- For Generation Z, the smartphone is the centre of their lives, the epicentre. With the smartphone, young people communicate and consume, using it for self-expression and as a source of information.

- Generation Z uses social networks not only sporadically, but daily. In doing so, young people do not focus on just one network. Still, they are registered with many social networks, which they use for other things.

- As digital natives, today’s young people are more technology-savvy than any generation before them – they are, therefore, usually willing to obtain financial services from a technology company, for example, without any problems.

- Although Generation Z spends much time in front of screens, they are cautious regarding advertising. Young people are more likely to trust the recommendations of friends and peers than to be influenced by advertising.

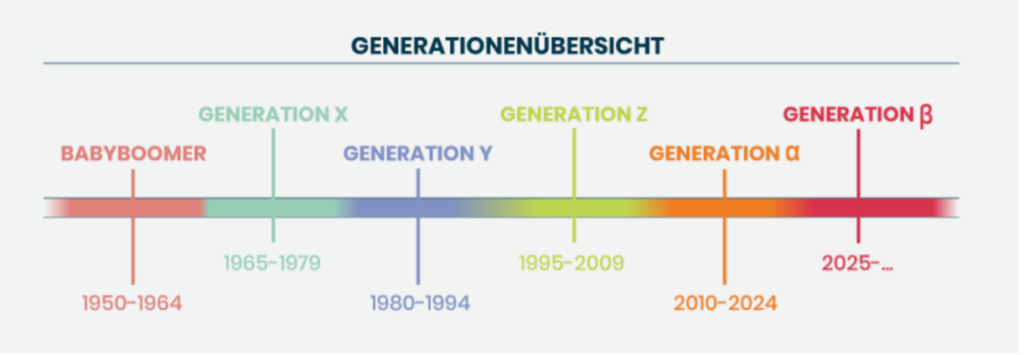

Generation Z – technological youngsters

Generation Z, also known as the digital generation, is growing up in a world where technology and the internet are ubiquitous. They are used to doing everything online, from communicating with friends and family to searching for information and shopping. For them, buying goods and services online is a matter of course. Convenience is of enormous importance to this target group. It can best be summed up as everything quickly, at any time and from anywhere.

Services are a matter of course. Convenience is of enormous importance to this target group. It can best be summed up as everything quickly, at any time and from anywhere.

E-commerce companies have adapted to Generation Z’s needs and offer them various ways to buy online. They have made their websites and apps user-friendly and provide a wide range of products and services. Some companies also offer to reserve products online and pick them up in a shop, or even offer a delivery service.

Generation Z attaches great importance to social responsibility and sustainability. E-commerce companies that consider these aspects are preferred by Generation Z. For example, they prefer companies that offer environmentally friendly products and are involved in social projects.

Brands that focus on Generation Z are:

H&M, NIKE, Adidas, or Vans – These fashion chains have a strong presence on social media and offer a wide range of fashionable and relatively affordable products that are attractive to Generation Z.

Generation Z and finances

One of the essential differences between Generation Z and previous generations is their relationship with money. They tend not to have the same fear of debt as previous generations and are more willing to borrow to achieve their goals. They are also more open to alternative forms of financing, such as crowdfunding and cryptocurrencies.

In times of zero interest rates, consumers can no longer rely on savings books, but have to become active and seek alternatives if something is to be done with the money. Therefore, in the past, solutions in the form of fintechs such as Easyfolio or Visual Vest, several new providers have entered the market promising a self-determined and supposedly convenient new form of investment. Together with the established offerings of the major banks, a veritable new market of investment and transaction options has thus emerged. Consumers have a wide range of options but are also confronted with new decisions and called upon to act if they want to take advantage of opportunities for returns.

Another significant difference is their use of technology in finance. Generation Z is used to doing everything online and often uses financial apps and online banking services. They expect a user-friendly and secure online experience and are willing to manage their finances across multiple devices.

In addition, youngsters also attach great importance to sustainability and social responsibility for finances. They prefer companies and financial service providers that offer environmentally friendly and ethical investment opportunities and are committed to social projects.

The topic of financial education is also enormously important for this generation. They usually have a different financial education than previous generations and rely on educational resources to manage their finances and achieve their goals. Therefore, companies and financial service providers should offer financial education programmes to help them manage their finances and achieve their goals. Keyword: Financial Education