- What are the main changes introduced by the UCC reform for D2C e-commerce? The UCC reform introduces a new Customs Scheme that requires D2C businesses to calculate and display customs duties at the point of sale, centralize reporting, and ensure customer transparency regarding customs duties.

- How does the UCC reform impact the responsibility of D2C platforms? D2C platforms are now responsible for calculating and reporting customs duties, shifting the compliance burden from customs authorities to businesses, and ensuring data accuracy and timely submissions.

- What are the benefits of the UCC reform for EU-based e-commerce businesses? The reform streamlines customs processes, enhances transparency for customers, and creates a level playing field, potentially reducing administrative burdens and improving delivery times for EU-based businesses.

Where the 2013 Update Fell Short

The 2013 UCC reform aimed to modernise customs procedures but faced challenges in addressing the specific needs of e-commerce. Key shortcomings included:

- Data Overload: The sheer volume of data generated by high-volume, small-parcel e-commerce shipments strained existing systems.

- Speed Constraints: Legacy customs systems struggled to match the rapid turnaround times demanded by the e-commerce industry.

- Limited Flexibility: Rigid processes within customs systems often hindered innovation and adaptation by e-commerce businesses.

The New Customs Scheme – Similarities to IOSS

The UCC reform introduces a new Customs Scheme designed to mirror the successful implementation of the Import One-Stop Shop (IOSS) for VAT. Key features and implications for D2C e-commerce include:

- Pre-Calculation of Duties: Like VAT under IOSS, D2C businesses will be responsible for calculating, displaying, and collecting customs duties at the point of sale.

- Centralised Reporting: Platforms will submit regular reports with customs duty payment data, replacing traditional collection by customs authorities.

- Customer Transparency: Customers will need clear information about customs duties upfront, ensuring no surprises upon delivery.

Understanding the Link

The successful implementation of the IOSS scheme for VAT paved the way for this proposed Customs Scheme. The reform aims to create a more predictable and streamlined process for D2C e-commerce transactions by aligning customs duty treatment with VAT.

Example:

Let’s say a customer in France orders a pair of shoes from a UK-based e-commerce retailer. Under the new Customs Scheme:

- At checkout: The retailer’s website would calculate and display the applicable customs duty alongside the price and VAT.

- Payment: The customer pays the total cost, including customs duty, upfront.

- Reporting: The retailer includes the collected customs duty in their regular centralized report to EU customs authorities.

The Shift from Collection to Reporting – Implications for D2C

Traditionally, customs duties functioned as a collection tax, with authorities calculating the amounts due and collecting them upon import. The UCC reform introduces a fundamental shift, making businesses (or their intermediaries) responsible for calculating and reporting customs duties. This new model has several implications:

- Responsibility Shift: D2C platforms must now calculate and report customs duties, shifting the burden of compliance from customs authorities to businesses.

- Data Accuracy: Robust systems and accurate product data (HS codes, origin, duty rates) are crucial for correct calculations and to avoid penalties.

- Upfront Calculations and Display: Customers expect transparency; platforms must display applicable VAT and customs duties at the point of sale.

- Reporting and Corrections: Regular filings for both VAT and customs duties will be required, along with processes to handle returns and adjustments.

- Potential Faster Clearance: Pre-calculating duties and providing detailed data upfront could streamline the clearance process, benefiting D2C sellers.

Systems Focus:

To navigate these changes, D2C platforms will likely need to update their systems. This might include:

- HS Code Database Integration: Accurate HS code assignment is essential for calculating duty rates.

- Customs Duty Calculators: Tools or integrations are needed to automate customs duty calculations based on product data, destination country, and applicable trade agreements.

- Reporting Functionality: Systems must be able to generate the required reports for centralized submission to customs authorities.

D2C Platform Requirements

To navigate this new landscape, D2C platforms selling into the EU must understand the specific requirements:

- Registrations:

- IOSS for VAT (if not already in place)

- EU-established EORI number (either via direct presence or an indirect representative)

- Systems and Integration: Platforms may need updates or new systems to handle customs calculations, reporting, and corrections.

- Intermediary Selection: Finding qualified indirect representatives or IOSS intermediaries can be challenging.

Current Issues: Potential Challenges and Uncertainties

While the UCC reform offers significant potential benefits for e-commerce, there are ongoing discussions and concerns about specific aspects of the implementation:

- Indirect Representation: Businesses without an EU presence rely on indirect representatives, which creates additional complexity. Finding reputable representatives and navigating potential liability issues remains a key concern for platforms.

- Temporary Storage Time: Earlier drafts proposed shortening the allowable temporary storage time for goods, significantly impacting e-commerce logistics. While the recently amended draft reverts to 90 days, this issue highlights the need to stay updated on evolving regulations.

- System Readiness: The success of the reform hinges on the timely development and implementation of the centralised Customs Data Hub and compatible systems by platforms. Potential delays or technical challenges could hinder the intended streamlining effects.

- Evolving Requirements: Specifics of the final implementation, particularly surrounding the Customs Scheme, may still be subject to change. D2C businesses need to stay informed and adaptable to ensure compliance.

Anticipated Rollout (With a Note of Caution)

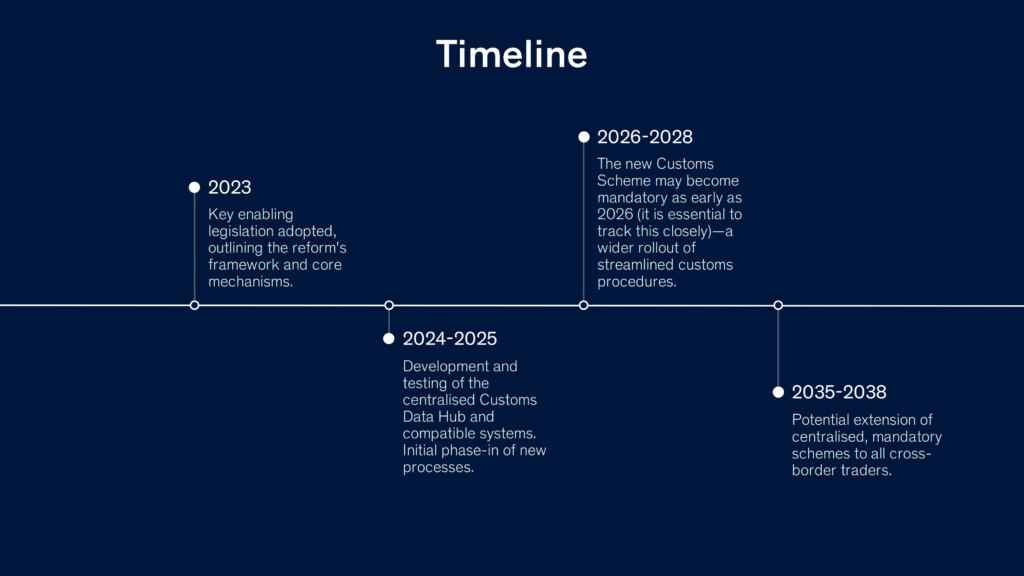

The UCC reform is a complex and ambitious undertaking with a multi-year implementation plan. Here’s a tentative timeline, but it’s vital to note that dates and the content are subject to change:

Dispelling Common Misconceptions

Misunderstandings can easily arise with any significant regulatory change. Let’s clarify some common misconceptions about the UCC reform and its potential impact on D2C e-commerce.

“The UCC reform will make cross-border e-commerce too complex and costly.”

- Fact: While the reform introduces new requirements, the goal is to simplify and streamline customs processes eventually. Centralised systems, pre-calculated duties, and the IOSS-like model aim to reduce administrative burdens and potential delays.

“Small e-commerce businesses will be disproportionately affected.”

- Fact: The UCC reform aims to create a level playing field, ensuring all businesses comply with the same standards. While the transition may require investment, the long-term benefits of a simplified system should benefit companies of all sizes.

“The UCC reform is solely focused on customs duties.”

Fact: The reform addresses various customs procedures, including VAT handling, data management, and overall modernisation. The changes in customs duty collection are just one aspect of a broader transformation.

The EU as a Role Model: Pioneering Customs Modernisation

With its ambitious UCC reform, the European Union is positioning itself as a leader in customs innovation. Here are some aspects of their approach likely to gain attention from other countries and regions:

- IOSS-like Customs Scheme: The success of the IOSS for VAT demonstrates the potential of centralised reporting and pre-calculated taxes to streamline cross-border transactions. We may see similar models adopted for customs duties elsewhere.

- Centralised Data Hubs: Consolidating customs processes through a centralised system offers the potential for greater efficiency and improved data management. This model could inspire other trading blocs to consider similar approaches.

- Focus on E-commerce: The UCC reform explicitly addresses the challenges of modern e-commerce. This focus on the needs of a rapidly growing sector could serve as a blueprint for other economies seeking to boost cross-border e-commerce.

Global Implications

While the UCC reform is tailored to the specific needs of the EU, its success could have far-reaching implications. As international trade becomes increasingly digitised, the EU’s approach may become a model for streamlining customs processes, enhancing efficiency, and boosting the global e-commerce market.

Competitive Advantage for EU Businesses and How Non-EU Businesses Can Prepare

The UCC reform has the potential to create a significant competitive advantage for EU-based e-commerce businesses in cross-border trade within the EU. Here’s why:

- Streamlined Processes: The centralised Customs Data Hub and standardised procedures will likely simplify customs clearance for EU businesses, potentially leading to faster delivery times and reduced administrative burdens.

- Enhanced Transparency: Customers will benefit from clear upfront information on VAT and customs duties, potentially boosting trust and conversion rates for EU sellers compared to competitors outside the EU.

- Level Playing Field: The reform ensures a standardised approach to customs compliance for all businesses operating within the EU, potentially eliminating any advantages previously held by non-EU companies navigating disparate national regulations.

Let’s stay in touch!

Stay up to date on the latest market trends, best practices and regulatory changes affecting cross-border trade by following us on LinkedIn.