Under certain conditions, deliveries to private customers in the EU where the purchase is made through a so-called electronic interface will be subject to a special rule after July 1, 2021: the fictitious chain transaction for VAT purposes.

The term electronic interface covers, for example, marketplaces such as eBay, Amazon, Limango and Zalando. Attention: The meaning of “electronic interface” is much broader and covers not only marketplaces but can also affect shop systems, platforms and other providers that virtually bring together supply and demand.

As a result of the new regulations, a merchant who sells goods to consumers in the EU via an online marketplace will be exempted from paying VAT. At the same time, the marketplace operator will become liable for paying VAT on the sale of the goods to consumers.

This special rule applies to two scenarios of deliveries conducted via an online marketplace.

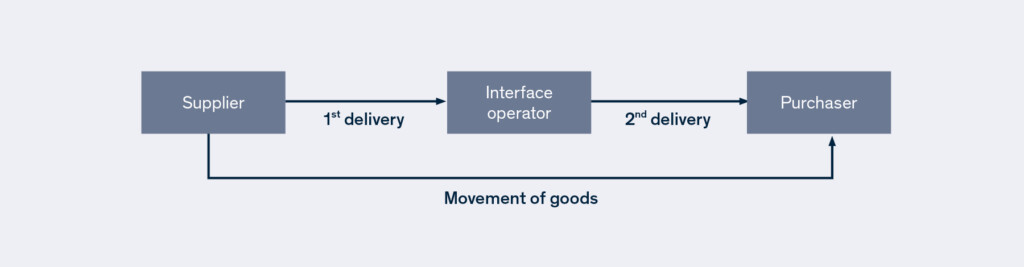

For both scenarios of deliveries, an online marketplace operator is fictitiously placed in the same position as if they had received the delivery from the merchant operating on the marketplace and then delivered it to the end customer. Thus, the merchant’s chain transaction to the customer’s online marketplace is fictitiously applied for VAT purposes. However, under civil law, the merchant sells directly to the end customer and remains responsible for delivering the goods.

Example 1: Keller, a company based in Switzerland, sells chocolate to private customers in the EU via an online marketplace called Buyonline. Starting in 2022, Keller will deliver from its central warehouse in Lucerne to private customers in Germany. Each consignment has a material value of €150 or less. The imported goods are declared by Keller exclusively at the customs office in Konstanz. The import of chocolate is exempt from import VAT.

The supply of chocolate to private individuals is generally subject to VAT in Germany. In this case, the sales threshold of €10,000 is irrelevant. Since all requirements for the fictitious VAT liability of the electronic interface are met, the taxable supply to the consumer in Germany is attributed to the online marketplace operator (fictitious chain transaction).

Accordingly, Keller carries out a fictitious supply – for VAT purposes – to Buyonline. This fictitious supply by the Swiss company Keller is not subject to VAT in Germany. It is subject to the VAT regulations in Switzerland (tax-exempt export). For VAT purposes, the fictitious supply of the marketplace operator Buyonline to private customers is treated differently: Buyonline must declare and pay VAT on the deliveries in Germany.

Note: the tricky point here is to elaborate on which parties involved will take over the import of the goods. The IOSS registration number under which the goods transaction will later be declared for VAT purposes would have to be included in the import and customs process to obtain the import VAT exemption. However, this would be the IOSS number of the online marketplace. The latter would either have to carry out the import itself (questionable) or pass on its IOSS registration to the merchant for use in the import process (also difficult).

Example 2: Lee, a merchant based in South Korea, sells goods via an online marketplace operated by Buyonline. Starting in 2022, Lee will deliver to Schmidt, a private customer in Germany, a) from a warehouse in Germany and b) from a warehouse in Belgium. The material values of the products vary; some exceed the €150 limit, whereas some do not.

The requirements for applying the Lee-Buyonline-Schmidt fictitious chain transaction are met. The merchant is a company established in a non-EU country that sells goods to customers in the EU via an online marketplace. The fact that the goods were already in a warehouse in Germany or Belgium at the time of sale to consumers is irrelevant. The material value of the goods is also irrelevant in this case, in which the goods are in a warehouse in the EU.

The fictitious supply between Lee and Buyonline in both variant a) and variant b) is VAT-exempt in Germany and Belgium.

In both cases, the Buyonline marketplace must declare and pay the German VAT resulting from Lee’s sale of goods to consumers in Germany. This is due to the fictitious supply – for VAT purposes – between Buyonline and the private customer Schmidt.

Any import of goods by Lee to warehouses in Germany or Belgium is subject to import VAT in either Germany or Belgium. The import VAT exemption via the IOSS does not apply because the goods are not directly sold when imported.

Fictitious chain transactions after July 1, 2021 – consequences and recommendations for marketplaces and merchants

The consequences of this new regulation are significant for online marketplace operators, in particular for the following reasons:

- The online marketplace must identify and prove where the merchants are located and where their goods are stored during shipment. This applies to ALL marketplace merchants because, in addition to identifying the positive cases in which the tax liability for the marketplace applies, appropriate measures must be taken to substantiate and prove to the tax authorities negative cases in which the online marketplace’s fictitious tax liability does not apply.

- Online marketplace ERP, shop and interfaced systems must be adapted to the new conditions. New control logic must be developed and tested for mapping the marketplace’s fictitious tax liability in the corresponding use cases.

- Online marketplaces must intervene appropriately in the payment process between merchants and consumers. This redirects the flow of funds concerning fulfilling the tax payment to their accounts. Online marketplaces risk a pre-financing in the form of the VAT payment to tax authorities without receiving funds from the merchant.

- The tax classification of products that merchants sell via a marketplace is the merchant’s responsibility. Merchants determine and set the applicable VAT rate for the respective product for the EU 27. With the new regulation for online marketplaces, operators are now faced with the challenge of either determining their tax classification of the merchant’s products for sale, for which they become liable to pay the VAT due to the fictitious supply, or relying on the information provided by the merchant regarding the applicable VAT rate. The risks and time involved are enormous, no matter how you look at it.

eClear offers the right solution with VATRules

Is the sale of goods taxable or tax-free? Which tax rate is applicable? — Regular, reduced or super-reduced? Which exemptions and re-exemptions apply? VATRules applies this tax content in your ERP or shop system. Article-specific, always up-to-date, and for all EU-27 (plus CH, UK, NO).

How does this affect merchants?

Not only online marketplaces but merchants also have to deal with this new regulation and the consequences for their marketplace sales.

- Transactions for which online marketplaces will be liable for VAT after July 1, 2021, should not be reported again by the merchant as subject to VAT. Merchants must pay close attention to the correct listing of these transactions in their VAT return and accounting to avoid unnecessary costs and margin losses. Reclaiming overpaid VAT from the tax office can be lengthy and complicated.

- At the same time, merchants must ensure that they declare and pay the corresponding VAT for transactions in which the electronic marketplace is not fictitiously liable for tax. Otherwise, there is a risk that transactions will not be recorded at all for VAT purposes, declared and paid. And this can be highly costly if discovered by the tax office. As a rule, VAT that has been inadvertently underpaid can be subsequently reported in an amended tax return for a limited time. But here, too, caution is advised. If this happens too often or on a large scale, it can result in a special VAT audit. In the case of foreign transactions, a foreign tax auditor could conduct the audit well.

- Merchants should inform themselves in good time whether and how the marketplace will intervene in the flow of funds between the customer and the merchant in the event of a fictitious tax liability. Depending on the marketplace’s structure, this can directly impact the merchant and may have to be handled differently.

What do you think if nothing works? No IOSS – what now? The following article in our series deals with which regulations apply when the IOSS is not used.