- What are the limitations of VIES in VAT ID validation? VIES often has outdated data, lacks detailed checks beyond basic VAT ID validation, and is not audit-proof, which can lead to compliance risks and operational inefficiencies.

- How does CheckVAT ID improve VAT ID validation? CheckVAT ID offers automated, audit-proof verification, 24/7 availability, seamless integration via API, qualified VAT ID checks, a demand-based billing model, and ten-year audit-proof record-keeping.

- What are the benefits of using CheckVAT ID for businesses? Businesses experience increased efficiency, reduced manual errors, enhanced compliance, and the ability to perform real-time VAT ID checks across the EU.

In EU trade, accurate VAT ID validation is more critical than ever. Are you relying solely on VIES for your VAT ID checks? While VIES (VAT Information Exchange System) has been a reliable tool for basic VAT ID validation, it has significant limitations that can impact your business’s compliance and operational efficiency.

Limitations of VIES

While useful, VIES is often plagued by several significant issues that can hinder your business’s compliance efforts. One of the primary concerns is that VIES data is frequently outdated. The system relies on member states to update their records regularly, which doesn’t always happen promptly. This delay can lead to businesses using incorrect or outdated VAT IDs, posing severe compliance risks.

Furthermore, VIES lacks detailed checks beyond basic VAT ID validation. It doesn’t verify critical information such as company names and addresses, which is essential for ensuring complete compliance with EU trade regulations. This shortfall can result in incomplete verification processes, leaving businesses vulnerable to errors and potential audits.

Another critical limitation of VIES is that it is not audit-proof. The data provided by VIES cannot always be substantiated during a thorough compliance audit. This lack of audit-proof validation means businesses relying solely on VIES might face challenges during audits, potentially leading to fines or other compliance issues.

Understanding these limitations sets the stage for why an alternative like CheckVAT ID is necessary. Unlike VIES, CheckVAT ID addresses these VAT ID compliance challenges by offering more accurate, detailed, and audit-proof validation, ensuring that your business operations are compliant, efficient, and reliable.

Features and Benefits of CheckVAT ID

CheckVAT ID stands out with its robust set of features designed to address the limitations of VIES and enhance your VAT ID validation processes. Here’s a closer look at its key features and benefits:

CheckVAT ID stands out with its robust set of features designed to address the limitations of VIES and enhance your VAT ID validation processes. Here’s a closer look at its key features and benefits:

Fully Automated and Audit-Proof Verification: CheckVAT ID provides automated, audit-proof verification for individual and multiple VAT identification numbers and matching of master data across the EU. This automation saves time, minimises human error, enhances efficiency, and reduces non-compliance risk.

24/7 Availability: CheckVAT ID offers EU-wide checks 24/7 for companies in all EU member states, allowing businesses to validate VAT IDs anytime. This flexibility prevents operational delays due to time zone differences or system downtimes, which is crucial for companies engaged in cross-border trade.

Seamless Integration: CheckVAT ID is an intuitive web application that can be integrated into your system environment via API, fitting seamlessly into existing systems. This enables businesses to quickly benefit from improved VAT ID validation without extensive system overhauls.

Qualified VAT ID Checks: CheckVAT ID provides simple or qualified VAT ID checks, matching names and addresses for all EU member states. This detailed checking goes beyond what VIES offers, providing a higher level of accuracy and reducing the risk of compliance issues related to incorrect or incomplete data. The required data is obtained from Germany’s Federal Central Tax Office (BZSt) and the Federal Ministry of Finance in Austria (BMF).

Demand-Based Billing Model: CheckVAT ID utilises a demand-based billing model, offering a cost-effective solution that scales with your business needs. Whether a small business with occasional checks or a large enterprise requiring extensive validations, the flexible pricing structure ensures you only pay for what you use.

Ten-Year Audit-Proof Record-Keeping: CheckVAT ID ensures compliance with comprehensive, audit-proof records, complete with BZSt time stamps. This is crucial for maintaining thorough records for audits and regulatory compliance, with records kept for ten years.

Use Cases

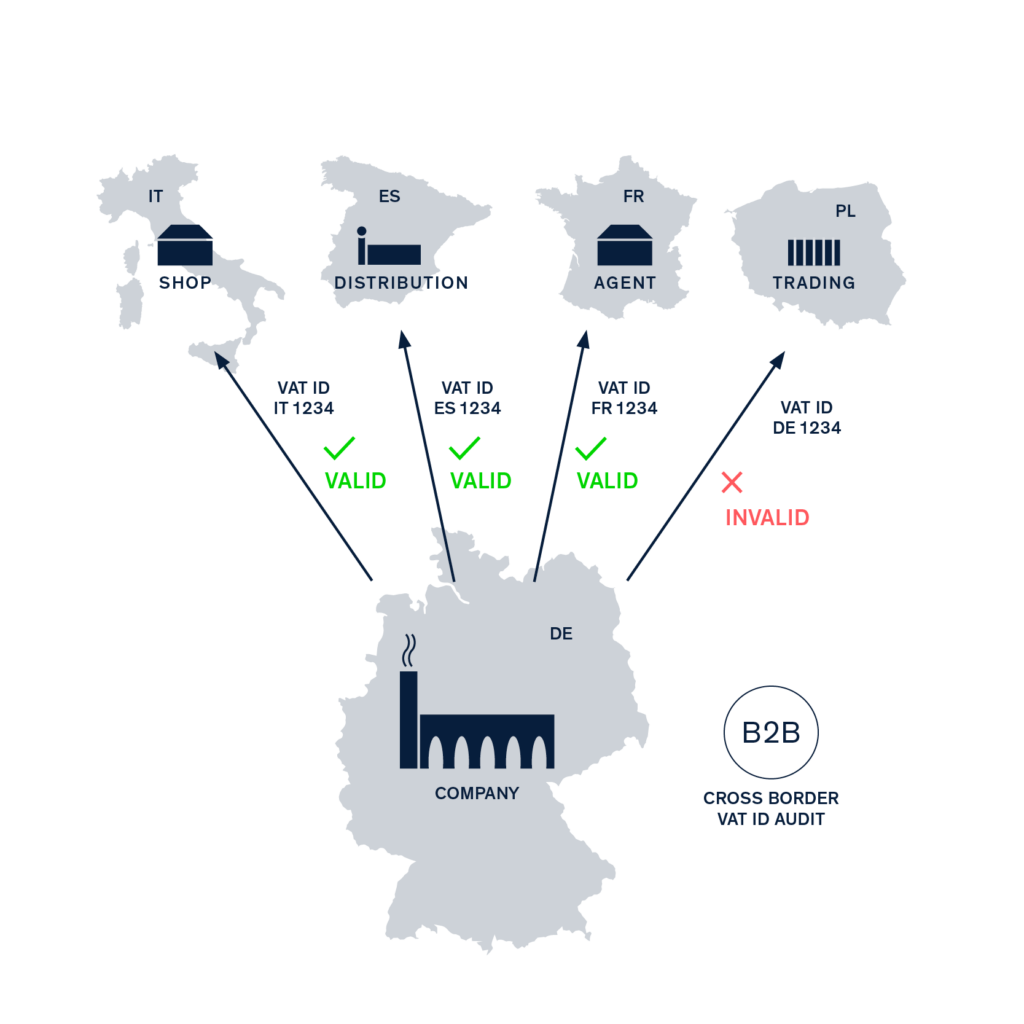

The real-world applications of CheckVAT ID demonstrate its transformative impact on business operations and compliance. Numerous businesses across the EU have integrated CheckVAT ID into their systems, experiencing significant improvements in efficiency and compliance.

Multinational Company

One notable example is a multinational company engaged in extensive cross-border trade. Before implementing CheckVAT ID, the company faced frequent issues with outdated and incorrect VAT IDs, leading to compliance risks and operational delays. By integrating CheckVAT ID via API, the company automated its VAT ID validation process, ensuring real-time checks and reducing manual errors. This integration resulted in a 40% increase in operational efficiency and substantially decreased compliance-related incidents.

Medium-Sized Enterprise

Another case study involves a medium-sized enterprise specializing in B2B services across multiple EU countries. The company needed help with the administrative burden of manually validating VAT IDs for hundreds of clients. After adopting CheckVAT ID, the enterprise utilized the batch search functionality to validate multiple VAT IDs simultaneously. This not only saved time but also provided audit-proof records that were crucial during regulatory inspections. The company reported a 50% reduction in the time spent on VAT ID validation and a notable improvement in compliance readiness.

Small E-Commerce Business

A third example is a small e-commerce business that needed a reliable solution to manage VAT ID validation as it expanded into new EU markets. The company integrated CheckVAT ID through its web application, enabling seamless and continuous validation of customer VAT IDs during checkout. This integration ensured that all transactions complied with EU VAT regulations, enhancing customer trust and reducing the risk of penalties. The business saw a 30% increase in customer satisfaction and a smoother compliance process overall.

How to Implement CheckVAT ID

Implementing CheckVAT ID is a straightforward process that can be seamlessly integrated into your existing workflows, whether through API or web application. Here is a step-by-step guide to get you started:

Choose Your Integration Method

API Setup: API integration is a robust option for businesses looking to integrate CheckVAT ID into their existing systems. This method allows for automated VAT ID checks directly within your business applications.

- Register for API Access: Register on the eClear website to gain access to the CheckVAT ID API. You will receive API keys and necessary documentation.

- Configure API Settings: Use the provided documentation to configure the API settings within your system. This typically involves setting up endpoints, authentication, and data formats.

- Test the Integration: Before going live, perform test validations to ensure the API is correctly integrated and functioning as expected. This step helps identify any potential issues and ensures smooth operation.

Web Application Setup: For those who prefer a more user-friendly approach, the CheckVAT ID web application offers an intuitive interface for managing VAT ID validations.

- Create an Account: Get in touch with our team and sign up for a CheckVAT ID account.

- Upload Data: Prepare your CSV files with the VAT IDs you wish to validate for batch searches. The web application supports easy data uploads and can handle extensive queries efficiently.

- Perform Validations: Use the web application to perform individual or batch VAT ID checks. The results will be displayed in a sortable format with PDF or XLS export options.

Batch Search with CSV Upload

- Prepare Your CSV File: Ensure your CSV file is formatted correctly, with columns for VAT IDs and any other relevant information, such as company names and addresses.

- Upload the CSV File: Use the web application or API to upload your CSV file. The system will process the batch search, providing results for all entries.

- Review and Export Results: Once the validation is complete, review the results in the web application. You can export the data for downstream systems, ensuring all records are maintained for audit purposes.

Ongoing Use and Maintenance

- Regular Updates: To maintain optimal performance, ensure your system is regularly updated with new features or updates from eClear.

- Monitor Compliance: Monitor your VAT ID validation processes to ensure they comply with EU regulations. CheckVAT ID’s audit-proof record-keeping will assist in maintaining accurate records.

Keep outdated VAT ID validation systems from holding your business back. Embrace the future of compliance with CheckVAT ID and ensure your operations are always a step ahead.

Let’s stay in touch!

Stay up to date on the latest market trends, best practices and regulatory changes affecting cross-border trade by following us on LinkedIn.