VAT compliance at the click of a mouse

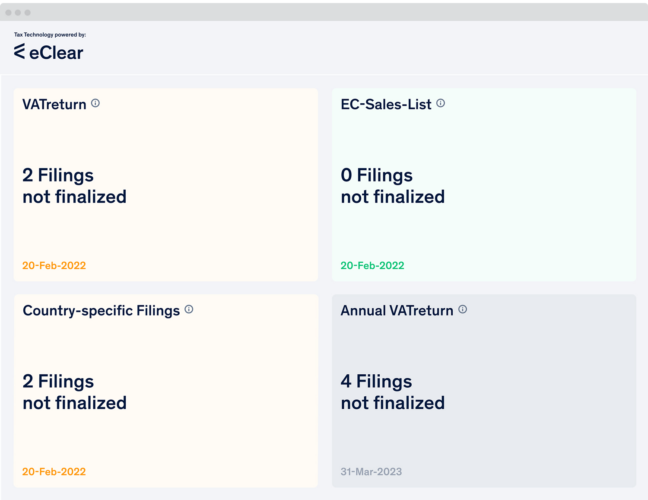

Manage your periodic and annual VAT returns, EC sales lists and VAT ledgers for up to 30 countries in a single easy-to-use filing portal: FileVAT processes your relevant data for reporting and submits it to the competent tax authorities at home and abroad.

How FileVAT works

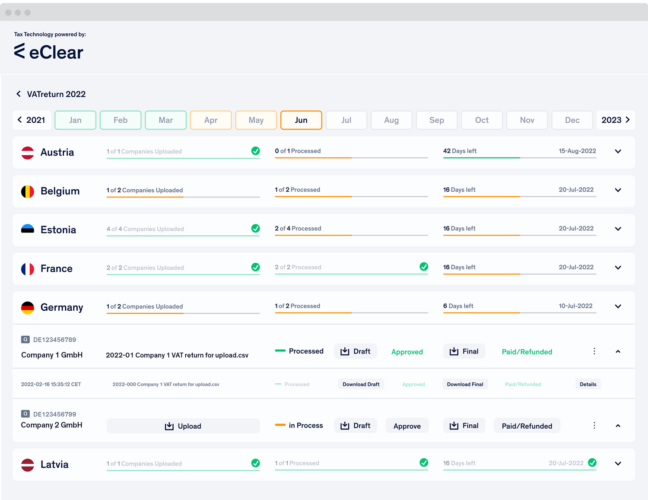

After securely uploading your data to the portal, FileVAT processes your data and provides a draft for review. Plausibility checks and real-time validation help you avoid correction returns.

Once you approve the draft by mouse click, FileVAT submits your returns to the competent authorities at home and abroad (depending on the degree of automation of the interfaces offered by the authorities).

National languages and required formats are automatically considered to simplify the preparation of your filings. Additionally, a deadline calendar with an alert function helps you to submit your returns on time.

Efficient collaboration, secure data transfer and archiving

A multi-user option and specific role allocation within the workflow allow you to collaborate efficiently with your colleagues and tax advisor.

Your data, drafts, submission protocols and corrections can be securely exchanged and stored within FileVAT – audit-proof and easily accessible for all stakeholders.

Efficient and collaborative workflows

- Minimised risk through deadline management with country-specific workflows

- Optimised workflow and information exchange through a single portal with end-to-end data transmission

- Multi-user option with role allocation, e.g. for tax advisors

- Time and cost savings through the automated generation and submission of returns

- Reduced necessity of correction returns through plausibility checks and real-time validation

- Secure data transmission and archiving

- Partner network of local tax advisors available (if need be)

Simplified compliance, enhanced control

Would you like to find out more?

Please complete this brief questionnaire and leave your request. We’ll be in touch shortly.

… or book an appointment with us directly

Schedule a 15-minute call to discuss your requirements and discover the perfect solution.