French tax authorities have obliged Amazon to provide data such as the VAT identification number of a seller’s Amazon business from the previous year by 31 January each year.

The French tax authorities can use this data to verify that the merchant complies with French tax requirements. In the event of violations of the guidelines, the Amazon.fr account may be blocked.

Important note

Special VAT rules apply to various supplies of goods and services, e.g. for small entrepreneurs, flat-rate farmers, tax-exempt individuals, certain other services according to § 3a paragraph 3, transport services (§ 3b UStG) and restaurant services (§ 3e UStG).

As a general rule, if VAT has to be paid in France, the business that owes the tax must also register there unless it participates in the One-Stop-Shop.

By the way: France also grants VAT exemptions, flat-rate taxation and relief for small businesses. Extensive information can be found here.

When do I have to register as a merchant in France?

Few EU businesses must register for VAT in France when providing services to local French companies. In most cases, the reverse-charge procedure takes place.

Registration is mandatory in the following situations:

- When importing goods into France, if the customer is not a French company with a local VAT registration (so-called reverse-charge procedure).

- The purchase and sale of goods in France if the customer is not a French company with a local VAT registration (so-called reverse-charge procedure).

- The storage of goods in a French consignment warehouse (warehouse of a supplier or service provider located near the customer and buyer) for at least three months.

- Sale of goods to French consumers via distance selling (internet, catalogues, etc.)

- Self-sufficiency in goods as a business

- Certain leasing services

How does registration with the French tax authorities work?

Registration as a company in France can be done, for example, via the official website. Here, non-resident merchants receive the VAT number (USt-IdNr) necessary for the regular advance VAT returns (UStVA).

Where does the VAT declaration take place in France?

Service des impôts des entreprises étrangères

10, Rue du Centre

TSA 20011

93465 Noisy-le-Grand Cedex

Phone: + 33 (0)1 72 95 20 31

E-mail: siee.dinr@dgfip.finances.gouv.fr

Website: www.impots.gouv.fr

Attention: However, much of the information is filed in French. Companies from EU member states are not obliged to appoint a fiscal representative. However, in case of language difficulties, it may be helpful to seek assistance. Therefore, a company from an EU Member State may voluntarily decide to appoint a fiscal representative.

What must be reported in a VAT return in France?

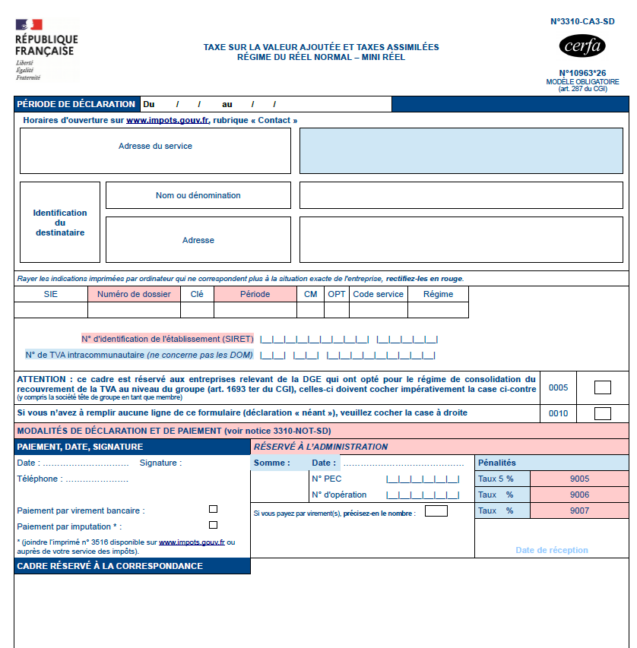

Theoretically, there is an obligation to declare taxable transactions in France, the tax due from the taxpayer, and the refund claim. This is done using form CA 3.

Companies in France must comply with strict declaration obligations – including regular VAT returns. Anyone who regularly carries out a turnover in France must submit a return electronically every month, similar to the advance VAT return (UStVA) in Germany. If no turnover has been executed in a month, a zero declaration must be sent. If the VAT was less than EUR 4,000 in the previous year, the declaration can be submitted quarterly. Those who do not comply with their declaration obligations must expect considerable penalties, such as late payment surcharges or fines.

For declaration obligations, this website of the French tax administration provides information.

Every standard rate, every reduction, every exemption

Your entire product portfolio precisely classified in the currently valid VAT logic of each EU member state (plus the UK).

Certified, system-integrated and permanently updated.

VATRules knows all the VAT rates you have to calculate in the EU-27 as well as the UK and clearly assigns them to your product groups.

Is the sale of goods taxable or tax-free? Which tax rate is applicable? — Regular, reduced or super-reduced? Which exceptions and re-exceptions apply?

VATRules applies this tax content to your ERP or shop system. Item-specific, always up-to-date and for all EU-27 (plus UK).

How does invoicing and invoice transmission work in France?

Invoicing

In France, too, invoices must be issued according to certain requirements. Businesses must ensure that the invoice contains the mandatory information according to Art. 226 of the VAT Directive.

Invoice transmission

Invoices can also be sent electronically in France. At the end of 2020, it was announced that from 1/1/2023, the electronic transmission of invoices in the B2B sector would even be mandatory. This project has now been postponed again: From 2024, the changeover will begin gradually, initially for large companies, from 2025 for medium-sized and in 2026 for small companies.

Simplified VAT reporting: The One-Stop-Shop Procedure

With the EU’s One-Stop-Shop procedure, online merchants can benefit from simplification: Instead of registering in different countries for VAT purposes, the One-Stop-Shop (OSS) can be used.

Here, all reporting obligations and payment obligations are handled centrally at a single point. Read more about the requirements here.

Third-country territories in France

France includes not only the mainland in Europe but also several islands (for example, Corsica) and the overseas territories, French “La France d’outre-mer (DOM)”. Essentially, these are former colonies. Although these territories belong to France under sovereign law, different regulations apply in some cases – also concerning VAT. Section 1.10 of the VAT Application Decree clarifies, for example, that France plus the Principality of Monaco is indeed part of the Community territory – but without Guadeloupe, French Guiana, Martinique, Mayotte, Reunion, Saint-Barthélemy and Saint-Martin. These territories are classified as third country territories, the so-called départements et régions d’outre-mer.