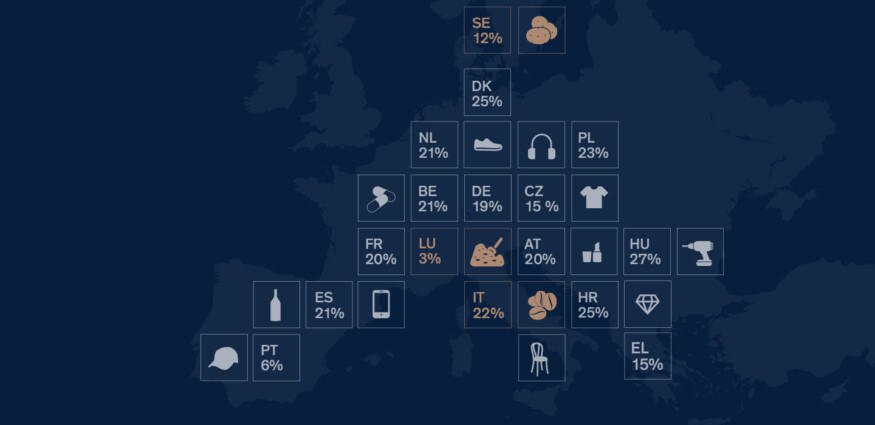

What do coffee, peat and potatoes have in common? That’s right! Quite curious tax rates in the different countries of Europe. In my monthly VAT Update I give an insight into the sometimes crazy taxation of different products.

Coffee in Italy

The Italians and their coffee: not only is the perfect roasted aroma of the coffee bean a science in itself, Italy is also not taking the easy way out in terms of VAT. Only coffee extract is taxed at a reduced VAT rate of 10%, classic coffee has to make do with the standard VAT rate of 22%.

Peat in Ireland, Italy, Portugal and Luxembourg

Do you know the different uses of peat? Peat as a heating fuel is taxed at a reduced VAT rate of 13,5% in the Republic of Ireland, while Italy reduces the VAT rate for peat when it is used as a fertiliser. Portugal takes an even more granular approach and has a reduced VAT rate only for peat litter used as fertiliser. Luxembourg takes the simpler route: peat is taxed at a reduced VAT rate of 3% here, regardless of its use.

Potatoes in Sweden and Finland

Sweden generally taxes potatoes for human consumption at a reduced VAT rate of 12%. However, if it is a seed potato, the standard VAT rate of 25 % applies. Their neighbour Finland has a different view here: the potato, whether for seed purposes or for our lunch, is taxed at a reduced VAT rate of 14%.