Immediately compliant for all EU: The Online VAT ID verification tool

Effortlessly validate VAT IDs across all EU member states with instant verification, real-time accuracy, and industry-leading security for complete compliance.

Example: DE309452892

Need to check more than one? Get CheckVAT ID!

Audit-proof VAT ID validation from €99 per month.

- Available as a web application or connection via API

- Display the correct identification and master data

- For all EU27, with 24/7 availability

Audit-proof and platform-independent

With the CheckVAT ID API and web application, you can check individual and multiple VAT ID numbers simultaneously and document the results in an audit-proof manner.

The required data is obtained from Germany’s Federal Central Tax Office (BZSt) and the Federal Ministry of Finance in Austria (BMF).

API query, batch upload, master data check, reporting

Simple or qualified VAT ID check (matching of name and address) for EU27 with 24/7 availability

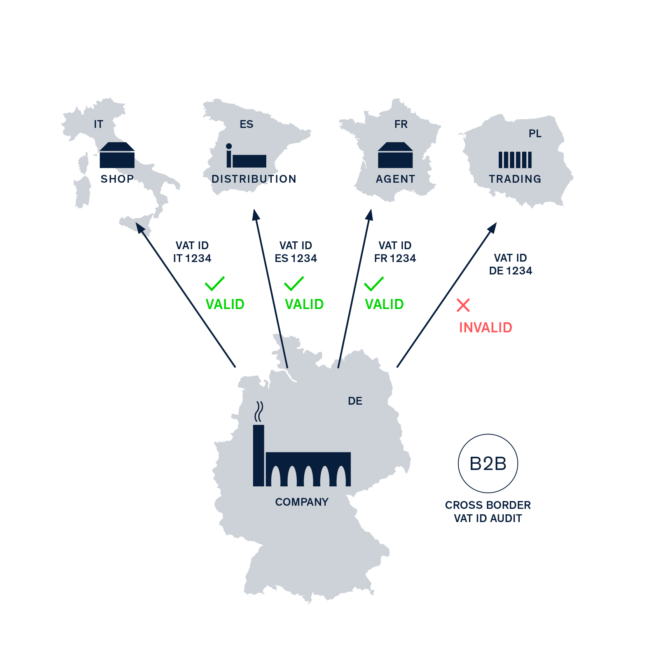

EU-wide checks from businesses in Germany, Austria and all other EU member states

Audit-proof reporting (records are kept for ten years and data is made available for documentation requirements)

Intuitive browser-based user interface or access via API integration

Single and multiple searches as well as batch search for extensive queries via CSV data upload

Continuously updated database for legally compliant VAT ID verification and matching of master data

Export option for downstream systems

Demand-based billing model

Why verifying VAT IDs is crucial for your EU business

- Ensuring Tax Exemption: The VAT ID confirms that the recipient of a consignment is a business. This is a prerequisite for proving a VAT-exempt intra-community supply (intra-community supply: when one business supplies goods to another business in another EU member state and these goods arrive in the other member state).

- Preventing Tax Fraud: Verifying the VAT ID ensures both parties are legitimate businesses, thereby preventing fraudulent activities.

- Legal Compliance: Legally required, verifying the VAT ID ensures that essential legal requirements for tax exemption are met.

- Automatic Data Exchange: A correct VAT ID ensures the proper processing and allocation of reports between the tax authorities of EU member states.