Switzerland shares borders with EU member states such as Germany, France, Austria and Italy, resulting in significant travel and goods traffic between these countries. However, as a non-EU member, Switzerland is not part of the EU customs territory, which requires special customs procedures for cross-border activities.

Switzerland and the EU

Switzerland is not a member of the European Union but maintains close relations with it through various bilateral agreements and partnerships. These relationships are of great importance both economically and politically.

Economy

Switzerland and the EU are important economic partners. Mutual trade in goods and services is around 1 billion euros per working day. The EU is Switzerland’s largest trading partner, accounting for about 42% of Swiss exports and 60% of imports. Economic relations between Switzerland and the EU are governed by the Free Trade Agreement of 1972 and the bilateral agreement 1999. These agreements grant Switzerland direct access to important sectors of the EU internal market.

Switzerland is a member of the European Free Trade Association (EFTA), which serves as a platform for its member states to negotiate free trade agreements with countries outside the EU. Through EFTA, Switzerland can participate in the European Single Market, which offers access to the free movement of goods, services, capital, and people.

Politics

Switzerland and the EU also work together in many political areas. These include the areas of security, asylum, the environment, and culture.

The Swiss Customs Administration

In Switzerland, the Federal Office for Customs and Border Security (“FOCBS”) collects customs duties and taxes and reports to the Federal Department of Finance (FDF).

The Swiss Customs Administration is organised into regional levels, each of which is responsible for a specific area:

- Customs North: Basel-Stadt, Basel-Landschaft, Aargau

- Customs North-East: Schaffhausen, Thurgau, Zurich, Zug, Schwyz, Lucerne, Obwalden, Nidwalden, Glarus

- Customs East: St. Gallen, Appenzell Innerrhoden, Appenzell Ausserrhoden, Graubünden, Principality of Liechtenstein

- Customs South: Uri, Ticino

- Customs West: Geneva, Vaud, Valais

- Customs centre: Jura, Neuchâtel, Bern, Fribourg, Solothurn

The Swiss VAT system

The Federal Tax Administration (FTA) collects and administrates VAT in Switzerland. It also reports to the FFA.

Switzerland has a three-tier VAT system, which was introduced in 1995. The tax rates apply to all goods and services produced or imported in Switzerland and consumed domestically.

- Standard rate (8.1 %): The standard rate applies to most goods and services, such as clothing, shoes, electronic devices, and furniture, and services, such as repairs, transport, and hotels.

- Reduced rate (2.6 %): The reduced rate applies to certain goods and services essential for everyday needs, such as food, books, magazines, newspapers, medicines, medical treatment and healthcare services.

- Special rate (3.8 %): The special rate applies to certain goods and services considered luxury goods, such as jewellery, furs, alcoholic beverages and tobacco products.

Exemptions

- Staple foods such as bread, milk, eggs, fruit, and vegetables

- Healthcare, such as medical treatment, medication, and medical care

- Education, such as school lessons and pre-school care

- Public transport

- Financial services, such as banking and insurance

- Cultural assets such as books, works of art and music

Importing Goods from the EU to Switzerland

Importing goods from the EU to Switzerland involves several processes and regulations to ensure compliance with Swiss customs requirements. Critical aspects of the import process include the customs declaration, customs duties calculation, VAT on imported goods, and exemptions and relief for private individuals.

Customs Declaration Process

Procedure

- Customs declaration: The importer of the goods is obliged to submit a customs declaration to the BAZG. The customs declaration can be made electronically via the e-dec import system or the QuickZoll app.

- Customs control

- the collection of customs duties

Customs declaration by companies

Companies are obliged to make a customs declaration for all imported goods. The customs declaration must contain the following information:

- Name and address of the importer

- Description of goods

- Tariff number

- Quantity

- Weight of goods

- Value of goods

- Country of origin

Customs declaration by private persons

Private individuals can import goods up to a total value of CHF 300 (including transport costs) without a customs declaration, provided they are intended for personal use or as a gift. A customs declaration is required for goods valued at more than CHF 300.

Customs Duties Calculation

The Swiss customs tariff is based on the internationally valid Harmonised System (HS). Customs duties are calculated based on the following factors:

- Tariff number: The tariff number is a six-digit number uniquely identifying the goods. It is defined in the HS.

- Quantity: The quantity of the goods determines the taxable value.

- Weight: The weight of the goods can also be included in the calculation of customs duties.

- Value of goods: The value of goods is the price at which the goods are sold. It is stated in Swiss francs (CHF).

- Country of origin: The country of origin of the goods can influence the duty rate.

Calculation formula

Duty = duty rate * value of goods

Example

A merchant imports 100 kilograms of coffee from Brazil. The value of the goods is CHF 10,000. The duty rate for coffee from Brazil is 3.8%.

Customs duty = 3.8% * 10,000 CHF

Customs duty = 380 CHF

Customs declaration procedure

The QuickZoll app enables goods to be declared before being brought into the country and customs duties to be paid directly.

Goods can be declared verbally at guarded border crossings. At unguarded border crossings, a written self-declaration can be completed.

Ordering goods from abroad

Customs duties, VAT, and customs clearance costs are generally charged to the recipient.

- Customs duties and VAT under CHF 5 are not invoiced in practice.

- For goods subject to the reduced VAT rate of 2.6%, the order value must be less than CHF 200 (including packaging and shipping).

Provisions for private persons

Switzerland has specific import regulations for private individuals that cover various categories of goods:

Personal effects: Clothing, linen, toiletries, sports equipment and electronic devices such as cameras, computers and musical instruments are exempt from duty.

Travel provisions: Ready-to-eat food and non-alcoholic drinks are exempt from duty for the day of travelling.

Allowances for alcohol and tobacco: Specific allowances apply for alcohol (up to 5 litres under 18% alcohol content and 1 litre over 18%) and tobacco (250 g or 250 cigarettes/cigars).

Total value limit for VAT: VAT applies to goods with a total value of over CHF 300.

Prohibited or restricted goods: Certain goods, such as protected plants and animals, counterfeits, weapons, fireworks, medicines, and cash, are either banned or subject to restrictions.

Export of goods from Switzerland to the EU

Exporting goods from Switzerland to the EU is subject to specific customs regulations and provisions. Companies should observe the following requirements and procedures to ensure a smooth and legally compliant export process.

Declaration procedure and customs declaration

Businesses must comply with specific procedures and regulations when exporting goods from Switzerland to the EU.

- Businesses must submit an export declaration to the Swiss Federal Office for Customs and Border Security.

- The declaration must include detailed information about the goods, such as Name and address of the exporter, Description of goods, Tariff number, quantity, weight, Value of goods, Country of origin, Place of destination & Mode of transport

- The declaration can be submitted electronically using the e-dec export system. Passar will gradually replace this system from 1 October 2023 to 30 June 2025.

Customs declaration

The customs declaration is based on the customs tariff, which regulates the classification of goods in specific customs tariff numbers. The customs duty rate is determined based on the customs tariff number and the country of origin of the goods. The debtor is the person who exports the goods from Switzerland.

Customs duties and preferential treatment

In principle, Switzerland does not levy customs duties on goods exports. However, under certain conditions, companies can take advantage of tariff preferences within the framework of free trade agreements. These agreements can reduce or even entirely waive customs duties on certain goods from Switzerland.

Requirements for preferential treatment

To obtain tariff preferences, companies must fulfil the following requirements:

- The goods must originate from Switzerland.

- The goods must comply with the rules of origin of the respective free trade agreement.

Proof of origin

To fulfil the requirements for preferential treatment, companies must submit a valid proof of origin. This proof confirms that the goods originate from Switzerland and meet the requirements for preferential treatment.

Types of proof of origin

- Movement certificate EUR.1: This certificate is issued by the customs authorities and confirms that the goods originate from Switzerland and fulfil the conditions for preferential treatment.

- Declaration of origin on the invoice: This declaration is issued by the exporter on the invoice for the goods and confirms that the goods originate from Switzerland and fulfil the conditions for preferential treatment.

Submission of the proof of origin

The proof of origin must be presented when the goods are exported. This can be done during the customs declaration or when the goods are handed over to the carrier.

VAT Considerations

Goods exported from Switzerland to the EU are exempt from Swiss VAT. Once the goods are in the EU, they are subject to the specific regulations and thresholds for VAT and customs duties of the destination country.

Other important regulations

- Performance-related heavy vehicle charge (LSVA): The LSVA is levied on road haulage with a gross vehicle weight of more than 3.5 tonnes.

- Transport and customs clearance: Companies can use freight forwarders or customs brokers to facilitate the export process.

- Document archiving: Keeping all relevant documents for the export process is necessary.

Changes from January 2024

- Documenting the origin of goods that remain permanently in Switzerland is unnecessary.

- Proof of origin may be required for goods processed and re-exported in Switzerland.

- Specific rules and value limits for determining origin are set out in the agreements. Goods under EUR 6,000 only require a declaration of origin on the invoice, while amounts over EUR 6,000 require an EUR.1 certificate.

E-commerce in Switzerland: guidelines and tax requirements

Providers of electronic services aimed at Swiss end customers must be registered in Switzerland and charge local VAT. This obligation also applies to companies based outside Switzerland.

Switzerland has adopted many EU regulations in e-commerce, including the reverse-charge procedure. In this procedure, the recipient of the electronic service pays the VAT to the tax authorities. A threshold value of CHF 100,000 applies for VAT registration.

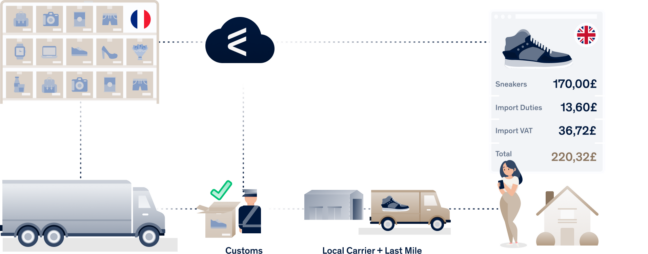

Seamless shipping to Switzerland

Our ClearCustoms® solution enables carriers, hauliers and online merchants to ship border-free to Europe’s most lucrative markets: Switzerland, the UK and Norway.