The Carbon Border Adjustment Mechanism (CBAM) is not just another regulation—it’s a major shift for importers, aligning with the EU’s overarching climate-neutral goals.

It’s not enough to rely on default values anymore. Importers and their indirect representatives must use actual emissions data from suppliers.

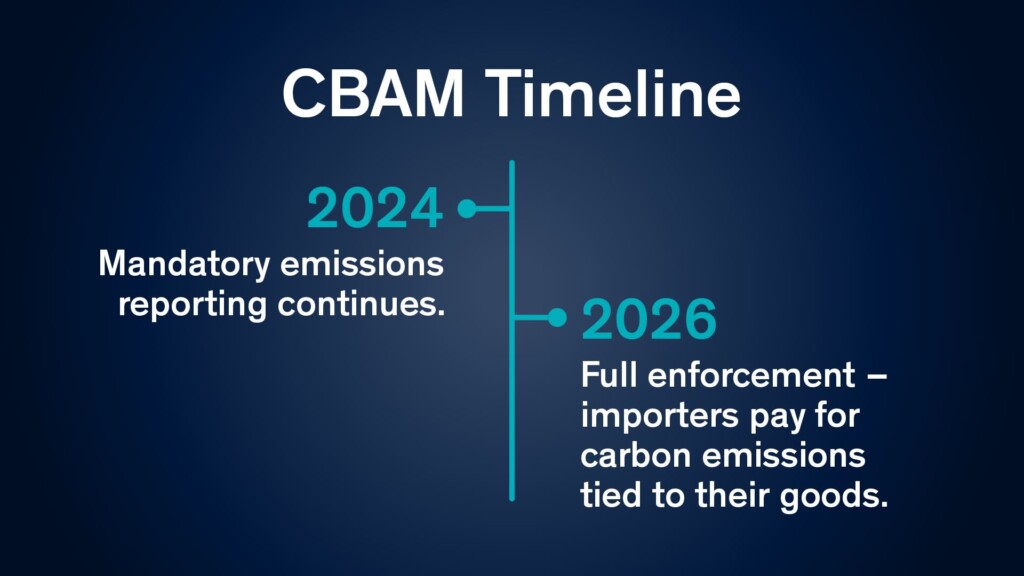

So, here’s how the regulation will unfold in the coming years and why your business should act immediately.

There’s a lot at stake

Failure to comply with CBAM requirements could lead to penalties ranging from €10 to €50 per tonne of unreported emissions. Even a minor oversight can result in significant financial and reputational damage for your business.

You must navigate complex supply chains, work with potentially non-cooperative suppliers, and track down emissions data for every batch of CBAM-covered goods.

The next full report, within the current reporting period, is due by October 31, 2024.

Without preparation, you may face severe risks in this rapidly evolving regulatory landscape.

Full Enforcement is Just Around the Corner

CBAM is part of the EU’s “Fit for 55” package, designed to align climate goals with economic practices. The mechanism was introduced in 2023, with a phased approach, allowing importers some time to adjust.

Starting from January 1, 2026, CBAM will shift to full enforcement. Then importers will have to purchase CBAM certificates.

These certificates will cover the embedded greenhouse gas emissions in their imported goods, ensuring they align with the EU’s carbon pricing.

Seeing the Good in CBAM

Complying with CBAM’s requirements, especially in this final phase, can transform your business’s operational efficiency.

Proactively managing your emissions reporting demonstrates your commitment to sustainability, boosting your reputation among environmentally conscious consumers and investors.

Additionally, being ahead of these requirements will help mitigate costly disruptions in your supply chain.

Important Next Steps

Four steps are very important to keep at top of mind when your company is affected by CBAM. Make sure the according procedures are being implemented or at least planned for, so you don’t have any bad surprises in 2026.

- Start engaging with your suppliers immediately to collect accurate emissions data.

- Establish an internal process for quarterly reporting, ensuring third-party verification compliance.

- Regularly review CBAM guidelines to stay informed on any regulatory updates.

Prepare for audits and additional checks by making emissions data traceable and transparent.

Taking CBAM regulations seriously helps protect your business from regulatory risks and builds trust with your partners and customers. Acting early will keep your operations running smoothly as full enforcement begins, and show that your company is a leader in sustainable trade.

Interesting links and further reading

Let’s stay in touch!

Stay up to date on the latest market trends, best practices and regulatory changes affecting cross-border trade by following us on LinkedIn.