Challenges and Solutions

Businesses face numerous challenges in customs processing: the need for skilled personnel, the complexity of customs tariff codes, regulatory compliance, and seamless integration into existing ERP systems. CustomsAI effectively addresses all of these issues.

Using AI and machine learning, CustomsAI automates the customs tariff classification process and comprehensively analyses product information. It automatically assigns the appropriate TARIC codes, minimising the risk of errors and delays and ensuring that the current VAT rates are always applied.

However, the role of technology is not the only factor. Despite the advanced algorithms, human expertise is an essential part of the process. Our team of experienced customs experts continuously reviews the data foundation of CustomsAI for accuracy and compliance with all legal requirements. This collaboration significantly contributes to ensuring that product data is accurately analysed and the correct TARIC code is automatically assigned.

This unique blend of cutting-edge technology and in-depth expertise makes CustomsAI an indispensable tool for companies seeking to streamline their customs processes and minimise risks. Our expert team’s continuous monitoring of data quality, dynamic reviews, and classification updates ensure your business remains compliant and costly mistakes are avoided, making CustomsAI the ideal solution for your customs processing needs.

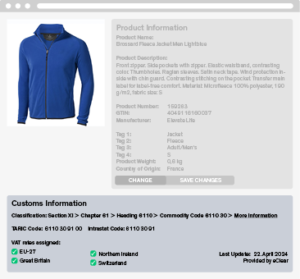

Practical Example

Let’s consider the product “Brossard Fleece Jacket Men Lightblue.” This garment, made of microfleece and manufactured in France, must be correctly classified. CustomsAI analyses the product details and accurately assigns them to the correct TARIC code (6110 30 91 00). This ensures that the product is correctly cleared through customs and that the correct VAT rates are applied for the EU-27, the United Kingdom, Northern Ireland, and Switzerland.

Real-Time Adaptation and Continuous Learning

One of CustomsAI’s features is its ability to adapt in real-time. Changes in customs regulations are automatically incorporated, ensuring that your business remains compliant without constant manual updates.

Benefits for Your Business

With CustomsAI, businesses benefit from increased efficiency, improved data quality, reduced costs, and continuous process optimisation. The seamless integration and the ability to outsource the classification process make CustomsAI an indispensable tool for internationally operating companies.

Your Challenges:

• Resource Requirements: Skilled personnel for customs tariff classification are costly, and the data volume grows with the product portfolio.

• Complexity of Tariffs: Constant changes require continuous monitoring of existing tariffs.

• Compliance Requirements: Misclassifications can lead to audits, delays, and penalties.

• Technological Integration: Connection to existing ERP systems must be seamless to avoid operational disruptions.

Our Solution: CustomsAI:

• Technology and Expertise: CustomsAI optimises the classification process through AI, supported by a team of in-house customs experts.

• Process Optimisation and Tax Compliance: The process is dynamic and continuously reviewed to ensure compliance and accuracy.

Your Benefits with CustomsAI:

• Increased Efficiency: Automation of the entire product portfolio.

• Qualified Master Data Enrichment: Ensuring the quality of master data through dynamic checks and updates.

• Cost Reduction: Freeing up internal resources and minimising the risk of customs penalties.

• Ensuring Tax Compliance: Automatic application of current VAT rates for the EU-27, the United Kingdom, Northern Ireland, and Switzerland.

• Ensuring Process Continuity: Seamless integration and automated updates prevent operational disruptions.

• International Expansion: Scaling the business without additional compliance burdens.

eClear’s CustomsAI represents a significant advancement in customs processing. By leveraging AI and ML, we offer a robust, efficient, and accurate solution to navigate the complexities of customs regulations. As a pioneer in tax technology, eClear remains committed to transformation to make regulatory compliance simpler and more reliable for our clients. Join us on this journey towards a smarter, more efficient future in tax technology. Discover how eClear can revolutionise your customs processing with CustomsAI.

Let’s stay in touch!

Stay up to date on the latest market trends, best practices and regulatory changes affecting cross-border trade by following us on LinkedIn.