Sales on Black Friday as well as the entire Cyber Weekend have continued to increase. New sales records are expected again this year. But which products are actually bought most frequently online on Black Friday? We take a look at the top sellers and give advice on what to bear in mind in terms of VAT.

The top sales items on Black Friday

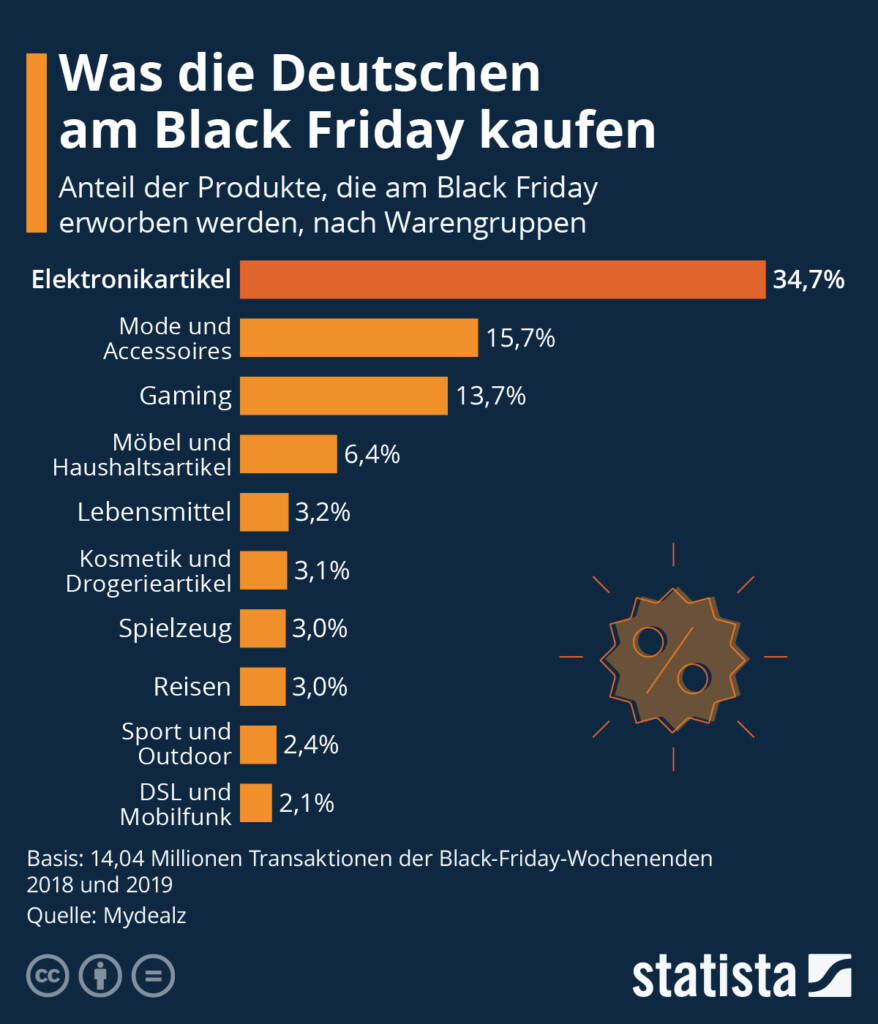

Statista analysed Black Friday 2018 and 2019 according to the best-selling product groups in Germany. Far at the top here is electronics, with almost 35%. According to Shopify, as many technology items are sold on Black Friday as otherwise in an entire month. Women’s fashion is in second place with 15.7%, closely followed by gaming items with 13.7%.

Germany is thus in line with the global trend. In countries such as Spain, the UK, France and the USA, the top-selling articles were also from the technology and women’s fashion segments. Strong growth in 2020 was achieved by the product groups sports and outdoor, home and garden as well as health and beauty. One of the biggest losers is the tourism and event industry. Here the pandemic has left obvious traces, as people now (have to) spend more time at home.

Online sales trends are similar around the world, and yet many online merchants still face hurdles in expanding their business.

Accessing new markets through e-commerce

In contrast to bricks and mortar retailing, e-commerce provides access to a worldwide market. Small producers in outlying provinces can sell their products via a web shop or platforms just as globally as established world market leaders. However, small and medium-sized enterprises often shy away from foreign markets because they know them only little. Besides the local distribution and logistics conditions and the competitor situation, it is above all the VAT regulations of the respective country that often seem too complex. However, sales via the online distribution channel are steadily increasing, and not only on Black Friday. The potential of other markets should therefore be exploited and VAT should not become a problem.

The correct calculation of VAT

Regardless of whether you as a merchant sell technology or fashion or entirely different products in Germany and the world: the correct VAT rates should always be filed in the shop system. This is especially important on peak sales days like Black Friday. Incorrect rates can have a negative impact on the business result. If the VAT is shown incorrectly and too much is charged to the customer, this can lead to a bad shopping experience. In the opposite case, the merchant has to pay an undercharged rate out of his profit. Both cases are not optimal and can be avoided because often it is only small things, like a shoe size, that can lead to significant differences.

An example: A French merchant sells children’s shoes size 34 to different countries in the EU. If a customer from Germany wants to buy these shoes, the VAT rate of 19% must be shown in the shop, as these are taxed at the standard rate in Germany. In Ireland, however, this shoe is not taxed because it is a child’s shoe. The standard tax rate of 23% is reduced to 0%, which is a huge difference.

Particularly on peak sales days such as Black Friday, attention must be paid to this and the settings in one’s own shop as well as in other marketplaces must always be checked. Because, as the example shows, the VAT system in Europe is very complex. Every country in the EU-27 has different standard and reduced VAT rates, plus numerous exceptions and special regulations that can change daily. Particularly annoying: even the official EU VAT Rates Database is flawed and incomplete. eClear already addressed that in an article.

VATRules – the VAT rate database

With the VATRules, eClear offers a permanently updated database with more than 1.2 million VAT rates of all EU-27 plus UK as well as 300 thousand exceptions and special regulations, which are clearly assigned to the product groups. Is the sale of goods taxable or tax-free? Which VAT rate is applicable? — Regular, reduced or super-reduced? Which exemptions apply? VATRules automatically applies this tax content in the ERP or shop system. Article-specific and always up-to-date.

The advantages at a glance:

- Tax-compliant application of the current VAT rates for the EU-27 and Great Britain

- Competitive advantages through country-specific price calculations, considering currently applicable local VAT regulations

- Process optimisation and time savings through automation in a one-time grouping process (fast go-to-market)

- Increased customer satisfaction through correct application of local sales tax rates

The integrated display function shows the correct gross product price in real time directly in the check-out for the customer. It guarantees the correct application, calculation, and display of the country-specific gross prices in the online shop.

Facts and figures

The merchant’s entire product range is precisely classified in the currently valid VAT logic of each EU member state plus the UK. Certified, system integrated and permanently updated.