The discount event Black Friday

Black Friday, the fourth Friday in November, remains the biggest event in online sales. However, German retailer sentiment is mixed. A 2021 HDE survey showed just over half of merchants were dissatisfied with Black Friday week sales, while 30% were satisfied. The volume remains significant despite an expected dip in overall holiday retail sales in 2023.

Black Friday enjoys widespread awareness in Germany, with a 2018 survey revealing that 94% of Germans are familiar with this shopping event. This high consumer interest presents a significant opportunity for e-commerce merchants, signalling a potential surge in traffic and the need to stand out.

Key Actions for E-Commerce:

- Optimise for Increased Traffic: Ensure your website can handle the Black Friday load.

- Competitive Offers: Craft promotions that entice shoppers amidst a crowded market.

- Cross-border VAT Compliance: Understanding VAT regulations in different countries is essential if selling internationally.

The story of Black Friday

What is Black Friday, and why are other shopping event days so important, especially for e-commerce businesses?

Final Decision in “Black Friday” Trademark Case

On June 29, 2023, the German Federal Supreme Court (BGH) dismissed an appeal by the “Black Friday” trademark owner. This ruling upholds the previous decision, requiring the removal of the “Black Friday” trademark from the German Patent and Trademark Office register.

BlackFriday.de, who initiated the legal action, sees this judgment as a long-awaited victory. Since 2016, the disputed trademark has hindered retailers and resulted in warnings issued to companies using the term.

Legal Proceedings Continue: The legal battle is still ongoing. In January 2023, the Düsseldorf Higher Regional Court ruled that the trademark owner must pay damages to BlackFriday.de. This decision is now under appeal to the BGH, with a final resolution pending.

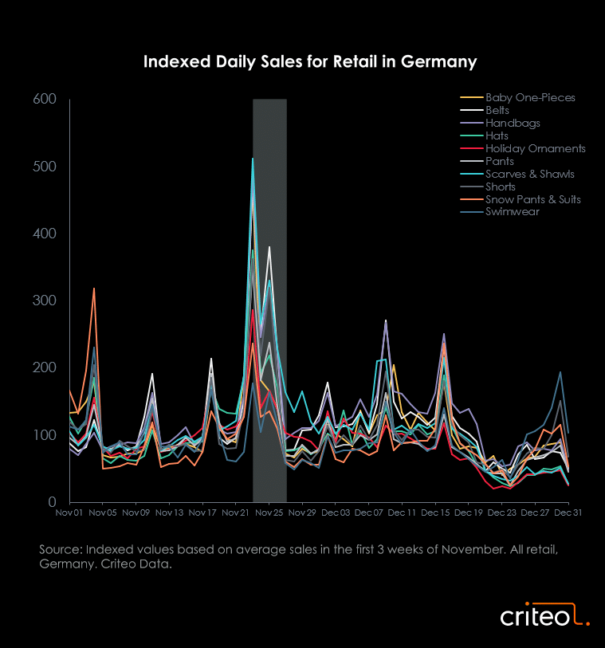

The most popular product groups in Germany on Black Friday

Black Friday sales and Cyber Weekend have gone from strength to strength. New sales records are expected again this year. But which products are bought most frequently online on Black Friday? We look closer at the top sellers and advise on what to watch for regarding VAT.

10 tips for e-commerce merchants to prepare for Black Friday

For e-commerce retailers, Black Friday is an essential indicator for Christmas business. Please find out how to prepare for the mega sales days in our info article.

The Black Friday checklist for e-commerce sellers

Get the free guide with over 30 tips for online merchants for a successful Black Friday Sale.

Online retailers must be able to cope with the flood of returns after Black Friday

Returns are annoying for customers and retailers alike. There are several processing options for online sellers to choose from.

Black Friday and Co. – The most famous special sales days in the world

Besides Black Friday, there are numerous other high-volume shopping holidays in the e-commerce world.

Do you also sell your products cross-border in the EU and Great Britain on Black Friday?

On 1 July 2021, the VAT liability for merchants in the cross-border sale of goods changed as a result of the entry into force of the VAT digital package. Find out about the lowered thresholds for turnover and other changes in B2C distance selling here.