Let’s face it: needing an indirect representative to handle customs clearance in Germany can feel like searching for a needle in a haystack. While it is possible, finding one in Germany often feels like a lost cause. You might get lucky and find them elsewhere in the EU, or perhaps you have existing contracts or strong relationships with customs agents.

However, the responsibility associated with the role makes finding a willing indirect representative in Germany a real uphill battle for many businesses.

The Intricacies of Cross-Border Trade

Behind the procurement and purchasing of goods abroad lies a complex system of cross-border goods movements and the associated customs formalities.

Customs Formalities: A Necessary Evil?

Crossing invisible borders often means encountering customs officials and their intricate paperwork. For many businesses and individuals, these formalities can seem like a tedious obstacle that hinders smooth trade. However, fear not! With the proper preparation and expertise, these hurdles can be effortlessly overcome.

Clarity from the Start: Defining Customs Responsibilities

From the very beginning, it’s essential to establish clear agreements with your business partner regarding the distribution of customs formalities. Who will handle the declarations? Who will bear the costs? Clear communication is your shield against surprises in the future.

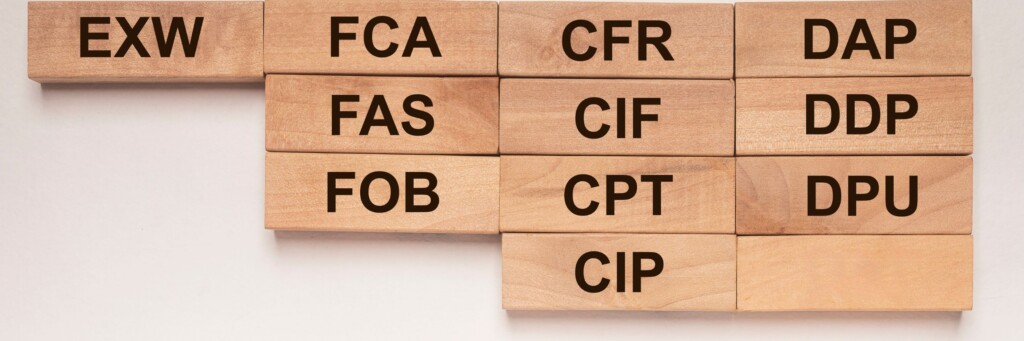

Incoterms: The Indispensable Guides in International Trade

Imagine you’ve ordered a handcrafted piece of jewellery from a faraway land. How does this exquisite piece reach your doorstep? Magic? No, it’s a complex symphony of cross-border movement of goods and, of course, the associated customs formalities.

But who is responsible for what?

This is where Incoterms (International Commercial Terms) come into play. These international trade rules clearly and unambiguously define the responsibilities of the buyer and seller in the transport and customs clearance of goods.

The most common Incoterms®

DDP and the Indirect Representative: A Team for a Smooth Process

When “DDP (Delivery Duty Paid)” is agreed upon in the Incoterm, the non-EU partner assumes responsibility for customs clearance in the EU? Sounds simple? Well, it takes a lot of work.

To fulfil this task, the DDP supplier must appoint an indirect representative. This EU-based specialist not only handles the payment of customs duties and VAT but also bears full responsibility for complying with all import regulations.

From Product Safety to Trademarks: The Indirect Representative Holds the Reins

These regulations include, but are not limited to:

- Product Safety: The indirect representative must ensure that the imported goods meet the applicable safety standards.

- Trademarks: They cannot import goods that infringe on trademarks.

- CBAM Reporting Obligations: Under the Carbon Border Adjustment Mechanism (CBAM), the indirect representative must provide detailed emissions data for certain goods.

CBAM: New Challenges for Indirect Representatives

The introduction of CBAM further complicates the tasks of indirect representatives. It is expected that these experts will:

- Contractually exclude specific HS codes to minimize the reporting obligations associated with CBAM.

- Meet high reporting and transparency standards to prove the origin and CO2 emissions of imported goods.

The Role of Customs Agents

Imagine you’re an entrepreneur eager to import goods from a distant land. The prospect of navigating the intricate maze of customs formalities and regulations can quickly send shivers down your spine. But fear not; you don’t have to embark on this daunting journey alone!

Customs Agents as Experienced Navigators

In these situations, a customs agent emerges as your saviour. These experts serve as seasoned navigators, guiding you through the uncharted waters of customs clearance. Equipped with profound knowledge and years of experience in all aspects of import and export, they are your indispensable allies in ensuring a smooth and compliant trade process.

The Diverse Services of Customs Agents

Customs agents offer a comprehensive suite of services to streamline your customs experience:

- Preparation and Submission of Essential Customs Documents: They meticulously prepare and submit all required customs documents, ensuring accuracy and adherence to regulations.

- Calculation and Payment of Customs Duties and Import VAT: They expertly calculate and settle customs duties and import VAT, ensuring timely payments and avoiding penalties.

- Effective Communication with Customs Authorities: They serve as your liaison with customs authorities, bridging the communication gap and ensuring seamless interactions.

- Expert Handling of Customs Inspections and Audits: They adeptly handle customs inspections and audits, safeguarding your interests and ensuring compliance.

- Comprehensive Advice on Customs Matters: They provide expert advice on all aspects of customs regulations, empowering you to make informed decisions.

When Responsibility Becomes a Balancing Act

While customs agents play a crucial role in facilitating trade, indirect representation can be particularly demanding. Indirect representation entails assuming the responsibilities of an importer, including customs clearance and liability for the imported goods.

Why Do Customs Agents Hesitate to Take on Indirect Representation?

The reluctance stems from the significant liability associated with indirect representation. The indirect representative essentially steps into the shoes of the importer, becoming fully accountable for the accurate customs clearance of the goods.

Navigating Liability Risks and Transparency Challenges

Complications arise when inaccuracies are discovered in the information provided by the client. In such cases, the customs authorities may hold the indirect representative liable for any discrepancies or non-compliance.

The challenge lies in the limited access to relevant information that the indirect representative often faces. They may not have direct access to the buyer’s purchase records or the seller’s accounting information, hindering their ability to verify the accuracy of the provided details.

Furthermore, the varying approaches to customs inspections and risk management across EU member states add another layer of complexity. This inconsistency can make it difficult for indirect representatives to ensure consistent compliance across different jurisdictions.

The challenges associated with indirect representation underscore the importance of collaboration among all stakeholders involved in the customs clearance process. Open communication, transparent information sharing, and a shared commitment to compliance are essential to ensure a smooth and efficient trade flow.

A Call for Action: Rethinking Customs Regulations for a Smoother Trade Landscape

Addressing the Complexities of Indirect Representation: A Shared Responsibility

The intricate challenges of indirect representation demand a paradigm shift from both authorities and policymakers. It’s time to embrace practical solutions that balance upholding customs regulations and enabling businesses to navigate them effectively.

Creating a Safe Harbor for Indirect Representatives: Building Trust Through Effective IKS

The key lies in establishing a framework that empowers indirect representatives to operate confidently within their Internal Control Systems (IKS). This entails providing clear guidelines, adopting practical interpretations of legal requirements, and fostering open and trusting collaboration with customs authorities.

Eliminating Unnecessary Hurdles: Fostering Economic Growth, Not Hindering It

An expert aptly stated, “Either we promote the economy and enable practical implementation of legal requirements, or we follow a rigid approach and restrict the freedom of action of economic operators.”

It’s high time we translate words into action. The message is clear: Unnecessary bureaucratic hurdles and an inflexible adherence to impractical regulations ultimately harm the economy and impede international trade.

Expanding Our Focus: Addressing Challenges Beyond Indirect Representation

The challenges extend far beyond indirect representation. Issues such as “Postponed VAT Accounting” (implemented in most countries except Germany) (You can find my update on this topic here) and the current backlog in issuing export licenses highlight the need for action across various fronts. .

The Evolving Role of Customs Agents: Adapting to a Changing Landscape

Digitalisation and the growing complexity of customs regulations pose fresh challenges for customs agents. Indirect representation, where the customs agent assumes full responsibility for customs clearance, carries heightened risks.

Abolishing DDP: A Potential Solution with Drawbacks

While abolishing the DDP Incoterm could mitigate risks for customs agents, it would also introduce new complexities. A new system for delivering goods between two non-EU parties to the EU would need to be developed.

Reliability and Planning Security: The Paramount Goals

Despite the uncertainties surrounding the future of customs agents, one thing remains clear: reliability must be the top priority for all stakeholders. Clear, unambiguous, and consistently applied rules are essential for businesses to plan effectively and maintain trust in customs processes.

Collaboration: The Path Forward

Collaboration among all stakeholders—authorities, policymakers, and businesses—is crucial to addressing the challenges of the future and ensuring a seamless and efficient international trade environment. Only through collective effort can we navigate the uncharted waters that lie ahead.

Together, we can shape a future where international trade thrives, regulations are upheld, and the risks faced by all parties are minimised.

Let’s stay in touch!

Stay up to date on the latest market trends, best practices and regulatory changes affecting cross-border trade by following us on LinkedIn.