Typically, the service provider issues an invoice, shows the VAT, and pays the tax to the tax office. The recipient pays the invoice and claims input tax (as far as entitled). This is a standard case in VAT.

However, with the RCV, there is a so-called reverse-charge: the service recipient must pay the VAT to the tax office and can also claim input tax (insofar as he is entitled to do so). The service provider, on the other hand, does not show any tax and does not have to pay any VAT. The invoice, therefore, only indicates a net amount.

The VAT Reversal in Germany: An Additional Perspective

In addition to the Reverse-Charge Procedure, as it is known in Germany, there is also the mechanism of VAT reversal. This mechanism is based on Article 194 of the VAT Directive and is applied to domestic services and deliveries of goods with installation.

A Practical Example for Illustration

A company from the USA, let’s call it “US Tech,” sells and installs specialised IT equipment to a German company, which we’ll call “DE Corp.” In this case, it is the task of “DE Corp” to report the VAT directly to the German tax office and pay it. This significantly facilitates international trade and ensures the correct collection of VAT.

Exceptions and Special Requirements

There are exceptions to this rule, such as certain passenger transport services and admission fees for trade fairs and exhibitions. The requirements for applying VAT reversal are clearly defined and apply to B2B services.

Rules for Use and Enjoyment

In some instances, the rules for the place of delivery may differ, especially if the service is consumed in a country apart from Germany.

VAT Reversal on Specific Goods

This regime is often applied to products more likely to be used for carousel fraud. It applies regardless of whether the supplier is resident or VAT-registered in Germany.

Services and the reverse-charge procedure

In the case of cross-border supplies, services – referred to as other supplies in the VAT Act – are particularly relevant: The RCP is also applicable to other supplies from a company established in a different part of the Community territory or third country that are taxable in Germany according to § 3a (2).

Electronic services also fall under the German Value-Added Tax Act’s § 3a (2). Consequently, many e-commerce businesses often find it necessary to apply the reverse-charge procedure.

Article 7 of the Implementing Regulation to the VAT System Directive defines in more detail what electronically supplied services are. They include providing digital products (e.g. software) or services that arrange or support a presence on electronic networks for business or personal purposes, e.g. a website or webpage. Many companies based in Germany make use of such services.

Example: Good-choice, a company based in Germany, uses a paid Google Suite Business account. In Europe, Google is based in Ireland. Google does not indicate VAT on the invoice (VAT (0%) EUR 0.00) but includes a statement regarding the reverse-charge (“Services subject to the reverse-charge – VAT to be accounted for by the recipient as per Article 196 of Council Directive 2006/112/EC”). Good-choice must calculate the VAT on the invoiced amount and consider it in its advance VAT return (and VAT declaration). Good-choice will pay the VAT in Germany.

Which Cases Lead to a Change in Tax Liability

The Reverse-Charge Procedure comes into play in some instances. A legal definition can be found in § 13b UStG. This clarifies when the Reverse-Charge Procedure is to be applied. Accordingly, the Reverse-Charge Procedure is particularly applicable to:

- Supply of goods and other services by a foreign-based company

- Deliveries of goods subject to a security interest in the grantor of the security interest to the grantee outside of insolvency proceedings

- Transactions subject to the Real Estate Transfer Tax Act

- Construction services

- Deliveries of gas, electricity, heat, or cold

- Transfers of entitlements in emissions trading

- Deliveries of items listed in Annex 3 to the UStG (e.g., slag sand, waste, and lead scrap, etc.)

- Cleaning work on buildings and parts of buildings

- Certain gold deliveries

- Deliveries of mobile phones, tablet computers, and game consoles, as well as integrated circuits after exceeding a threshold

- Deliveries of items listed in Annex 4 to the UStG (among other things, precious metals) after exceeding a threshold

- Other telecommunications services.

What invoice issuers must pay attention to

Many e-commerce companies in Germany regularly issue invoices for their services to companies based in foreign countries. If there is a case in which the RCP applies, the service provider must ensure that VAT is not shown on the invoice. It is not critical if the VAT is stated at 0% and EUR 0.00. However, suppose the seller does show VAT on the invoice mistakenly. In that case, the tax office must pay the amount by the strict liability in § 14c of the German Value-Added Tax Act.

Mistakes, in this case, are annoying for all parties involved. The service recipient also owes the VAT shown on the incoming invoice but cannot claim an input tax deduction as this tax is not legally owed. Civil law questions can also arise if he remits the erroneously stated VAT to the invoice issuer. This can also lead to a cashflow disadvantage for the recipient – at least temporarily until the preparation of the invoice.

„I think that verifying incoming invoices is essential, especially regarding a possible shift in tax liability. This also applies if tax is shown on the invoice despite the reverse charge. So, if German companies receive invoices from companies based in another EU member state, then increased attention is required.“

Reverse-charge procedure: What must be shown on the invoice?

According to § 13b of the German Value Added Tax Act, the supplying merchant must issue an invoice containing certain mandatory information. This includes (according to § 14 (4) with § 14a (5), if no credit note is issued) the following:

- Name and address of both the supplier and recipient

- Tax number and/or VAT identification number of the supplier and recipient of the service

- Invoice date

- Sequential invoice number

- Quantity and nature of the goods supplied or scope and nature of other services provided

- Time/date of delivery/provision of service

- Amount due

- According to § 14b (1) sentence 5: reference to the duty of the recipient to retain records

- Note: “The recipient is liable for VAT.”

Important: No VAT may be shown on the invoice. However, there must be a reference to the RCP. According to § 14a para. 1 UStG, this also applies if the service is provided to a recipient resident in the rest of the EU. For example, the wording can read: “The recipient is responsible for taxation of the service/goods “. As a rule, an invoice for a service to a recipient in a third country is not subject to German regulations for a proper invoice.

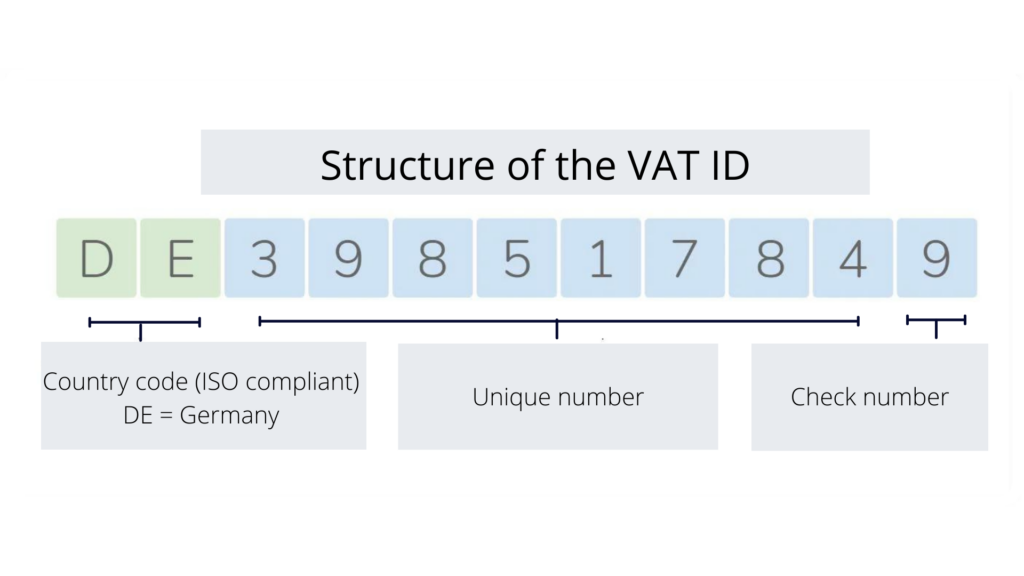

Check the VAT identification number.

The issuer of the invoice must also ensure that his valid VAT identification number and the VAT identification number of the service recipient are shown on the invoice if the recipient is located in another community territory of the EU.

The validity can be checked via the Federal Central Tax Office website. Integrating the query into the company’s software system via an interface is also possible. The VAT identification numbers can then be queried automatically. This procedure can significantly reduce manual effort, especially for e-commerce companies.

Tip: Companies should document the query. Anyone interested in the Federal Central Tax Office website should document and keep the question. Here, you will find detailed information on the VAT ID check.

Reverse-charge procedure in the advance VAT return

Recipients of services must declare the tax they owe by § 13b German Value-Added Tax Act. This also applies if the service recipient is, for example, a small business or only handles tax-exempt sales. According to § 13b, the sales must be declared accordingly in an advance VAT return. However, if the service provider is a small business, transfer of tax liability does not apply.

Example: advance VAT return for 2022

- The service recipient must make appropriate entries on lines 40 to 42

- The supplying merchant must make entries on lines 49 and 50. The supplying company must submit a recapitulative statement to the Federal Central Tax Office for services supplied to the rest of the Community.

Advantages and risks of the reverse-charge procedure

Service providers benefit from the RCP because they do not have to declare or pay VAT to the tax office. However, they must submit a recapitulative statement for services in the community territory and report the “non-taxable services according to § 18b sentence 1 (2) of the German Value Added Tax Act” in the advance VAT return.

In cross-border situations, the RCP can help reduce bureaucracy. After all, in these cases, the service provider does not have to register in the other state to pay sales tax there. Tax authorities are not faced with the problem of collecting taxes from companies based in foreign countries.

However, the RCP can also entail risks. The service recipient must know when a tax liability change applies, and the VAT must be paid to the tax office. A lack of information on the invoice does not release the service recipient from these obligations. Even if the invoice incorrectly shows VAT, the service recipient must still pay the VAT to the tax office.

Conclusion

The reverse-charge procedure can reduce bureaucracy – especially for the service provider. However, the prerequisite is that companies take special care when issuing and checking invoices. For e-commerce merchants, it may be a good idea to use technological options to automate the process.