Switzerland forms a customs and VAT enclave in the middle of Europe. As it is not a member of the EU, special regulations apply here for the shipment of goods, similar to deliveries from the USA or the Far East.

E-commerce merchants, especially from Switzerland, do not have it as easy when exporting and making returns as they do when shipping between two EU countries and have to observe special regulations.

What has to be considered when shipping from a third country, in this case, Switzerland, to the EU?

These consignments must be declared, labelled and accompanied by valid delivery or customs documents. Here, the shipping method is crucial. A distinction is made between Incoterm DAP (Delivered at Place) and DDP (Delivered Duty Paid). With a DAP shipment, the sender only pays the transport costs. The consignee of the consignment pays duties, such as customs duties, import VAT and customs duties. In the case of a DDP shipment, these import duties are also borne by the seller and declared as “delivered duty paid”. However, a DDP delivery requires registration of the consignor in the destination country, which can be very complex due to the risks and expenses involved.

Dispatch of small consignments

The letter channel can be used when sending small goods up to 2 kg gross weight, which does not exceed the shoebox size. Here, a Harmonised Label from Swiss Post is used for customs clearance. Small consignments with more than CHF 400 value require the customs declaration CN23 and a commercial invoice. This is also provided by Swiss Post and must be filled out correctly.

Sending items as a parcel

Anything larger or heavier than a small consignment is sent via the parcel channel. This consignment must accompany a consignment note and a triplicate commercial invoice. The amount of import duties (customs duties and taxes) depends on the transaction value. The cost of a customs declaration varies greatly, from EUR 6 at the post office to EUR 50, depending on the transport service provider. Here, it is worth comparing the service providers more closely. As a merchant, all costs up to the front door and further costs, such as those incurred for returning the goods, should always be shown transparently to the customer.

Why a correct declaration is important

Those who deal with customs in detail must provide the correct and complete customs documents and inform customers accordingly to run the risk of having goods blocked by customs or being refused acceptance of the goods by the customer. Some merchants even shy away from this and prefer to forego market share.

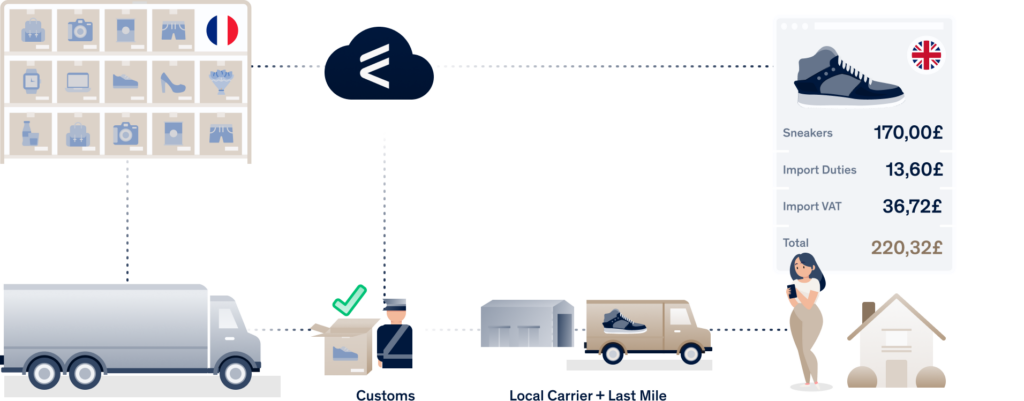

Why stress over customs procedures when you can simplify them with ClearCustoms, a full-service customs solution designed specifically for e-commerce? With ClearCustoms, your shipments from or to a third country are as straightforward as domestic ones. Plus, all additional costs are transparently displayed to your customers during check-out, eliminating any potential for unpleasant surprises.

ClearCustoms offers e-commerce merchants a secure and protected way to distribute their goods across borders—no need for registration in the destination country or worrying about customs formalities and risks. From the classification of goods and payment options to customs and tax registration – everything is seamlessly integrated into a “worry-free solution”.

ClearCustoms® – Border-free e-commerce

Seamless shipping to Switzerland

Our ClearCustoms® solution enables marketplace merchants to ship border-free to Europe’s most lucrative markets: Switzerland, Great Britain, and Norway.