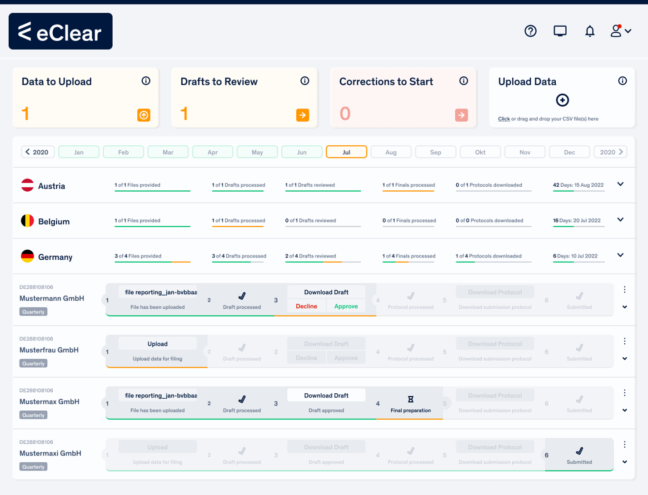

A single portal for all your clients

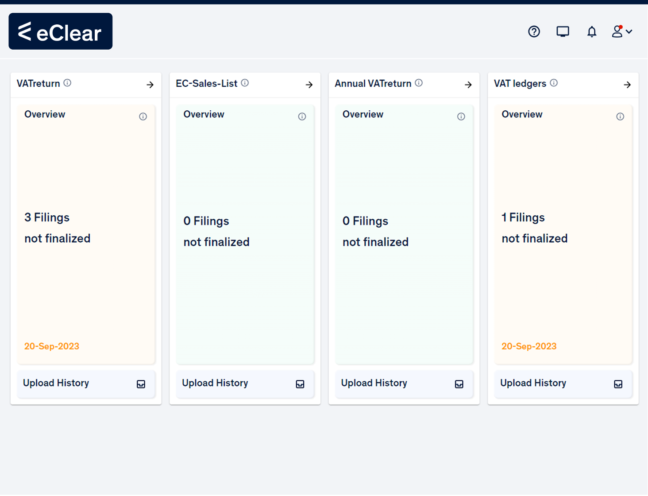

With FileVAT, you efficiently manage the transaction data of multiple clients and report to the respective tax authorities at home and abroad. The tax advisor portal lets you easily handle periodic and annual VAT returns, EC sales lists and VAT ledgers. FileVATs intuitive interface supports you in accomplishing strict VAT compliance and optimal client management.

How FileVAT works

Data uploaded to FileVAT by your clients is automatically processed for submission. The processing result is available in the portal as a draft for your and/or your clients’ review.

With the approval of the person in charge (optional role allocation), FileVAT then submits the return to the competent authorities at home and abroad at the click of a mouse (depending on the degree of automation of the interfaces offered by the authorities).

The respective national languages and required formats are automatically considered.

Unlock efficiency: FileVAT optimises your workflow

- Clear overview of all clients in one dashboard: upcoming reportings, approvals, submitted returns, corrections and deadlines

- Efficient collaboration through intuitive user interface connecting tax advisors, clients, tax authorities

- Minimised risk through deadline management with alert function for all stakeholders, real-time validation checks and updates

- Breakdown into individual work steps and collaboration between all stakeholders involved

- Time and cost savings through the automated generation and submission of reportings

- Reducing the necessity of corrective reportings through plausibility checks and real-time validation

- Secure data transmission and archiving for all clients in one single portal

Developed to meet the needs of modern tax consultancy

FileVAT simplifies VAT compliance for multiple clients

In the eClear user portal, you manage data uploads and reportings for your clients. This is where you administrate the approval and submission of reportings to the national authorities in collaboration with your clients, are informed about the status of filings and are reminded of submission deadlines.

One portal – 30 tax authorities.

Get started now