How it works

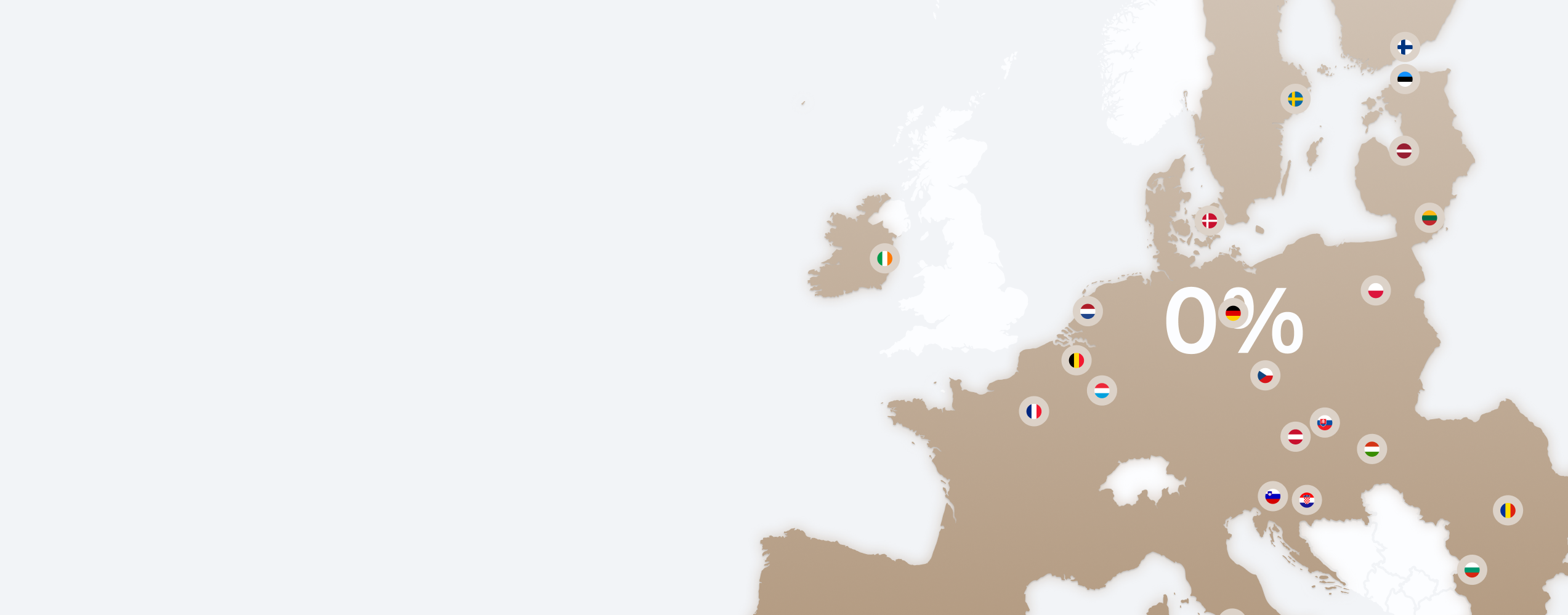

ClearVAT® integrates into the platform’s checkout. When it detects a cross-border sale, the transaction is processed by eClear: We collect the total amount from the customer. We pay the VAT to the tax authorities. And the seller receives the revenue. Since the consumer pays the service fee, ClearVAT® is free for your marketplace merchants.

ClearVAT features

Full landed cost calculation on

product page based on VATRules®

Reliable reconciliation and

transaction reports included

Would you like to find out more?

Please complete this brief questionnaire and leave your request. We’ll be in touch shortly.

… or book an appointment with us directly

Schedule a 15-minute call to discuss your requirements and discover the perfect solution.