It probably doesn’t happen often that the legal foundation upon which an entire career is built is completely overhauled. In my career in customs, 2024 is already marking the second revolution in customs regulations.

Introduction of the UCC 2013

The first major change was the introduction of the Union Customs Code (UCC) in 2013 (Regulation (EU) No. 952/2013), which codified a comprehensive European view of customs law that incorporates all changes and new technological possibilities since 1992.

The rollouts and necessary IT adjustments to the processes and capabilities implemented in the regulation still occupy us today (e.g., in cross-member state authorisations). For more information, refer to the EU’s work program (UCC—Work Programme) and the project timeline.

As of now, not all functions and processes stipulated in the 2013 law are feasible due to the lack of IT systems and, particularly, their interconnection across the 27 member states. However, the timeline suggests that all projects should be implemented by 2025 to 2026.

Right on time for …

2024: Significance of the New EU Customs Rules for Global Trade

Now, more than ten years after the introduction of the “Union Customs Code,” we are once again in a phase of upheaval: The EU Commission has presented a draft for a new regulation on EU customs law and the EU Parliament has already presented its first adaptation and made adjustments, which will significantly impact businesses and the industry.

This draft aims to reflect the significantly changed conditions in today’s everyday global trade, especially in e-commerce and its various forms (particularly the rise of so-called “cross-border e-commerce transactions”). An important step is incorporating the now-changed tax legislation (removal of the €22 import VAT exemption in 2021) into customs law, with the necessary adjustments. We have already discussed the upcoming changes concerning e-commerce in an article.

Of course, the draft also includes various changes for businesses and the industry, such as the possible change in the maximum duration of temporary storage (currently 90 days, first draft 3 days, now back to 90 days) or the new Trust and Check Trader. Many companies are presently AEO, and it will be a significant question for them, depending on the exact requirements for the Trust and Check Trader, whether the effort and investment in this “upgrade” is worthwhile.

The Current Draft Status

It must be articulated that the reform is currently in draft status. It will still have to overcome several hurdles in the EU Parliament and the EU Council before the final regulation and the associated implementing acts are available.

However, it is not surprising that this draft is being discussed and debated on many levels, especially at this stage, when there is still the possibility of influencing the final regulation and its attached legal acts.

Based on experience, the deadlines, particularly for the implementation of IT systems, are set quite long. This means that many colleagues in the customs field will be dealing with the reform and its impacts for a significant period, potentially twenty years or more.

E-Commerce and Automation: Objectives of the Reform

The main objective of the reform is to account for new business models and circumstances while keeping administrative burdens low or manageable through automation.

Accounting for new business models such as e-commerce, specifically cross-border e-commerce. What other areas like VAT law have already addressed. Creating equal conditions for all economic operators across the entire EU. Cross-member state authorizations should be much easier to implement with an EU customs system. We are committed to focusing even more on IT in this step, ensuring confidence in our technological capabilities.

We can certainly agree with most of these goals, but it is rightly sceptical that the EU could have made a better impression regarding IT projects and timelines in the past. Whenever there was a choice between a “practical solution” and “more effort and requirements for companies,” the latter was always chosen.

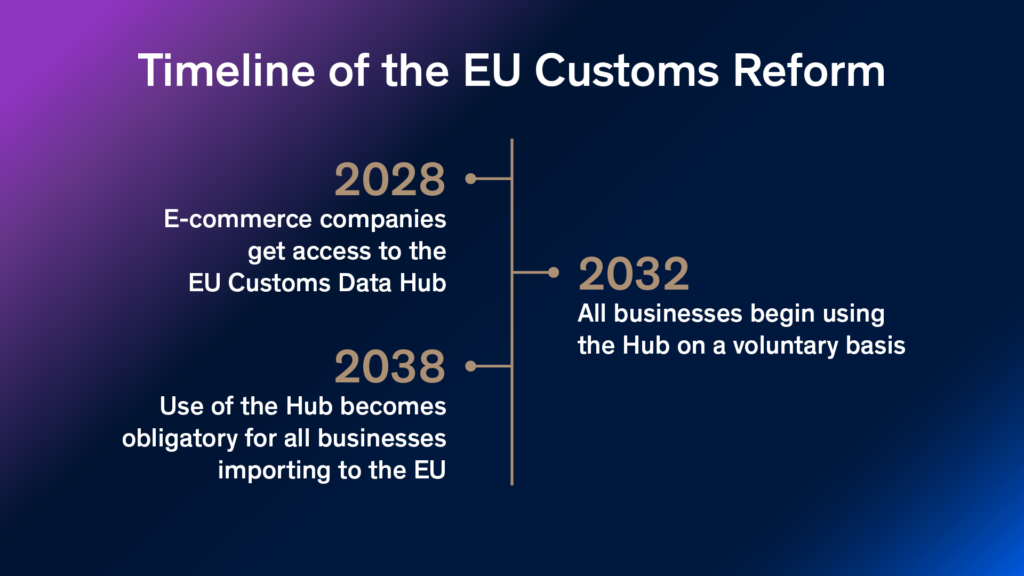

Timeline

The timeline from the original draft by the EU Commission is still visible on the EU website. In the text amended by the Parliament, these dates have been brought forward (e.g., instead of 2028, 2026).

It remains to be seen whether these very ambitious goals can actually be met and whether they will survive further readings until ratification. Those responsible for the practical implementation of the proposal (member states, IT system providers) are expected to request more time to implement the significant changes into functioning operational and IT processes.

While I welcome a swift implementation, it is important to exercise caution based on experiences. I do not believe that the EU will be able to establish a ‘Customs Data Hub’ in less than two years, even if it is a stripped-down version focused on e-commerce. For economic operators, the best advice for now is to ‘wait and see.’

Challenges for Business / What Companies Can Expect

The draft and the lawmakers’ vision for the future of customs has sparked considerable discussion – and rightly so. Many questions remain unresolved, and in several areas, the legislators’ understanding simply does not align with the everyday reality of economic operators and customs agents. It is crucial that we all strive for clarity in this complex situation. Here, I would like to refer to some excellent statements from business associations.

- Statement of the DIHK from 07/11/2023

- Statement of the DSLV Bundesverband Spedition und Logistik e. V. from 06/06/2024

The points raised are of high relevance to the involved parties, such as customs agents and freight forwarders, and legal uncertainties regarding terms like importer and exporter should be urgently avoided. The issue of “indirect representation” (a topic we have examined more closely in a previous article) is becoming a significant sticking point. This is as true for the industry (CBAM, etc.) as it is for those involved in e-commerce (and may also impact established models such as DAP clearance to end customers via express networks).

„Freier Verkehr“ Podcast by AEB: Ole Zimmer on EU customs reform

As part of this, I was a guest on the AEB podcast “Freier Verkehr,” which deals with customs topics from a practitioner’s perspective. This time, it featured a live on-site recording for the first time.

(The podcast is in German.)

Topics:

- Introduction of the “Trust and Check Trader”

- “Deemed Importer” – Mirroring the “Deemed Supplier” for customs

- Simplified customs rates for e-commerce (so-called “Buckets”)

- Data submissions to the “Customs Data Hub”

- And, of course, the potential central EU customs authority and its responsibilities.

- There is also some speculation about this customs law reform’s possible implementation and spirit.

My Expectations

I rarely hide my opinions and indeed have high expectations—especially when the EU announces such a major reform—that the involved parties fulfil their duties.

For the EU, this clearly means:

- Building IT capacity and excellence, as the press release itself speaks of “cutting-edge technology,” otherwise the reform will become a paper tiger and fail to achieve its goal.

- The development process involves practitioners from every sector (industry, customs agents, e-commerce, trade, commerce, etc.).

- Our highest priority must be seamlessly integrating existing systems and data sources. This will ensure a smooth transition and the continuity of operations, providing reassurance to all involved.

Let’s stay in touch!

Stay up to date on the latest market trends, best practices and regulatory changes affecting cross-border trade by following us on LinkedIn.