The use of digital tools is indispensable for the efficiency of an e-commerce company. These applications support the simplification and automation of processes and enable transparency in all operations. Solutions that provide a quick and clear overview of activities on online marketplaces, ERPs and all other transactions play a special role here in the shop systems used. In cross-border trade, applications for VAT and customs are also of great importance.

In our overview, you will find a selection of online tools to help your company master the challenges of the highly competitive e-commerce sector.

Online marketplaces

Around the world, merchants use online marketplaces to reach customers who want to buy the company’s products and services online. Online marketplaces offer many advantages, such as being an additional source of revenue, lower marketing expenses and easy internationalisation.

Amazon

- One of the world’s largest logistics companies

- Diverse distribution options for merchants, for example Amazon FBA

- Around 5 billion website visits per year in Germany

eBay

- one of the largest trading platforms in the world

- Perfect for entry-level e-commerce, but also suitable for large companies

- Around 3 billion website visits per year in Germany

Shop systems

When choosing a shop system, one should primarily pay attention to existing interfaces to ERP systems and digital payment service providers. These interfaces should also comply with the legal requirements.

Shopify

- One of the leading software solutions for e-commerce

- Perfect for beginners or large trading companies

- all e-commerce and point-of-sale functions available

Magento

- World’s leading shop system

- Numerous templates and plugins

- Open-source application

ERPs

Depending on the company’s size and the industry, there are different requirements for an ERP (enterprise resource planning tool), as different process flows and services have to be managed. Here, too, the trend is moving more and more towards cloud applications.

Plentymarkets

- Multichannel platform for sales management across multiple channels

- Available for more than 50 online marketplaces worldwide

- More than 50k users per day

SAP Commerce

- Central and flexible platform for digital customer processes from shop to service portal to online configuration

- Scalable and future-proof system infrastructure

- Integration for SAP ERP and SAP C/4HANA

eClear offers users of Plentymarkets and SAP Commerce optimised management of VAT liability. Find the suitable plug-in for your portfolio and target markets in the respective app stores.

SPOT® The revenue manager

In SPOT, users can see all their shop systems, all online marketplaces and all transactions in one dashboard, allowing them to make data-driven decisions for a successful business.

- Localisation of the best-performing markets

- Identification of high-turnover products

- Transaction visualisation

- VAT rate audit

- Key KPIs always in view

VAT

In cross-border online commerce, the large number of different tax rates and the associated exemptions pose a particular challenge, which has an enormous impact on the company’s profit. An automated solution is usually the best option for merchants with a diverse range of goods or services. A small portfolio, on the other hand, can also be managed manually.

VAT optimisation

Applying the wrong tax rates can lead to the unintentional reduction of VAT and reduce your margin.

Determine your VAT optimisation potential to avoid overpayments!

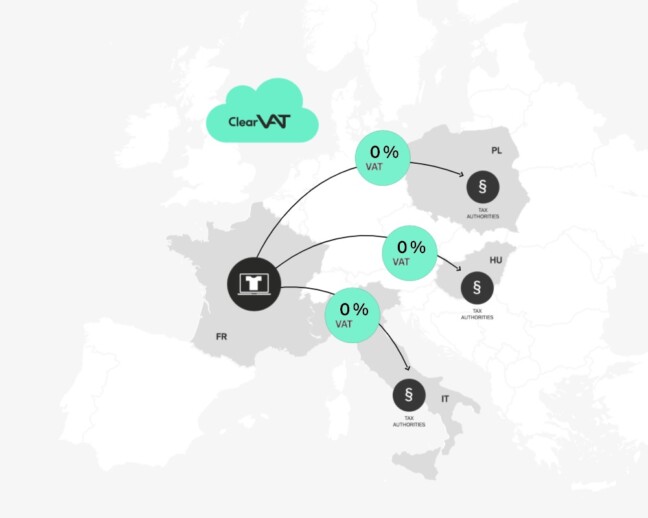

Zero Cross-Border VAT

With ClearVAT, merchants are no longer hampered by their VAT obligations in the EU. They don’t have to register for VAT abroad or worry about VAT payments, national regulations or your liability risks there.

ClearVAT boosts cross-border business and reduces marketplace liabilities

ClearVAT not only takes care of all VAT obligations for merchants, but also ensures that the product prices on the digital platforms always include the correct VAT amount according to the applicable EU regulations.

Customs

As of 1 July 2022, new regulations apply to imports into the EU and exports. These are intended to facilitate and accelerate customs clearance by digitalising the processes.

EZT (Elektronischer Zolltarif) und TARIC (Integrierter Tarif der Europäischen Gemeinschaft)

Two information systems are available for importing or exporting goods in the European Union, providing goods-related information on, for example, duty rates (including customs duties) and foreign trade measures and regulations.

- EZT-online – provided by the Federal Finance Administration

- TARIC – provided by the European Commission

ATLAS

One solution for automating information collection is the IT procedure ATLAS, the “Automated Tariff and Local Customs Clearance System”. ATLAS is used to electronically process declarations for the introduction of goods and their subsequent placement in a customs procedure, as well as the pending administrative files. Some of the necessary notifications and declarations, e.g. for customs for the transfer of goods, are recorded electronically and transmitted to the customs office.

Border-free e-commerce between the world and Europe

With the e-commerce customs solution ClearCustoms, online merchants can sell their goods across borders to other countries without customs formalities and risks. From the classification of goods and payment options to customs and tax registration – everything is integrated into one solution.