KEY TAKEAWAYS

How are automation and AI transforming VAT and customs compliance? Automation simplifies compliance by streamlining VAT filings, customs clearance, and ensuring real-time updates to regulations.

What challenges should businesses consider when implementing these technologies? Businesses need to ensure data accuracy, manage complex regulations across jurisdictions, and integrate systems effectively, as our examples show.

As businesses expand into global markets, they face increasingly complex compliance requirements, particularly in the areas of value-added tax (VAT) and customs regulations. Navigating these rules across multiple jurisdictions can be time-consuming and risky, with even minor errors potentially resulting in costly penalties. However, advancements in automation and artificial intelligence (AI) are providing much-needed solutions, helping businesses streamline these processes.

The Complexity of VAT Compliance Across Jurisdictions

For businesses operating across multiple countries, managing VAT compliance is a significant challenge. VAT rates, filing deadlines, and regulatory requirements vary between jurisdictions, and keeping track of constant changes can create operational bottlenecks. Without the right systems in place, errors can lead to fines, audits, and reputational damage.

Automating VAT Compliance

Automation is becoming a game-changer in this space. Automated VAT solutions help businesses manage VAT rates and filings across various countries, ensuring compliance through timely updates of tax laws. By reducing the reliance on manual processes, these tools minimise errors and the risk of non-compliance.

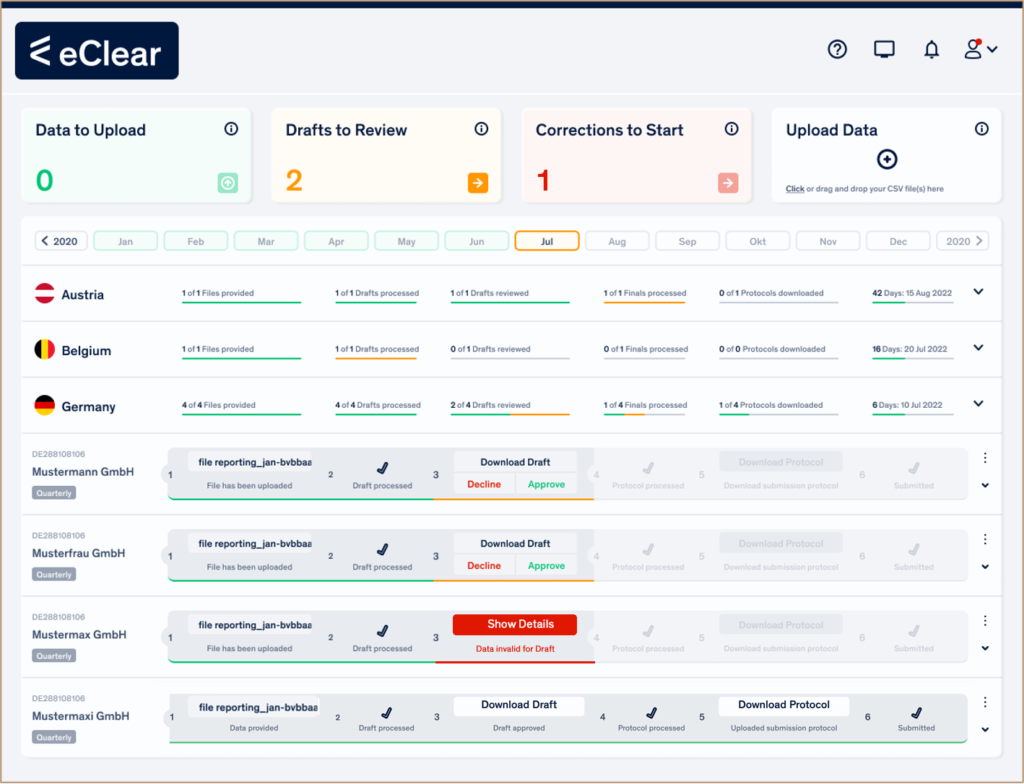

Let’s look at eClear’s platform of automated solutions and services as an example: VATRules calculates the current VAT for each cross-border transaction based on the destination country (EU27, CH, GB), ensuring that the correct rate is applied. FileVAT automatically generates and submits VAT returns, ensuring filings are accurate and completed on time. Additionally, automation significantly reduces the need for internal teams to keep up with ongoing changes in VAT regulations, allowing them to focus on other tasks.

Addressing the Challenges of Automation in Compliance

While automation and AI offer substantial benefits, there are some potential challenges businesses must keep in mind when implementing these systems.

- Data Accuracy and Integrity

Automation systems depend heavily on accurate data inputs. Incomplete or incorrect data can lead to errors in VAT filings or customs classifications. Businesses need to ensure that their data is consistently accurate and up to date for automation to function effectively.

- Managing Complex Jurisdictional Regulations

Navigating the complexities of multi-jurisdictional regulations is one of the biggest challenges in compliance. VAT rates, customs duties, and regulatory requirements vary from country to country, and these regulations are frequently updated. Without careful attention, businesses may struggle to remain compliant in every market where they operate. AI and automation help streamline this process by continuously updating compliance systems with the latest regulatory information.eClear’s platform, for example, provides automated updates for VAT rates and customs codes across different jurisdictions, ensuring businesses can maintain compliance without having to manually track every regulatory change. This flexibility is crucial for companies operating in multiple countries, as it allows them to stay agile and avoid potential compliance pitfalls.

- Integration with Existing Systems

One challenge businesses often encounter when implementing new automation tools is integrating them with their existing ERP, accounting, and e-commerce platforms. Without seamless integration, data silos can emerge, reducing the efficiency of automated systems and creating new challenges for compliance management.Choosing a solution that offers robust API connectivity ensures that automated platforms can integrate smoothly into existing business environments. This enables real-time data exchange between systems, allowing for consistent updates.

- Ongoing Monitoring and Maintenance

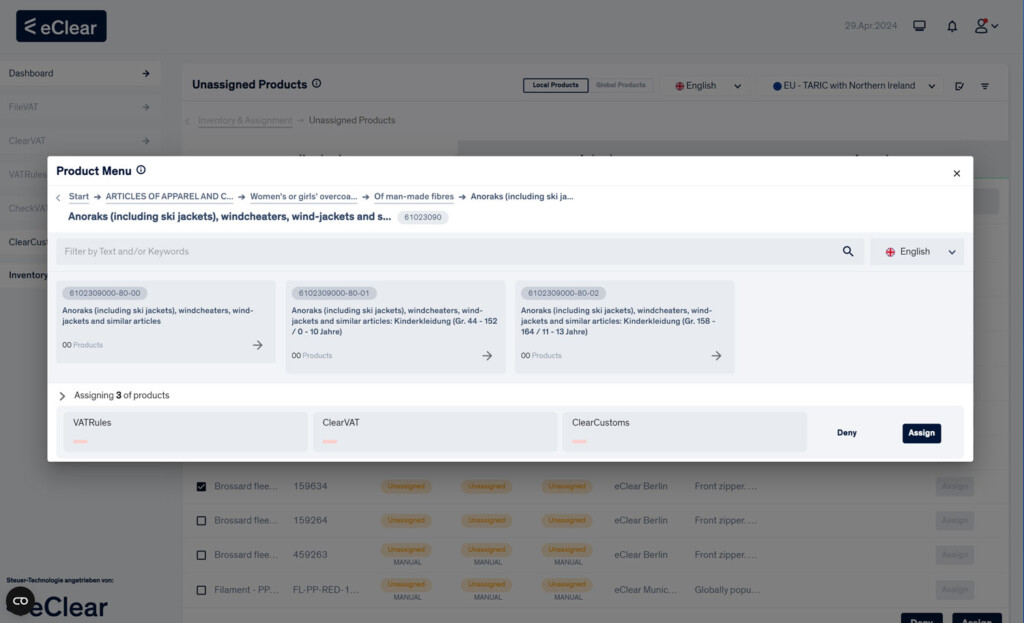

While automation greatly reduces the burden of manual compliance tasks, businesses must still monitor their systems to ensure they remain accurate and aligned with the latest regulations. AI-driven systems, in particular, benefit from regular updates to reflect changes in rules and regulations. However, even the most advanced AI tools require human oversight to ensure optimal accuracy, especially in complex areas like customs compliance.One of the key strengths of eClear’s classification tool, CustomAI, is the combination of AI-driven automation and expert supervision. While the AI handles the bulk of the classification work, a team of in-house experts oversees the process to ensure that data accuracy is maintained at every step. This hybrid approach helps businesses navigate complex customs regulations with confidence, as it blends the efficiency of AI with the nuanced understanding of human experts.

Customs Compliance in a Global Market

Cross-border trade brings additional compliance challenges, particularly in customs regulations. While the EU operates under a unified customs framework through the Union Customs Code (UCC), businesses importing goods from non-EU countries must ensure they comply with EU customs rules. Non-compliance can result in delays, penalties, or even the seizure of goods.

Automating Customs Processes

Automating customs compliance can dramatically simplify these processes by streamlining customs classifications, declarations, and tax calculations. AI-powered systems—as in the example of CustomsAI—can analyse product data and automatically assign the correct customs codes, ensuring that businesses comply with local regulations without the need for manual intervention.

The Role of AI in Proactive Compliance

In both VAT and customs compliance, AI can play a critical role in moving businesses from reactive to proactive management of regulatory risks. AI-driven systems help analyse historical data to detect patterns that may indicate potential compliance issues before they become significant problems.

For example, AI can monitor transactions in real time, identifying anomalies that may signal non-compliance or fraud. These early warnings allow businesses to investigate and address issues before they escalate into fines or penalties. AI-powered predictive analytics can also help businesses anticipate regulatory changes and adjust their compliance processes accordingly.

Embracing Automation for the Future of Compliance

As global trade continues to grow and regulatory environments become more complex, businesses must look towards automation and AI to manage compliance efficiently. From automating VAT calculations to streamlining customs processes, these technologies are reshaping the way companies approach compliance.

By considering the challenges—such as data accuracy, multi-jurisdictional complexity, and system integration—businesses can ensure they implement these solutions effectively. eClear’s platform, designed to address these issues, allows businesses to stay compliant with the latest regulations while reducing the administrative burden. Automation not only ensures efficiency but also enables businesses to scale their operations with confidence, knowing their compliance processes are future-ready.

Let’s stay in touch!

Stay up to date on the latest market trends, best practices and regulatory changes affecting cross-border trade by following us on LinkedIn.