Why do you have to confirm VAT IDs?

The verification of VAT IDs is crucial to ensure tax exemption for intra-community supplies, prevent tax fraud, and comply with legal requirements. The corresponding VAT ID must be indicated on all invoices when trading within the European Union.

What is a VAT identification number?

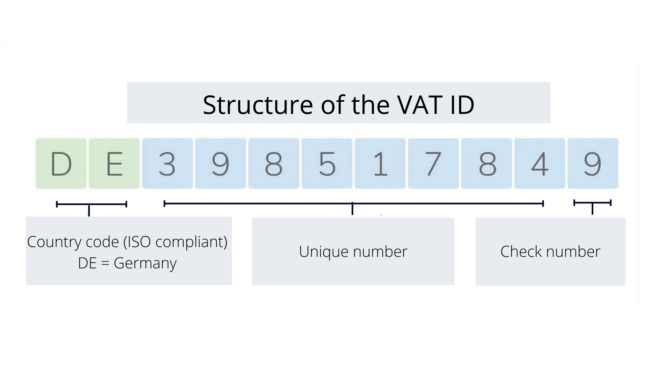

The VAT ID (in Germany: USt-IdNr. and UID) is issued to businesses by the Federal Central Tax Office (Bundeszentralamt für Steuern – BZSt) in addition to the tax number. It is used to identify active companies within the EU and sell and buy goods internationally. It consists of eleven digits:

- 2-digit country code

- 8-digit unique number

- 1-digit check number

Confirmation of the VAT identification number

Simple confirmation:

Information on whether the VAT identification number (VAT ID) is still valid in the issuing EU Member State at the exact time of the request.

Qualified confirmation:

- Is only carried out in combination with the Simple Confirmation

- Checking the validity of the VAT identification number

- Checking for further links of the VAT ID to the company name, legal form and address

For companies that do many requests for business reasons, it is a good idea to integrate the confirmation requests into their systems. However, not all data can be confirmed, and causes can be missing information from the business partner or spelling mistakes.

Where can you check VAT IDs?

VIES system is provided by the EU and is a system for electronic validation of the VAT number or VAT ID of merchants registered in the European Union for cross-border transactions of goods or services.

The main disadvantage is the lack of automation of the query. If you have to check many UIDs regularly, it is very time-consuming.

VAT ID checks for the entire EU

CheckVAT ID offers real-time validation, top-notch accuracy, and industry-leading security standards for seamless compliance.

Validate VAT IDs from €99 per month with our easy-to-use web application or through API integration with 24/7 accessibility.

- Single and multiple searches as well as batch search for extensive queries via CSV data upload

- Simple or qualified VAT ID check (matching name and address)

- Audit-proof reporting