Competitive pricing in European E-Commerce

VAT rates vary across the European Union. Nevertheless, many merchants rely on uniform product prices across countries. However, they need to pay more attention to the losses when local reductions and exemptions are not considered for VAT reporting.

Other merchants base their prices on the purchasing power of the respective target market. That’s why avoiding unnecessary losses due to overpaid VAT is vital.

Calculate your VAT Optimisation Potential in seconds

Enter your sales and product groups in the VAT Optimiser and find out whether you could benefit from exemptions and reductions in local VAT law in your target markets.

What is the VAT Optimisation Potential?

The VAT Optimisation Potential calculates the difference between the general application of standard VAT rates and the application of the required VAT rates, depending on the product class. The latter considers all current exemptions and reductions.

White Paper “Automated tax rate determination as a success factor in European e-commerce”

Solutions to automate tax rate determination simplify merchants’ processes, create competitive advantages and enable additional revenues.

Our experts provide information on the numerous advantages of automated tax rate determination in our white paper.

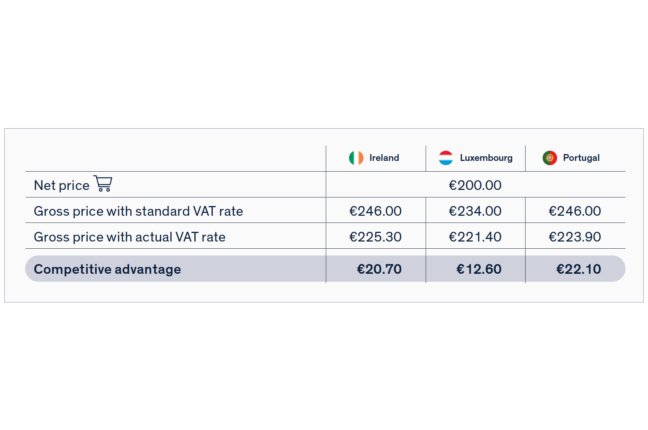

Pricing in a highly competitive EU market

A basket worth €200 (net) with four items (children’s clothes and shoes, a book, and a guitar) is shipped to three countries. As a competitive advantage, we show the difference between applying the standard VAT rate (IE 23%, LU 17%, PT 23%) and the VAT rate actually required for each item (e.g., IE: children’s clothes 0%, children’s shoes 0%, book 0%, guitar 23%).*

The consideration of applicable VAT exemptions allows the merchant to offer this basket in, for example, Ireland for €225.30 instead of €246.

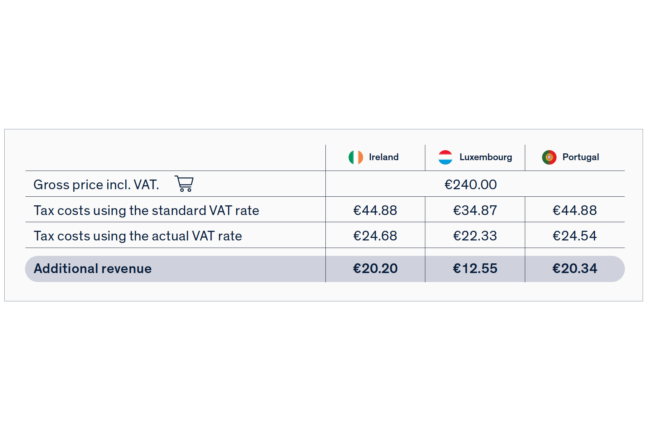

Increased margin

A basket worth €240 (gross) with four items (children’s clothes and shoes, a book, and a guitar) is shipped to three countries. As additional revenue, we show the difference in VAT to be paid out by the merchant to the tax authorities when applying the standard VAT rate (IE 23%, LU 17%, PT 23 %) and the VAT rate actually required for each item (e.g., PT: children’s clothes 23%, children’s shoes 23%, book 6%, guitar 6 %)*.

Using Portugal as an example, applying country-specific VAT rates will add €20.34 to the merchant’s basket.

* Subcategories can be taxed differently. For example, the “children’s shoes” category can be assessed differently regarding shoe sizes. In our examples, we assume the maximum reduction.

VATRules: One VAT database for your entire product portfolio

- All VAT rates and rules for selling your products in the EU-27 and Northern Ireland

- Incl. country-specific exemptions, reductions, and temporary changes

- Continuously updated and provided into your system environment on-demand