SAP + eClear

VATRules provides full landed cost calculation during offer and order creation based on Europe’s largest continuously updated tax database. The solution is SAP certified and built on SAP BTP for seamless integration via API.

Simplify your cross-border business

With eClear’s automation solutions, businesses overcome the complexity of VAT obligations in Europe and accelerate their cross-border B2C and D2C business.

One VAT database for your whole inventory

Certified, system-integrated and always up-to-date tax rates. Classify your entire product range in the specific VAT logic for all EU-27 + Northern Ireland, Great Britain and Switzerland.

Every standard rate, every reduction, every exception

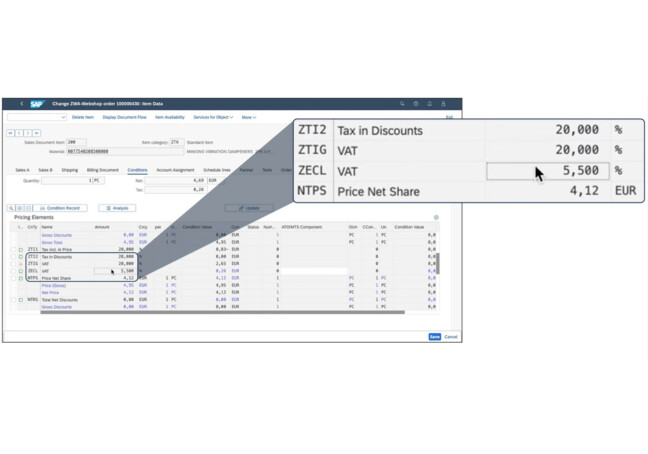

VATRules integrates into the SAP pricing determination with direct access from the SAP SD module (Sales & Distribution).

Is the sale of goods taxable or tax-free? Which tax rate is applicable? — Regular, reduced or super-reduced? Which exemptions and re-exemptions are in effect?

eClear’s database provides valid VAT rates at the point of offer and order creation in SAP. Article-specific and always up-to-date.

Your benefits with VATRules

- Integrate full landed cost calculation into your existing SAP business processes: With VATRules, you can seamlessly integrate the precise calculation of full landed costs into your existing SAP business processes, allowing for accurate price communication at the point of offer and order creation.

- Turn Compliance into a competitive advantage: VATRules safeguards your margins and ensures compliance by consistently preventing overpaying or underpaying VAT, helping you maintain a competitive edge while staying within legal requirements.

- Increase customer satisfaction: Enhance customer satisfaction across your European markets with VATRules, enabling you to design competitive sales prices by accurately applying local VAT rates, ensuring transparency, and minimizing pricing errors.

- Follow the latest EU legislation: Stay in full compliance with the ever-changing EU legislation using VATRules. With up-to-date tax determination and calculation capabilities, you can confidently navigate the complex landscape of tax regulations without any worries.

- Save Time and Costs with automated processes: Boost efficiency and reduce costs with VATRules’ automated processes. By eliminating the need for manual corrections and enabling fast go-to-market strategies, you can expand your business to other countries quickly and effortlessly.

VATRules’ features

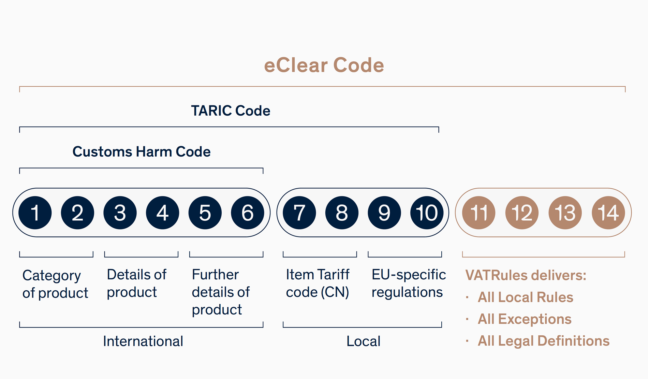

- Article-specific allocation of applicable VAT rates: More than 1.2 million eClear codes ensure accurate product mapping and application of tax rates following the latest country-specific legislations of the EU-27 + NIR, GB and CH. – With 300,000+ VAT exceptions, reductions and temporary adjustments.

- Continuous VAT updates: Stay up to date with VATRules’ certified update engine, ensuring the perpetual renewal of your tax content. With real-time updates, you can navigate evolving tax regulations effortlessly, guaranteeing accurate and compliant VAT calculations at all times.

- High-performance REST API: Benefit from VATRules’ high-performance REST API, which boasts lightning-fast response times of less than 100 ms. With this level of speed and efficiency, you can seamlessly integrate VAT calculations into your SAP processes, ensuring a smooth and optimal user experience.

- Automated product assignment: Experience up to 85% accuracy in automated product assignment within relevant categories using VATRules. This feature streamlines your tax determination process, reducing manual effort and minimizing errors, enabling efficient and precise VAT calculations.

- Certified data quality: Rely on VATRules’ BDO-certified data quality, meeting rigorous software, accounting, and bookkeeping standards (ID880). Trust the accuracy and reliability of the system to ensure compliance without compromise.

Order VATRules now

VATRules is available to purchase on the SAP Store for SAP S/4HANA, R/3 and Business One.