- What are the main challenges of VAT compliance for international businesses? VAT compliance involves understanding local regulations, handling multiple languages, registering for VAT in different countries, and adhering to various reporting deadlines and formats.

- How can companies automate their VAT compliance processes? Automation can reduce manual errors and save time by recording and processing transaction data, centralizing VAT ID management, and ensuring timely compliance with reporting requirements.

- Why is collaboration with external VAT compliance experts important? External experts provide specialized knowledge, ensure legal compliance, offer practical solutions, and help integrate compliance processes seamlessly into the company’s operations.

VAT compliance is becoming increasingly complex, especially for companies with cross-border business or multiple European locations. When companies generate taxable sales in another country, they must often register for VAT there and make the corresponding declarations and payments. This involves various requirements, including registering with foreign tax authorities, correctly calculating tax amounts, and complying with specific reporting deadlines and formats. Given the different tax laws, languages, and reporting portals in the various EU countries, this represents a considerable challenge.

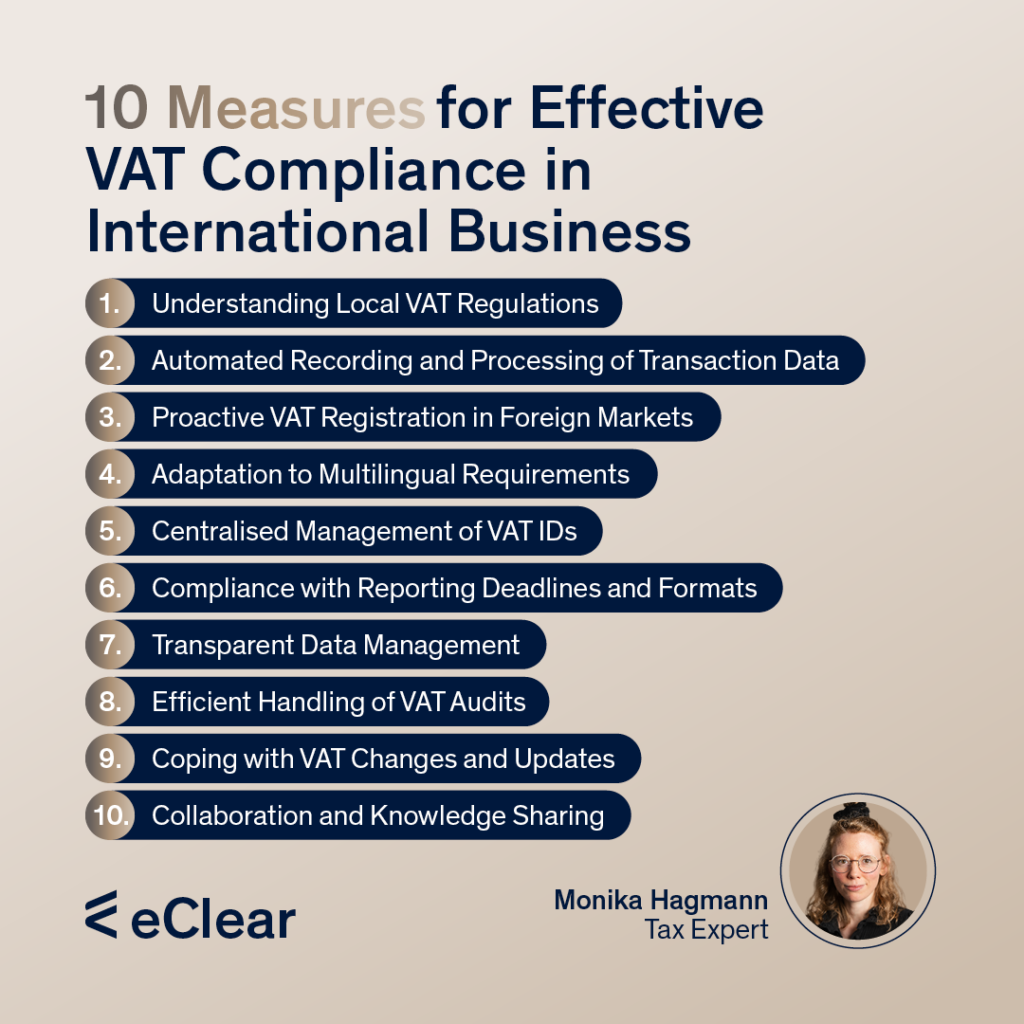

A strategic approach is required to ensure compliance efficiently and minimise the risk of late penalties or even criminal sanctions. This requires, among other things, the automation of data processing, the integration of current regulations, and the centralisation of deadlines and data management. The following overview summarises these and other necessary measures.

Ten measures for effective VAT compliance in international business

- Understanding local VAT regulations: Ensure compliance in each business country by capturing the specific local legislation.

- Automated recording and processing of transaction data: Reduce manual time and error-proneness using automation technologies.

- Proactive VAT registration in foreign markets: Register for VAT in countries where taxable sales are to be made well before the start of business operations.

- Adaptation to multilingual requirements: Ensure that your team or tools can handle multilingual documents and requests from authorities.

- Centralised management of VAT IDs: Maintain an overview of foreign registrations and foreign group companies or branches in all relevant countries.

- Compliance with reporting deadlines and formats: Use planning tools to ensure that all VAT filings are submitted on time and in the correct (primarily electronic) format.

- Transparent data management: Standardised data management for all involved parties improves the overview and accessibility.

- Efficient handling of VAT audits: Prepare for potential audits with clean, well-documented records.

- Coping with VAT changes and updates: Be prepared for legislative changes through continuous training and up-to-date software.

- Collaboration and knowledge sharing: Encourage team exchange and use external expertise to clarify complex VAT issues.

Cooperation with Externals

Utilising external support in the area of VAT compliance has long since become the norm for most companies, especially when it comes to international business activities. It is important to organise the collaboration in such a way that it meets the company’s requirements.

When selecting an external service provider, companies should ensure in particular that:

- Clear and transparent communication is ensured to avoid misunderstandings and promote efficient workflows.

- The service provider has the necessary expertise to not only fulfil legal compliance requirements but also offer practical solutions for day-to-day challenges.

- Privacy and data security are prioritised to protect the integrity and security of sensitive information.

- The service enables seamless integration into the company’s existing processes without extensive customisation.

These requirements are crucial to ensure that external support contributes to increasing efficiency and simplifying VAT compliance.

Centralised Compliance Management

Our reporting portal, FileVAT, was created to meet modern companies’ requirements for effective VAT compliance. We designed the platform specifically to guide companies—including those working with external partners or consultancy—clearly and efficiently through reporting processes. This means that you not only retain control over your VAT obligations but also benefit from a platform that promotes transparency and simplifies collaboration. If you have any questions, please do not hesitate to contact me.

Let’s stay in touch!

Stay up-to-date on the latest market trends, best practices and regulatory changes affecting cross-border selling by following us on LinkedIn.