The One-Stop-Shop (OSS) was introduced with the so-called EU digital VAT package. It replaces the previous Mini-One-Stop-Shop (MOSS). Since 1 July 2021, German companies that have registered to use the OSS procedure can transmit their reporting and payment obligations for VAT purposes centrally. In Germany, the transmission is made to the Federal Central Tax Office.

OSS registration

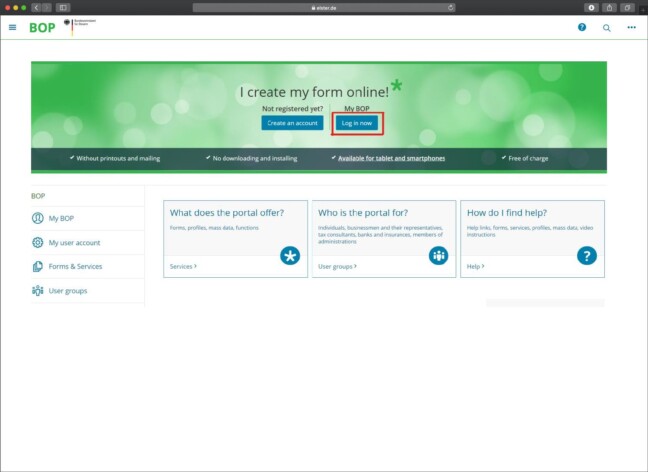

Registration takes place via the BZSt online portal (BOP): https://www.elster.de/bportal/start

At present, various forms are available for selection on the BZSt online portal, for example:

— Registration notification for participation in the OSS EU scheme (formerly Mini-One-Stop-Shop)

— Change of registration data for the OSS EU scheme (formerly Mini-One-Stop-Shop)

— Deregistration from the OSS EU scheme (formerly Mini-One-Stop-Shop)

The portal can thus be used to process registration notifications, but also to change registration data. Anyone who no longer wishes to participate in the OSS procedure can deregister via the portal at the beginning of the next taxation period.

Who can I register for the OSS?

Companies based in the country that make intra-Community distance sales for consideration, provide services to private individuals in other EU Member States or provide services via electronic interfaces can register for the OSS. Registration starts on the first day of the calendar quarter following the application.

Note: Third-country merchants who operate a warehouse within the country and supply goods to private individuals in other EU Member States may also register for the OSS.

How to report

We provide step-by-step instructions for online merchants on how to report their data with the EU One-Stop-Shop via the BOP of the German Federal Central Tax Office.

VAT returns and payment of VAT via the OSS

The VAT period is the calendar quarter. The VAT returns must be submitted electronically in accordance with the officially prescribed data set within one month of the end of each taxation period, i.e.:

I. Calendar quarter by 30 April,

II. Calendar quarter by 31 July,

III. Calendar quarter by 31 October,

IV. Calendar quarter until 31 January of the following year.

The VAT is due on the last day of the month following the tax period.

Registration: Complete or not at all

Those who opt for the OSS procedure participate in the procedure uniformly for all EU Member States. It is therefore a fundamental decision that the merchant has to make for himself.

„Merchants have to weigh up whether they want to register locally in the different EU Member States or use the one-stop shop. However, it should be borne in mind that despite participating in the One-Stop-Shop, further local registrations may be required abroad.“

Where the OSS is still flawed

The OSS procedure is supposed to simplify the declaration obligations of companies with foreign sales. However, initial experience shows the opposite: the procedure is still complex and time-consuming in many places.

Manual declarations for the third quarter of 2021

And the technical implementation is anything but successful for the third quarter of 2021 as the taxation period: The process actually envisages that companies can upload their data to the portal, ideally fully automated, either electronically via CSV file upload or by an electronic interface. But as reported in various media, this is not yet working for the third quarter of 2021. Nevertheless, the declaration must be submitted on time by 31 October. For this, companies will probably now have to enter their OSS data manually. This costs a lot of time and is annoying.

Not all shipments are subject to the OSS procedure

The basic idea of declaring distance sales via the OSS is that the beneficiary companies are relieved, especially when it comes to registration and reporting obligations. However, a number of stumbling blocks still make the process considerably more difficult in practice. For example, it is problematic that certain deliveries cannot be processed within the framework of the OSS.

— Goods subject to excise duty, which are not taxable as intra-Community acquisitions, must be taxed by the supplier in the respective EU member state. This requires local registration – the OSS is excluded here.

— The supply of new vehicles, for example, cannot be handled via the OSS either.

— Tax-exempt supplies are not recorded in the OSS according to the EU Commission’s guidelines of March 2021. This also applies to supplies that are subject to a zero VAT rate.

„The One-Stop-Shop is not applicable to all supplies of goods. Businesses therefore need to categorise their supplies of goods accurately and check when local registration in another EU Member State has to take place. If necessary, a fiscal representative should also be engaged to assist the company in handling VAT declaration obligations.“

Transition to OSS

Difficulties may also still arise in the transition to the OSS procedure: Those who were registered for the MOSS will still submit the VAT return for the second quarter according to this procedure. A corrected tax return is also possible in this way – but not according to the OSS procedure. Therefore, anyone who has to correct transactions afterwards will have to deal with the different procedures again.

In certain circumstances, return cases cannot be processed via OSS

This applies in particular if a company was still registered locally in an EU member state before 1 July 2021. If the business has registered for the OSS as of 1 July 2021, returns may be problematic for VAT purposes: If returns are made after 30 June 2021 for supplies made before 1 July 2021, then the change of taxable amount according to § 17 UStG must still be made in the VAT assessment of the respective member state. The OSS does not offer a solution for these cases. This significantly increases the additional workload for businesses in terms of declaration obligations. One cannot therefore speak of a simplification through the OSS here.

Obligation to declare even in the case of zero reporting

VAT returns must always be submitted on time. Even if a company has not carried out any turnover in a calendar quarter, a zero return must be submitted.

Lower threshold for deliveries

As of 1 July 2021, the delivery threshold has been set at a total of 10,000 euros throughout the EU. Previously, different and above all higher delivery thresholds applied in the EU member states. In France, for example, the value was 35,000 euros until 30 June 2021. If a company from Germany remained below this value with its corresponding turnover in France, it could declare the VAT in Germany. However, since 1 July 2021, many more companies will now be covered by the new regulations due to the Europe-wide lower delivery threshold of 10,000 euros in total.

Example: The watch shop owner Meier regularly delivers cuckoo clocks to France. In the year, he achieves an average turnover of approximately 22,000 euros. Until 30 June 2021, the de minimis limit of 35,000 euros applied to France. Meier was therefore able to pay VAT in Germany. Since 1 July 2021, the EU-wide supply threshold of 10,000 euros applies: The watch seller must now pay the VAT in France. There are two options available to him in this case: Meier must decide whether to register for VAT in France or participate in the OSS procedure.

This means that even small businesses can quickly reach a turnover amount that obliges them to pay tax abroad for the first time. This can be costly to implement, especially for very small businesses.

„Many small businesses whose turnover was below the respective applicable supply thresholds until 30 June 2021 will now have to reassess their foreign turnover and comply with registration obligations. However, this should not deter them from continuing to generate turnover abroad: With a tax advisor at your side, the changeover will succeed, so that cross-border commerce will continue to be successful in the future.“

Input tax cannot be refunded in the OSS

If an entrepreneur wants to claim input tax, he cannot do so in this procedure, even if he is registered for the OSS. The refund must be obtained through the input tax refund procedure or in the local VAT returns. Here, too, businesses must therefore act again in a separate procedure.

However, if the entrepreneur performs other transactions in an EU Member State and therefore registers there for VAT purposes anyway, then the input tax must be declared in the assessment procedure.

“The One-Stop-Shop does not offer a complete VAT solution. Businesses still have to deal with other procedures, for example, for input tax refund. VAT on foreign sales therefore remains complex for businesses.”

Attention for warehouses with cross-border fulfilment structures

A problem for users of Amazon’s fulfilment structures is that, regarding the OSS procedure, Amazon also carries out cross-border transfers of goods without the merchant having any influence on this. And these transactions must theoretically also be assessed for VAT purposes. What would a merchant then have to report? And what registration obligations does this trigger? Especially with these questions, many merchants are now uncertain and should seek advice from a tax expert.

Conclusion

The OSS is supposed to offer businesses simplification options. However, the reality still looks different at the moment. There are still many unanswered questions, and local registrations are still required for various transactions. The technical implementation will cause considerable additional work, especially in the third quarter of 2021. But despite the bumpy start, companies should take advantage of the OSS for the future and let their tax advisor guide them through the implementation of the new rules.