Digitalisation and the power of processes in e-commerce

VAT compliance is not a new idea and does not necessarily require a technological solution. Over the past 30 years, dozens of providers have specialised in VAT reporting for clients in EU Member States. However, the growing market of small and medium-sized e-commerce traders has created a need for automated reporting procedures in cross-border trade. Start-ups are soliciting business from SMEs, especially smaller traders from large marketplaces such as Amazon, eBay, Otto, and others. In the process, the term “digitalisation” is often used to promote their offerings. But is this really something new and genuine digitalisation?

The term digitalisation is often misunderstood and trivialised. In reality, it is about the digital transformation of processes. An example is a German health insurance company that has developed an app that allows members to scan their sick notes and send them to the health insurance company. However, the document is printed out and presumably entered manually into a system – this is not really a comprehensive digitalisation of the process.

Digitisation means transforming procedures into orderly processes, documenting them and defining instructions for action and roles. It is about written processes that machines or people can follow. Suppose one understands programming as the writing down of processes. In that case, it becomes clear that creating a code is a new form of legislation. A new normative force is emerging alongside the legislature, changing how we live together and our legal system.

An example of this is the experience of being refused a loan because the scoring systems of the house bank have already decided this in advance. Here, a legal vacuum is created in which the bank’s law applies, and its regulations are authoritative. The question is who brought in the information based on which the programme runs and what is made the subject of the processes.

The role of the human being as the connecting element between technology and content is crucial. That we as a society have failed to address the question of who gets the “power” to code our future over the past 20 years is a societal issue that remains to be debated.

Digitalisation vs. digital transformation in VAT reporting

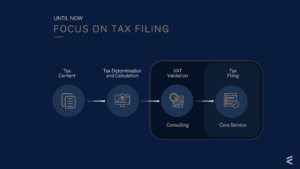

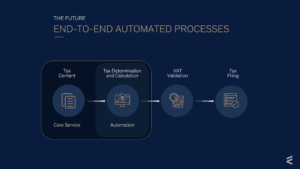

Digitalisation refers to mapping processes, while digital transformation encompasses entire business models that replace previous processes. In VAT reporting, we are currently experiencing a digital transformation, which legislators are triggering. The goal is not only to digitalise sub-processes but to abolish the traditional “tax return filing”.

Tax Compliance and Start-ups

Start-ups in tax compliance build interfaces (APIs) and extract order information from various systems such as ERPs, shop systems or e-commerce marketplaces. This data is filled into Excel spreadsheets (CSV files) and sent to tax consultants, who then manually upload it to the online portals of the tax authorities. In the process, the regulations of the German Fiscal Code (AO) and the Principles of Proper Accounting (GoBD) are often strained. The extraction of data from the upstream systems is complex and often called “dirty data”.

eClear and the payment reconciliation

To improve data quality, eClear has added a second data source in addition to order data: Payment data. Interfaces to payment service providers such as Klarna, PayPal or Worldline enable payment reconciliation to perform the “data cleansing” process. This step is called “accounting-preparation automation”.

The Role of the EU and the CESOP Database

The EU member states and the EU Commission are pushing ahead with end-to-end automation. The focus is on the CESOP database, into which payment providers must also supply transaction data from 2024. The political goal is to record goods movements seamlessly, and payment flows in cross-border trade.

Challenges for small merchants

The increasing complexity and legal costs will be difficult for smaller merchants to cope with. They will have to join larger schemes, even though the stated aim of the EU administration is to promote small and medium-sized merchants and open up the European single market to them.

The Role of Marketplaces and payment service providers

Marketplaces and payment service providers are the two crucial players in the e-commerce business. They play a central role in the implementation and scaling of automated solutions, especially in tax technology. Embedded tax solutions are currently the fastest-growing market in this area.

These automated solutions offer numerous advantages to both marketplaces and payment service providers. On the one hand, they enable them to meet increasingly complex regulatory requirements more efficiently by ensuring compliance and marketplace liability. On the other hand, they offer a way to expand their services by offering them as “proprietary” solutions for partner companies.

In this way, marketplaces and payment service providers actively contribute to the digital transformation of taxation and support smaller merchants in coping with the growing complexity and constantly changing requirements in e-commerce.

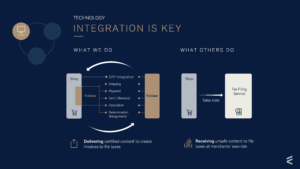

Integration is the key

Integrating “embedded tax solutions” is crucial for successfully digitalising tax and duty processes in e-commerce. Software components must not only be functional in themselves. Still, they must also be able to be linked together as modules from different providers. Platforms offer the possibility to create and maintain these connections.

The digital revolution and legal changes such as the Payment Service Directive (PSD2) have led to traditional companies such as financial institutions and banks adapting their business models and becoming more open to the platform economy. Two forms of integration need to be distinguished: Extracting information from open APIs and full integration (core integration) through plug-ins that enable bidirectional communication.

For merchants and companies that use cloud-based software, the certification of interfaces and the software itself is gaining importance. The auditing standard 880 of the Institute of German Certified Public Accountants (IDW880) has established itself as the “gold standard”. When choosing a provider, customers should pay attention to the service’s operational reliability, performance and availability, which are the essential aspects of a service-level agreement (SLA) between customer and provider.

Tax content as an element of end-to-end automation in VAT

Tax automation is a key aspect of modern tax policy, automating tax reporting and reducing tax fraud. Companies such as eClear recognise the potential in the gig economy, especially by integrating tax-filing solutions into marketplaces to support entrepreneurs and marketplace operators.

Automation in tax law prevents tax fraud and supports taxpayers in applying correct tax rates. Companies can thus optimise their margins and minimise liability risks.

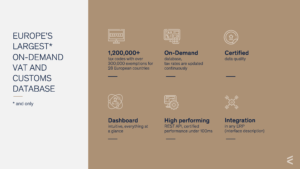

eClear’s VATRules tax engine offers a comprehensive, IDW880-certified database on tax and customs tariffs in the EU, which supports companies in correctly applying tax regulations. Integration into ERP or shop systems enables efficient and legally compliant fulfilment of tax obligations.

The eClear TAX code – a new standard for Europe

The EU has difficulties with its inconsistent VAT taxonomy, and existing databases are incomplete and unreliable. To solve the problem, eClear developed the TAX code based on the customs tariff and the Combined Nomenclature (CN) and extended it to meet VAT requirements. The eClear TAX code enables reliable information for correct tax returns and promotes a harmonised system for cross-border commerce within the EU.

In the search for a uniform approach, we came across TARIC. This ten-digit customs tariff code contains references to VAT. As the granularity of TARIC was insufficient, and the system is inconsistent across countries, we developed the eClear TAX code, a 15-digit system based on TARIC and HS Code. In this taxonomy, eClear manually entered over 300,000 exception facts and created 1.2 million eClear TAX codes. A five-digit appendix was developed to map all EU member states’ exceptions and enable a doubtless identification of articles or article groups.

eClear first developed its nomenclature based on the customs nomenclatures of 30 European countries and merged them into a uniform eClear taxonomy. This enables the cross-country classification of articles and the consideration of exceptions in different countries.

Subsequently, 300,000 exceptions were assigned to the “eClear TAX-Tree”, for example, for trainers in different countries, based on size or age. Despite the complexity of this task, the mapping was done manually and without artificial intelligence. This resulted in a secure tax database product that enables correct tax and customs declarations. The core service of eClear AG’s “VATRules and CustomsRules Database” is to map every item group and exception within a customs tariff number.

TAX Assignment – Outsourcing Tax Determination to the Cloud

The database does not link articles with static codes but with article groups and their exceptions. The database quality depends on the correct assignment of the articles to the codes. Users drag their entire assortment into the eClear TAX Cloud and assign article groups using an interface.

Item matching is now fully automated, with eClear achieving a hit rate of over 85% using AI-powered NLP. Customers can upload assortments of up to 2 million items, which are then automatically categorised. eClear already has over 80 million recorded consumer items in its database and plans to offer a collection of 1 billion items by 2025. Tax determination is partially outsourced to the cloud, which enables tax rates to be constantly updated. eClear operates a tax-certified online editorial team that keeps the database current. ERP systems can connect via an API. Once connected, there is no need to maintain or update tax content, as changes are automatically updated in the merchant’s shop and ERP system.

ERP integration of the VATRules API using the example of SAP S4/HANA

Using an example integration of the eClear VATRules API in SAP S4/HANA, the simple process can be summarised in three steps at this point:

Step 1 – Article Assignment – Assignment of the articles

Merchants assign their products to a product tree semi- or fully automatically based on product master data without direct assignment of tax rates. Instead, the assignment is made to a product category backed by an eClear tax code. eClear’s data science team is working on innovations to refine further the automated assignment, including matching with existing items, AI algorithms, product texts and image recognition.

Step 2 – Calling the API

As a certified SAP Business Partner, eClear offers pre-built plugins that use the VATRules API in the eClear Cloud. The API is activated in the order creation to transfer relevant data such as item number, service provision date and net price. At the same time, the current or historical tax rate is fed back from the cloud to the customer’s SAP system. This API call runs fully automatically in the background.

Step 3 – Presentation of the result

Tax determination takes place in SAP orders and provides an optimised, reduced tax rate in the example shown. The process is part of the internal SAP tax determination and is extended by eClear to qualitatively improve the tax assignment without overwriting the existing determination chain. In the example, the standard tax rate of 20% for France was checked by the eClear API, and a reduced rate of 5.5% was applied. The eClear TAX code triggers the known SAP tax code, which ensures the complete auditability and traceability of tax rates and product groups.

A paradigm shift in the modern tax department

The difference between digitalisation and digital transformation was discussed. To which aspect should the business model be assigned, and what disruption can be expected? In the short term, tax technology innovations will change the tax return by replacing paper-based and web-based forms. The tax advisor will not be abolished, but his job description will change towards obtaining and using the right content from automated machines. Future VAT tasks include:

- Determining correct tax rates.

- Monitoring Tax Determination and Tax Calculation.

- Validating ELT model data and automated payment reconciliation.

The tax consulting industry should prepare for a dynamic change that offers many opportunities despite traditional caution.

|

|

GreenVAT® or VAT as a political steering instrument

An epilogue on the digitalisation of the VAT system shows opportunities to use taxes as a political steering instrument. The ECOFIN Council conference decided in December 2021 to liberalise tax rates in the EU, which could combine economic and ecological goals. The rigid three tax rates will be more flexible, as states can now choose tax rates for 24 product groups between 5% and 25%, and a further seven product groups can be reduced below 5%.

This innovation promotes ecological change by taxing sustainable products and services differently. The author launched the GreenVAT® initiative to enshrine this in law. Critics, however, fear an increased administrative burden.

Technological progress enables the use of taxes as a steering instrument through high-performance tax databases and tax reporting automation.