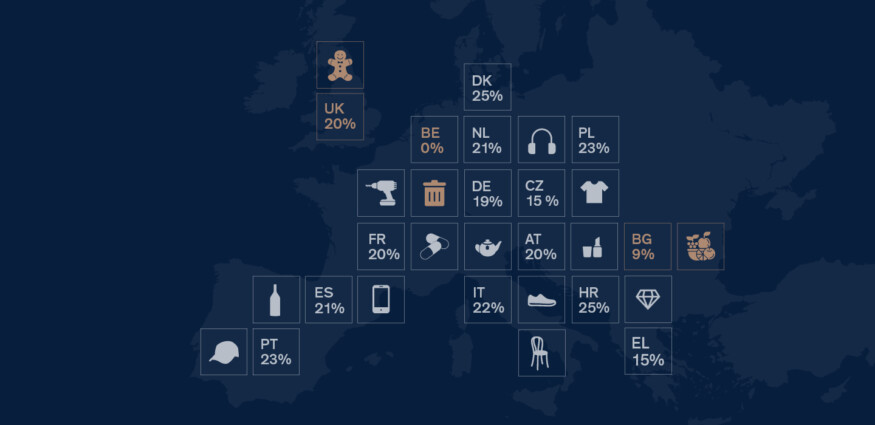

As an online merchant who sends a wide variety of goods to the EU, it is sometimes very difficult to apply the correct VAT rule. All of the EU-27 member states use different VAT rates and calculation bases, and there are also many special rules, some of which are incomprehensible. In my update for the month of August, I have summarised three of the most curious cases that I have encountered during my work as a VAT consultant in recent weeks.

Waste and scrap in Belgium

Belgium relies on recycling: waste and scrap is generally taxed at a VAT rate of 0%. It does not matter whether the waste is made of zinc, iron, steel or, for example, plastic – sustainability is the be-all and end-all!

Food purees in Bulgaria

With its accession in 2007, Bulgaria is still a very young member of the European Union. However, this should not be an obstacle to the implementation of a slightly curious VAT regulation.

Bulgaria is an EU country that offers few reductions in the world of VAT compared to other EU countries. Mainly purees of vegetables, fruit, meat or fish for infants and young children benefit from the reduced VAT rate of 9%. It should be noted, however, that only purees that do not exceed a sales unit of 250g are taxed at a reduced VAT rate.

Gingerbread people in Great Britain and Northern Ireland

It’s hard to believe, but in less than 5 months it will be Christmas again! If you live in Great Britain or Northern Ireland, you better take a closer look at which gingerbread people you buy. If the gingerbread of your choice is dressed in chocolate clothing, you’ll pay a whopping 20% VAT. However, if the gingerbread has only chocolate chips for eyes, they will benefit from a reduced VAT rate of 0%. Isn‘t that crazy?

VATRules takes all special cases and exceptions into account

Whether chocolate chips are used as eyes or not, VATRules always knows the correct VAT rate and applies it directly in the merchant’s shop system. The database has 1 million tax codes and contains over 300,000 exceptions – item-specific, always up-to-date and for all EU-27 plus UK. It’s save to say: Christmas can come!