VAT rates vary across the EU. In addition to the country-specific standard rates (from 17% in Luxembourg to 27% in Hungary), Member States can apply reduced (from 5 to 15%) or super-reduced rates (below 5%). Some EU countries also apply a zero rate to specific transactions, and it is up to each Member State to decide which rate to apply to a product. In early December, the EU’s Economic and Financial Affairs Council, ECOFIN, also voted in favour of new freedoms for Member States to apply reduced VAT rates.

Merchants underestimate losses due to VAT exceptions

Many e-commerce merchants nevertheless rely on uniform product prices for consumers across countries. However, they underestimate the losses when tax reporting does not consider local reductions and exceptions. Instead, the standard rate is passed on to the tax authorities. A difference that the company could add to its revenue.

If VAT exceptions are not considered, EU e-commerce will be hit with an overpayment of EUR 3.8 billion in 2022, according to our estimations. The calculation is based on a forecast as of 14 February 2022 by Statista Global Consumer Survey, expecting an e-commerce turnover of EUR 388,371 for the EU-27 in 2022. eClear aggregates and continuously updates all tax rates and rules relevant to online merchants in its VATRules database.

Example:

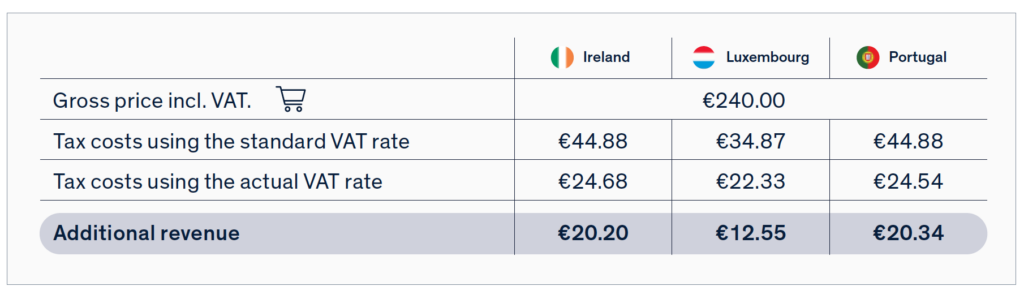

A sample basket worth EUR 240 gross, filled with children’s clothes and shoes, a book and a guitar, would result in EUR 44.88 VAT in Portugal and Ireland to be passed on to the respective tax authority, with the application of the standard rates.

If the merchant had considered applicable deductions and exceptions, it would only be EUR 24.54 and EUR 24.68, respectively. And he would be left with a good EUR 20 per shopping basket as additional revenue.*

eClear’s VAT Optimiser warns of possible VAT overpayment

Companies that count the effort of an EU-wide tax rate determination with continuous updating to be higher than its advantages can now check if their product groups are affected by reductions and exceptions in other EU countries.

For a quick calculation, enter the revenue by country into the VAT Optimiser developed by eClear and weigh the product groups proportionally. In a few seconds, the VAT optimisation potential is shown in Euros. Anyone interested in a breakdown by country and product group can request this information by e-mail. The service is free of charge.

According to VAT Optimiser, an online store that turns over 980,000 EUR in the Netherlands and 750,000 EUR in Belgium in the Home & Garden product group could improve its result by 36,000 EUR. The result (VAT optimisation potential) describes the difference between the general application of standard VAT rates and the application of the VAT rates required depending on the product class; the latter then consider all current exemption rules and reductions.

Check out eClear’s VAT Optimiser for free at eclear.com/vat-optimiser/.

* Notes on the shopping basket example: Portugal’s standard rate is 23%; the current rate for children’s clothing and shoes is 23%, and for books and guitars, 6%. Ireland’s standard rate is 23%; the current rate for children’s clothing and shoes and books is 0%; for guitar, 23%. Subcategories can be taxed differently; for example, the category “children’s shoes” can be assessed differently regarding shoe sizes. In our examples, we assume the maximum reduction.