Merchants from all over the world want to take advantage of the steady growth in e-commerce by selling their products outside their home territory. Europe is an especially lucrative market with outstanding sales potential. But one of the biggest hurdles here is the complex and confusing tax system. Each of the 27 EU countries has its laws, which makes things difficult for merchants from third countries. Basically, for every article imported into the EU using the IOSS customs system, the tax must be precisely calculated, collected from the customer and remitted to the competent tax authority.

The devil in the details – correct calculation involves lots of stumbling blocks

Even if you manage to apply the correct rates, you also have to pay close attention to the calculation. When multiple items are sent in one package, everything depends on the products inside and the additional costs. The following example makes this clearer.

Mr. Wang, a Chinese retailer, sells a variety of sporting goods for children and adults through his online shop. He also markets these products in Europe. A customer from Ireland and a customer from Germany coincidentally purchase the same articles from Wang: boy’s gym shoes for EUR 40 euros and a soccer ball for EUR 20.

Wang packs two separate packages and calculates the import VAT for the shoes and the ball according to the tax rate in each of the countries (he searched on the internet and found 19% for Germany and 18% for Ireland). He adds the shipping costs of EUR 10 for each package, lists this amount separately, and ships the goods to the destination countries.

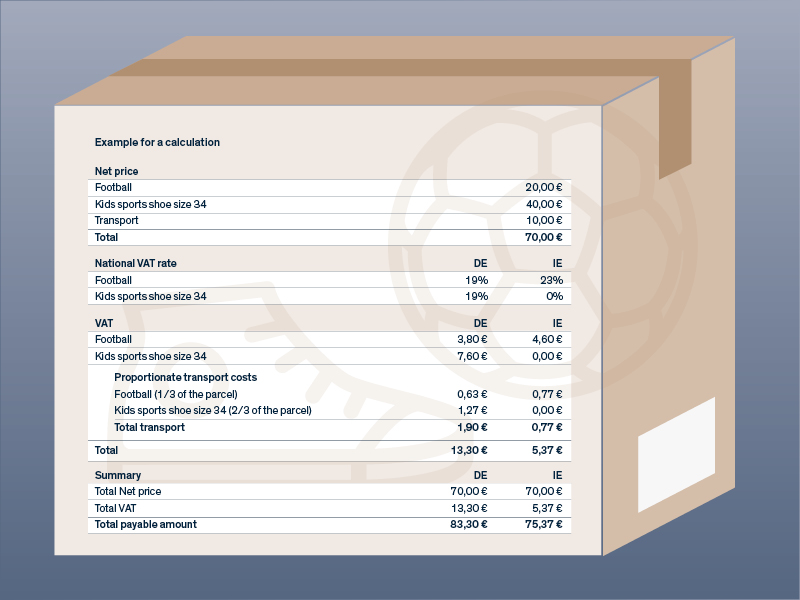

This all sounds simple, but unfortunately, it’s not correct. Mr. Wang has made crucial mistakes in calculating the tax – resulting in a disadvantage to him and to his customers. What he didn’t know is that, in Ireland, an exception is made for children’s size 35.5 gym shoes and the tax rate is 0%. In this case, the import VAT does not have to be calculated at all. Mr. Wang has also listed the EUR 10 shipping costs separately and did not charge tax. However, it is mandatory to calculate VAT for all costs shown on the invoice. This includes shipping fees (as long as the merchant has listed them separately), any insurance on the package, and everything else for which the buyer pays extra.

Additional costs are taxed proportionally to the package content

Here is another challenge when it comes to calculating VAT: The tax on additional costs must be levied proportionally to the purchased goods.

For the packages from Mr. Wang containing children’s gym shoes and a soccer ball, the shoes make up 2/3 and the soccer ball 1/3 of the total value of the package. Therefore, the import VAT must be applied proportionally to the EUR 10 shipping cost.

A concrete calculation using the example of Germany and Ireland illustrates this point:

This involves an enormous calculation effort, not only for Mr. Wang, but also for any other e-commerce merchants who want to take advantage of key sales markets in Europe.

All goods shipped to the EU must be declared to customs and the import VAT must be calculated correctly for each item as well as for any additional costs. This requires the merchant to have access to the correct tax rates, including exceptions and special regulations. If this is not the case, there may be some unpleasant surprises.

eClear solutions ensure correct tax calculation

The full-service ClearCustoms product from eClear makes shipping from a third country to Europe easy and 100% compliant for merchants. This enables online retailers to sell their goods across borders to other countries without registration, customs formalities and risks. ClearCustoms includes everything from the classification of goods, to payment options, customs, and tax registration.

For shipments to the EU 27 valued at less than EUR 150, the eClear IOSS+ product offers merchants a service that handles registration with the Import-One-Stop-Shop and takes care of all tax obligations.