At the same time, it aims to make it work better for businesses and more resistant to fraud by incorporating but promoting its digitalisation. Today’s proposal also seeks to address the VAT challenges created by the development of the platform economy.

According to the latest figures on the VAT gap, also published today, Member States lost €93 billion in VAT revenue in 2020. According to conservative estimates, a quarter of the lost revenue can be directly attributed to VAT fraud in intra-EU trade. These tax losses damage public finances when member states adjust their budgets to deal with the social and economic impact of recent energy price spikes and Russia’s war of aggression against Ukraine. In addition, VAT regimes in the EU can still be burdensome for businesses, especially SMEs and other companies that operate across borders or want to expand their business.

The measures proposed today will help Member States raise €18 billion more in VAT revenue each year while stimulating business growth, including SMEs:

Switch to real-time digital reporting based on e-invoicing for companies operating across borders in the EU

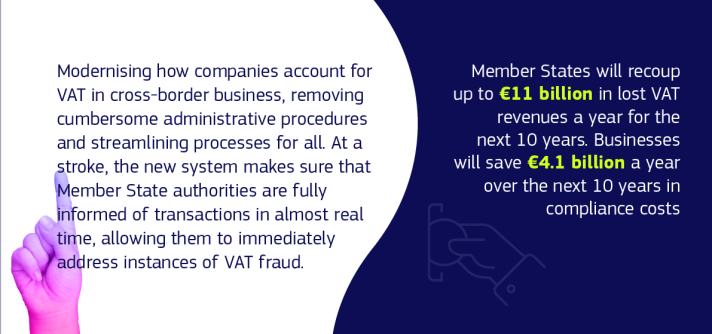

The new system will introduce real-time digital reporting for VAT purposes based on e-invoicing, providing Member States with valuable information they need to step up the fight against VAT fraud, particularly carousel fraud. The switch to e-invoicing will help reduce VAT fraud by up to €11 billion per year and reduce administrative and tracking costs for EU traders by over €4.1 billion per year over the next ten years. It also ensures that existing national systems are merged across the EU and paves the way for Member States to set up national digital reporting systems for domestic trade in the coming years.

Updated VAT rules for passenger transport and short-term accommodation platforms

Under the new rules, platform operators in these sectors will be responsible for collecting and remitting VAT to the tax authorities where service providers do not do so, for example, because they are small businesses or sole sellers. Together with other clarifications, this will ensure a consistent approach across Member States and help ensure a level playing field for online and traditional short-term accommodation and transport services. It will also make life easier for SMEs who would otherwise have to understand and comply with VAT rules in all Member States where they operate.

The introduction of single VAT registration in the EU

Building on the already existing One-Stop Shop (OSS) model for business VAT, today’s proposal would allow businesses selling across borders to register only once for VAT purposes across the EU and fulfil their VAT obligations through a single online portal in one language. It is estimated that this move could save businesses, especially SMEs, around €8.7 billion in registration and administrative costs over ten years. Other measures to improve VAT collection include the mandatory introduction of an import-one-stop-shop for specific platforms that sell to consumers in the EU.

Next steps

Today’s package of proposals includes amendments to three EU legislative acts: the VAT Directive (2006/112/EC), the Council Implementing Regulation (EU 282/2011) and the Council Regulation on administrative cooperation (EU 904/2010). The legislative proposals will be sent to the Council for agreement, the European Parliament, and the Economic and Social Committee for consultation.

Further information:

Questions and Answers: VAT in the Digital Age

Source: taxation-customs.ec.europa.eu