What products are subject to reduced or zero VAT rates? What VAT regions apply the most zero and reduced VAT rates? To answer these questions we queried our VAT Rules knowledgegraph. Our knowledgegraph extends a public product taxonomy that is used to classify goods for customs purposes (i.e. TARIC). It contains VAT rates, regions with special VAT treatment and product categories that are needed to differentiate different VAT rates. It does not consider services. For the analysis we only report product categories on the coarsest level.

The following plot shows the 15 product categories with the highest frequency of zero or reduced VAT rates. Most of these top categories are in food but also fertilizers and print products. It is not uncommon that more than 50% of products that are contained in these categories have reduced or zero vat rates.

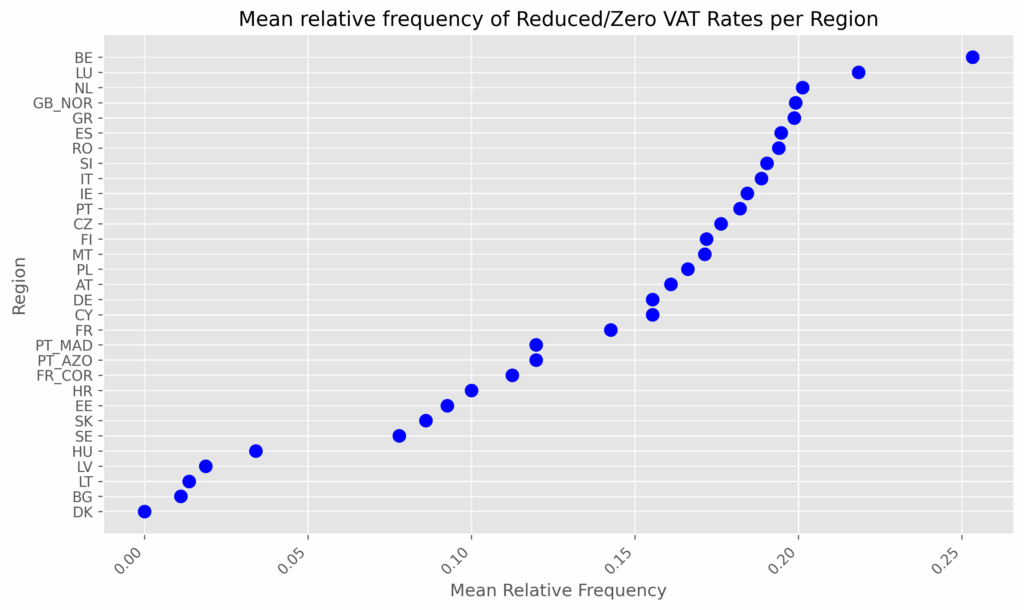

The next plot shows the top countries with reduced or zero vat rates. To create the plot we take the average percentage of reductions for each product class and region and take the average over regions. Top of the list are the Benelux countries followed by Northern Ireland (labelled GN_NOR_0) with 20% to 25% reductions or zero vat rates. Denmark is last because it does not apply reductions for products that are part of our knowledgegraph (i.e. no services) at the requested date (October 2025).

In summary we see a lot of variation both across regions and categories.

If you struggle to master this variation in you master data (pun intended) or apply the standard rate for all the countries and categories listed above and would like to increase your margins – we are happy to connect you to our knowledgegraph.