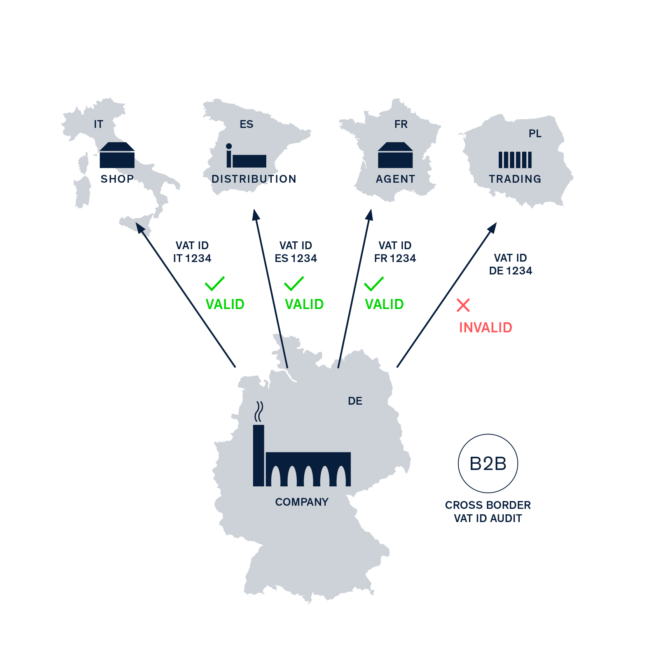

Validate the VAT ID of your B2B trading partners

Audit-proof VAT ID verification for all EU countries – now for just 24.99€/month 49.99€, plus €0.04 per check.

- qualified checks, through address verification

- missing company information enhancement

- Excel Upload, Intuitive UI for manual upload or API integration

- Stability through fallback solutions (e.g. VIES)

Audit-proof and platform-independent

With the CheckVAT ID® API and web application, you can check individual and multiple VAT ID numbers simultaneously and document the results in an audit-proof manner.

The required data is obtained from Germany’s Federal Central Tax Office (BZSt) and the Federal Ministry of Finance in Austria (BMF).

API query, batch upload, master data check, reporting

Requirements for checking the VAT registration number

Since 1 January 2020, the specification of the valid VAT identification number (VAT ID number) of the recipient of delivery as part of the EC Sales List (ESL) is an explicit requirement for the tax exemption of intra-Community deliveries (regulated in the Quick Fixes to the EU VAT reform).

The supplier must make sure that the VAT number of the purchaser is correct and is valid at the time of delivery (§ 6a para. 1 no. 4 UStG). In case of non-compliance, the tax exemption is not applicable.

Would you like to find out more?

Please complete this brief questionnaire and leave your request. We’ll be in touch shortly.

… or book an appointment with us directly

Schedule a 15-minute call to discuss your requirements and discover the perfect solution.