With Value-Added Tax (abbreviated to VAT), the financial transaction or turnover between two parties is subject to taxation. This is an important aspect of VAT compliance for businesses. VAT is continuously assessed on a company’s revenue, specifically focusing on its domestic business operations. In the context of VAT, taxable services include goods and services provided for remuneration by an entrepreneur within the country. The payment is calculated based on what the service recipient expends to acquire the service, excluding the VAT amount. This is crucial for understanding VAT liability and filing accurate VAT returns.

Mehrwertsteuer (Sales Tax) & Umsatzsteuer (VAT) – What is the difference in Germany?

In Germany, consumers often use the terms ‘Mehrwertsteuer (sales tax)’ and ‘Umsatzsteuer (VAT)’. However, businesses and entrepreneurs need to understand that the term ‘Mehrwertsteuer ‘In German tax law has yet to be officially recognised. From a legal standpoint, only ‘Umsatzsteuer (VAT)’ and ‘Vorsteuer (input tax)’ exist. ‘Mehrwertsteuer’ has become a colloquial term in Germany but is not used in official tax documentation. It resembles the English term ‘Value Added Tax (VAT).

Who has to pay VAT?

All businesses, from startups to multinational corporations, are subject to VAT regulations and must pay tax on their sales revenue. In this process, VAT is initially invoiced to the customer and subsequently remitted to the tax office, a crucial aspect of VAT compliance for businesses.

Input Tax

Regarding B2B transactions, other companies’ VAT charged to businesses and service providers can be reclaimed as input tax from the tax office. This is an essential part of VAT management and can significantly impact a company’s cash flow.

When must VAT be paid?

In general, all business transactions are subject to VAT. However, as is often the case in tax law, there are many exceptions.

Subject to VAT:

Supplies (e.g., Sales of Goods): Standard VAT rates apply, with some countries offering reduced rates for specific goods.

Other Services (e.g., Provision of Services): VAT rates may vary depending on the type of service, such as hospitality or culture.

Intra-community Acquisition: Often attracts a zero VAT rate for international transport.

Imports from non-EU countries: Subject to the standard VAT rate of the importing country.

Goods and Services with Input Tax Deduction: Businesses can claim input tax deductions for business-related purchases.

Not subject to VAT:

Real Estate Transactions: Real estate property sale, renting, and leasing are generally not subject to VAT.

Professional Services: Turnover generated by insurance agents, doctors, alternative practitioners, and midwives is usually exempt from VAT.

Cultural Institutions: Certain cultural institutions like museums and art galleries may not be subject to VAT on turnover.

Educational Institutions: General education or vocational training institutions such as schools and self-employed teachers are often exempt.

Cross-border Transactions: Exports and intra-community deliveries are generally not subject to VAT.

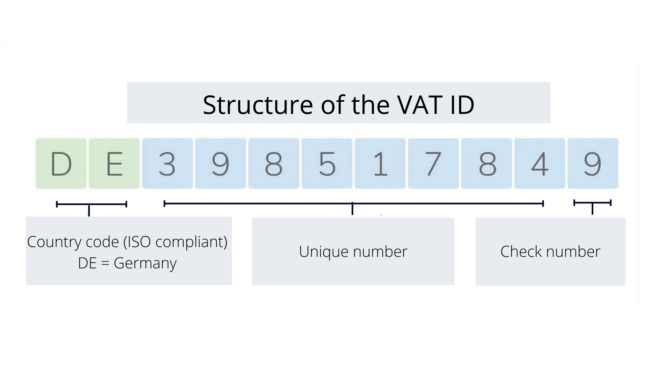

VAT identification number – determination and verification

The VAT ID, known as USt-IdNr. in Germany and UID in other EU countries, is issued to entrepreneurs by the Bundeszentralamt für Steuern (Federal Central Tax Office). This unique identifier is crucial for businesses operating within the EU, especially those involved in international trade of goods and services. It serves as an essential tool for VAT compliance and cross-border transactions.

VAT regulations for e-commerce

The VAT digital package for cross-border online trade has introduced sweeping reforms impacting merchants and consumers. The key areas affected include the One-Stop-Shop EU VAT return (OSS), the end of low-value import VAT exemption, the introduction of the Import One-Stop-Shop (IOSS), and new regulations making marketplaces deemed suppliers for VAT collection. These changes aim to simplify VAT compliance, streamline cross-border transactions, and tackle VAT fraud, thereby fostering a more robust digital single market within the EU.

VAT rates in the EU

The European Union consists of 27 member states with unique tax rates and regulations. For online merchants, particularly those with large product portfolios, navigating this complex VAT landscape is a significant challenge. A correct VAT application can lead to compliance issues and even jeopardise revenue and customer retention.

One effective solution is automated tax rate determination. This technology ensures accurate VAT application, enhances customer satisfaction, and streamlines the checkout process.

By leveraging such automation, merchants, and platforms can simplify the intricacies of tax compliance, freeing them to focus on business growth.

VAT on intra-Community distance sales and intra-Community supplies

The European Union has specific regulations that differentiate between Intra-Community Distance Sales and Intra-Community Deliveries, each with its set of VAT implications. The primary distinction lies in the type of customer involved in the transaction.

In an Intra-Community Distance Sale, the buyer is generally a private individual, falling under the B2C (Business-to-Consumer) category. These transactions are subject to the VAT rate of the customer’s residing country, making it essential for online merchants to be aware of varying VAT rates across the EU.

On the other hand, Intra-Community Deliveries are typically B2B (Business-to-Business) transactions. Here, the VAT consequences often involve reverse charging, where the buyer is responsible for accounting for the VAT.