The introduction of the One-Stop-Shop (OSS)

Since 1 July 2021, the second stage of the so-called VAT digital package of the EU Commission applies. Linked to this is the introduction of the One-Stop-Shop, or OSS.

The One-Stop-Shop refers to the central processing of all VAT reporting and payment obligations arising from trade in goods with consumers in the EU-27 in a single tax return.

The use of this scheme requires that the trader registers for it. The Federal Central Tax Office (BZSt) is the competent authority in Germany.

VAT is due in the country of destination

As of 1 July 2021, an EU-wide threshold of EUR 10,000 applies to supplies of goods to consumers. This replaces the previously applicable country-specific delivery thresholds.

Suppose the turnover from cross-border sales of goods to private individuals in the European Union (distance sales) exceeds the threshold of EUR 10,000 (net). In that case, the turnover tax is due in the EU Member State where the goods sold enter or are consumed. The trader must apply the VAT rates applicable in the country of destination, report the VAT there and pay it to the tax authority responsible there. The prerequisite for this is registration for VAT purposes in the respective country of destination of the goods. Alternatively, merchants can register for the One-Stop-Shop procedure since 1 April 2021.

Registration

The BZSt online portal (BOP) is available for applications in Germany. For this purpose, the German VAT identification number (USt-IdNr.) is required. Each EU Member State has its contact point where EU merchants established there can register.

Participation in the OSS procedure applies uniformly to all EU Member States, i.e. distance sales will only be considered under the One-Stop-Shop declaration.

Theoretically, registration begins on the first day of the calendar quarter (quarter) following the application submission.

Note: Registration must be completed by the end of a quarter to be able to report via the OSS in the next quarter.

OSS Report

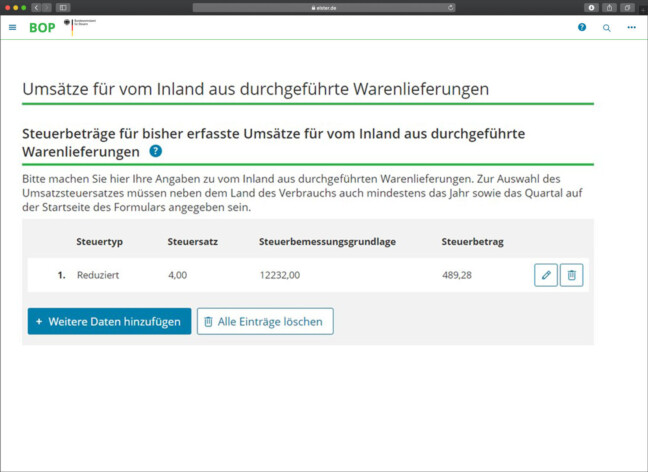

The reporting and payment of tax liability in other EU countries for merchants based in Germany are carried out via the BZSt online portal (BOP).

We describe step by step how the OSS reporting works.

Responsibilities and functioning of the One-Stop-Shop for European merchants

The One-Stop-Shop allows merchants to declare and pay for all sales within the European Union centrally in only one EU Member State (and not in 27). This single declaration shall then include, broken down by individual Member State, all distance sales, incl. of the VAT incurred thereon, which were transacted in the Member States of the European Union. Payment of the resulting VAT liability is also made centrally to this single point of contact.

An essential task of the one-stop-shops is the so-called clearing. Clearing refers to the distribution of the VAT declared by the merchant and paid to the competent contact point to the EU Member States where the respective sales transactions have occurred. The distribution of VAT to the EU Member States takes place based on the submitted OSS declarations.

VAT registration and reporting obligations since 1 July 2021

Cross-border sales of goods in the EU (distance sales) are accompanied by registration and tax declaration obligations for merchants in the EU Member States. Merchants can either register for VAT in any of the 27 EU Member States in which they sell goods, declare their sales there regularly and pay VAT to the local tax authorities of the EU Member State.

Or merchants use the so-called One-Stop-Shop (OSS for short) as a “single point of contact”. The OSS option can only be exercised for all EU Member States as a whole. Mixing individual local remote sales registrations and using the OSS for only a few selected countries at the same time are not possible. But: When participating in the OSS procedure, additional local registration may be required in individual EU countries, for example if warehouses (e.g. FBA) in other EU countries are included in the transaction.

Local registrations in EU Member States

Merchants may already have a registration in other EU countries (e.g. if exceeding the previously applicable supply thresholds required registration).

- Existing registrations can theoretically be maintained (declaration of all turnover, incl. distance sales). Still, then participation in the OSS procedure is not possible.

Local registration is mandatory in the following cases

- for intra-Community acquisitions, intra-Community deliveries (B2B; additional declarations, e.g. recapitulative statement, Intrastat, SAF-T), e.g. for warehouse transactions, Amazon FBA

- Commingling (selling your products through other merchants to make them available quickly)

- for local deliveries that are not distance sales

Declaration of sales via One-Stop-Shop (OSS)

Merchants can use the One-Stop-Shop (the alternative is local registration).

If the One-Stop-Shop procedure is used, registration shall take place exclusively in the State of residence.

Registration for the OSS procedure has been possible at the Federal Central Tax Office (BZSt) since 1 April 2021.

The taxable period is always a calendar quarter.

Declared (reported) are all distance sales from Germany and other EU Member States.

Participation in the OSS procedure + foreign registration

Additional local registration may be required in individual EU countries when participating in the OSS procedure. The following declaration obligations apply:

- OSS declaration: quarterly at the Federal Central Tax Office (BZSt)

- Local registration in selected countries: monthly or quarterly declaration (depending on the country)

Advantages and disadvantages of participating in the OSS procedure

Advantages

VAT for all EU distance sales is declared via a single registration.

VAT is paid to the BZSt for all distance sales within the EU per quarter.

In the OSS procedure, distance sales from a warehouse to another EU Member State can also be declared.

There is no obligation to issue invoices (under VAT law).

Disadvantages

VAT is not refunded via the OSS but via the tax authority of the respective country of destination.

The risk of a VAT audit in the respective country. EU country, as well as communication with state authorities, still lies with the merchant.

For all distance sales (cross-border sales of goods to consumers) in the EU Member States, the use of the OSS is to be carried out uniformly.

Should I register for the One-Stop-Shop?

Registration for the OSS procedure for all relevant sales is recommended. Otherwise, all transactions above EUR 10,001 (net) must be reported in the country of destination. Your tax advisor will advise you on the need for action in your specific case.

Obligations when using the OSS

Registration for the OSS procedure obliges to file the OSS tax return electronically in due time.

General deadlines

The following deadlines must be met for declaring your distance sales to the OSS:

Sales 1st quarter to 30 April,

Sales 2nd quarter to 31 July,

Sales 3rd quarter to 31 October,

Sales 4th quarter until 31 January of the following year.

If no turnover was executed in the quarter, the submission of a zero return is required.

Payment on time

The declared VAT must be paid on time (i.e. receipt of payment by the respective deadline mentioned above by the competent federal treasury, stating a specific purpose of use). Direct debit is not possible.

Your tax advisor will advise you on the need for action in your specific case.

Record-keeping obligations

Records must be made available electronically on request to the Federal Central Tax Office, the competent tax office or the centrally competent authorities of the other EU Member States. The retention period for the records is ten years.

No declaration of excise duties in the OSS

Declaring excise duties (e.g. for alcohol, coffee, sparkling wine, and tobacco) is impossible in the OSS procedure. Please consult your tax advisor regarding including VAT on goods subject to excise duty.

No OSS with differential taxation

There is no application of the distance selling regulation in the OSS procedure for goods subject to differential taxation (this includes second-hand goods).

Revoke participation in the OSS procedure

Cancellation of participation in the OSS procedure is generally possible at the Federal Central Tax Office (Bundeszentralamt für Steuern, BZSt) subject to a cancellation period of 15 days at the beginning of a new taxation period (calendar quarter) with effect from this period.

Changes to registration data

Changes in registration data must be notified to the Federal Central Tax Office (BZSt) electronically (use of BOP access, under the heading “Forms”) by the tenth day of the month following the change in circumstances at the latest.

However, a company name and address change must be reported exclusively to the competent tax office.

Registration data may be changed within three years after the deregistration from the special scheme takes effect.

The deregistration from the special scheme shall take place at the latest on the tenth day of the month following the occurrence of the change (use of the BOP access under the heading “Forms”) if:

- the service provision has been discontinued

- the eligibility requirements are removed in all EU Member States

- registration in another EU member state because the conditions for participation in Germany no longer apply (e.g. after the relocation of the registered office or after closing a permanent establishment in Germany).

If no turnover is made for two years, the tax authority can exclude the entrepreneur from the OSS.