Home · Check VAT ID Online – EU VAT Number Check Tool

Check the VAT ID and company details of your EU trading partners

Instantly verify if a VAT ID is valid — and retrieve the official registered company name and address before invoicing to stay compliant.

- VAT ID

—- Result

- —

- Company

- —

- Address

- —

- Checked at

Daily limit reached

You’ve used your free checks for today.

Keep going with CheckVAT ID and unlock all features:

- Qualified checks, through address verification

- Missing company information enhancement

- Excel Upload, Intuitive UI for manual upload or API integration

- Stability through fallback solutions (e.g. VIES)

Definition

What is a VAT Identification Number (VAT ID)?

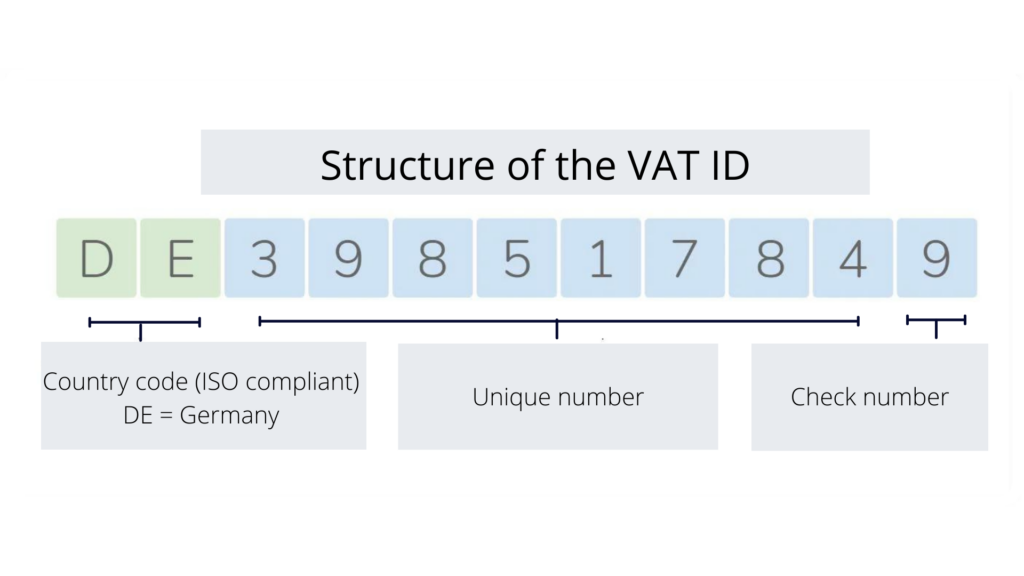

A VAT Identification Number (VAT ID) is a unique identifier assigned to businesses registered for value-added tax within the European Union.

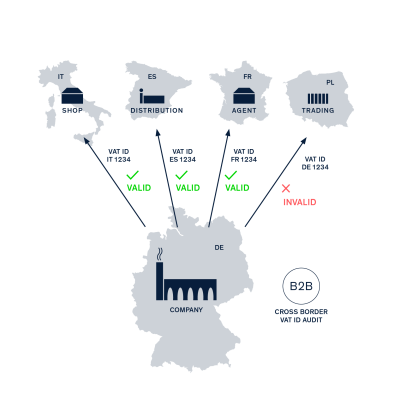

It is used to identify companies in cross-border B2B transactions and is a mandatory requirement for VAT-exempt intra-Community supplies.

Each VAT ID is issued by a national tax authority and consists of a country code and a unique identifier.

Use Case

Audit-proof VAT ID validation for EU businesses

With the CheckVAT ID API and web application, you can validate single or multiple VAT IDs simultaneously and automatically document all results in an audit-proof manner.

The solution supports bulk checks, recurring validations and system integrations, making it suitable for finance, tax and compliance teams.

All validation data is sourced directly from official authorities, such as the Federal Central Tax Office (BZSt) in Germany and the Federal Ministry of Finance (BMF) in Austria.

Background

Why VAT number validation matters

Since January 1, 2020, a valid VAT Identification Number (VAT ID) of the buyer has been a mandatory requirement for VAT exemption on intra-Community supplies, following the EU VAT Quick Fixes reform.

Suppliers must ensure that the VAT ID of their customer is valid at the time of the taxable transaction (delivery or invoicing).

If a VAT ID is invalid or cannot be proven as valid, the VAT exemption does not apply, which may result in additional tax liabilities and administrative effort.

Benefits

Everything you need for compliant, scalable VAT ID validation

CheckVAT ID combines automation, reliability and audit-proof documentation in one solution — making VAT number validation across the EU fast and accurate.

-

Flexible access — via web or API

Use CheckVAT ID as an intuitive web application or integrate it seamlessly into your system via API for automated VAT validations.

-

Single, multiple or batch checks

Validate one or hundreds of VAT IDs at once. Easily upload CSV files for bulk checks in seconds.

-

Qualified validation with name and address matching

Perform simple or qualified checks for all EU27 member states — ensuring your business partner’s VAT details are correct and complete.

-

Official data from BZSt and BMF

All validations are conducted directly through the Federal Central Tax Office (BZSt, Germany) and the Federal Ministry of Finance (BMF, Austria).

-

Audit-proof documentation

Each check is archived with an official BZSt timestamp and securely stored for ten years — fully compliant and verifiable.

-

Flexible, usage-based pricing

Choose a billing model that fits your business needs, from occasional checks to large-scale, automated validation.

Comparison

CheckVAT ID vs. VIES — what’s the difference?

| Feature | CheckVAT ID | VIES |

|---|---|---|

| Qualified validation (name & address matching) | Available | Not available |

| Web application with user login | Available | Not available |

| Audit-proof documentation | Yes | No |

| Official timestamp | Yes | No |

| Bulk / batch checks | Supported | Supported |

| API access | Yes | No |

| System availability | High availability with fallback | Depends on member state availability |

Reference

"Using CheckVAT ID, we can quickly check the VAT ID of our European clients and with little effort. The ability to check entire files is a real labour-saver!"

About AHP Merkle

AHP Merkle has been developing, designing and manufacturing high-quality hydraulic cylinders for global markets since 1973.In addition to its headquarters in Gottenheim (Germany), the family-owned company operates sales offices in Giussano (Italy), Marinha Grande (Portugal), and in Hong Kong, Shenzhen and Suzhou (China). AHP Merkle uses CheckVAT ID to efficiently process its trade transactions with European customers.

Team Dispatching

Contact

Get unlimited access to CheckVAT ID

Please submit the form below. We’ll review your request and respond shortly.