Established in 2009, the EORI number revolutionised customs clearance for businesses within the European Union. It functions as a single identifier throughout the EU, eliminating the need for multiple registrations in different member states. This simplifies the process significantly for businesses that import or export goods. Obtaining an EORI number is straightforward – contact your national customs authority. The EORI system benefits both businesses and customs authorities by:

What is an EORI Number?

- A unique identifier for businesses trading goods with countries outside the EU (including the UK).

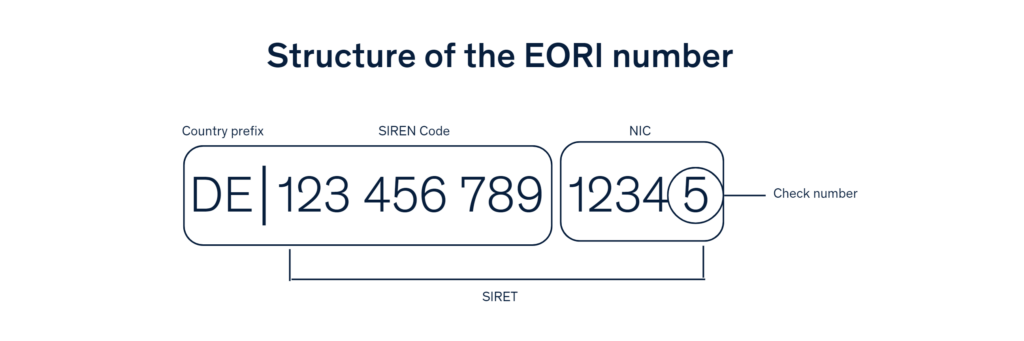

- Composed of:

- Country Prefix (e.g., “DE” for Germany)

- Unique Identification Code (letters and numbers varies by country)

- Check Digit (for validation)

Additional Notes:

- In France, the SIREN code (company registration number) may form the base of the EORI.

- In Northern Ireland, the NIC (National Insurance Code) can be connected to the EORI.

Why Do I Need an EORI Number?

- Mandatory for all customs communications within the EU, including:

- Customs declarations

- Commercial invoices

- Applications and appeals

How to Obtain an EORI

- Apply through your national customs authority (online or by post).

- Businesses typically only need one EORI number for trade across the entire EU.

- Once issued, the EORI has no expiry date.

Who needs an EORI number?

Any business or individual involved in the following activities with countries outside the EU must obtain an EORI number:

- Importing goods into the EU

- Exporting goods from the EU

- Moving goods in transit through the EU (even if those goods aren’t entering or leaving the EU)

This requirement applies to:

- Businesses of all sizes, across all industries (manufacturers, retailers, freight companies, etc.)

- Individuals importing or exporting goods for personal reasons

- Other entities involved in trade (freelancers, customs agents)

How to Apply for an EORI Number

Contact: Your national customs authority is responsible for issuing EORI numbers.

Online Option: Many countries offer convenient online application forms. Check your country’s customs website for details.

Information Needed: Be prepared to provide:

- Company/individual name and address

- Business registration or tax identification numbers

- Description of the goods you’ll be trading

Processing Time: While it varies by country, applications are usually processed within a few days.

Important Notes:

- Apply Early: Get your EORI number before starting to trade internationally. This avoids delays and ensures you’re compliant.

- Keep It Updated: Your EORI number is permanent, but notify your customs authority if your business information (name, address, etc.) changes.

Brexit and EORI Numbers: Key Changes

The UK’s exit from the EU necessitates separate EORI numbers for trade between the UK and EU countries.

Businesses and Individuals Based in the UK:

- You need a “GB” EORI Number. Apply for this through the UK government website: www.gov.uk/eori.

- This is essential to comply with customs regulations and ensure smooth trade with the EU.

Businesses and Individuals Based Outside the UK:

- You likely need TWO EORI Numbers:

- A “GB” EORI for trade with the UK.

- An EORI from your EU member state.

- Application: The process for a “GB” EORI depends on whether your business is in the UK [link to relevant GOV.UK guidance].