Over the past year, many small and mid-sized retailers have started selling their products online. This trend accelerated slightly following the temporary closures of retail outlets during the coronavirus pandemic.

But merchants who decide to move to online retail face several follow-on questions. One of the most important is “Should the goods be sold through an independent online shop, or an online marketplace – or both?”

This is the question addressed in this article, which is the start of a 4-part miniseries specifically for the e-commerce market.

Retailers planning to expand online business

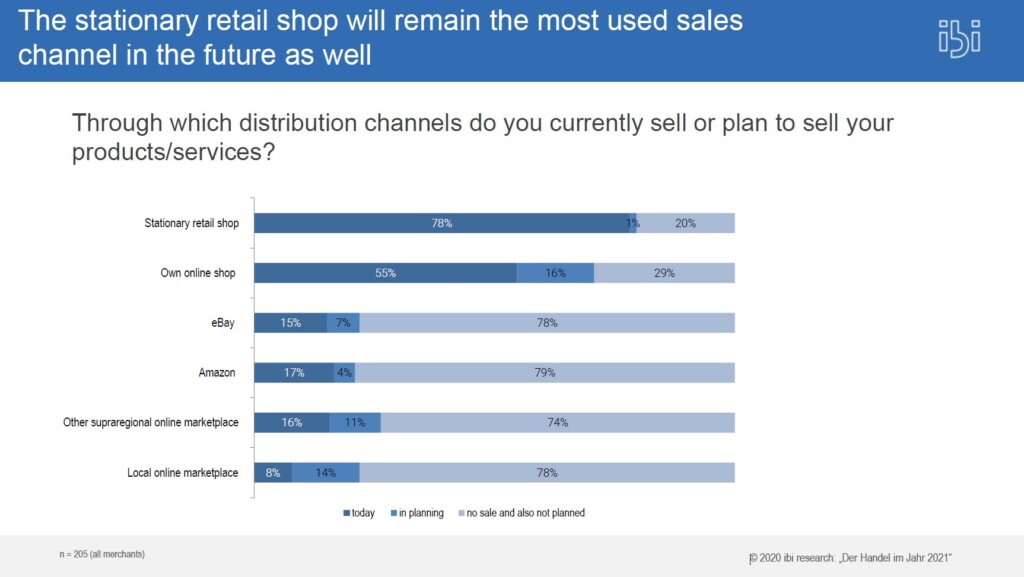

The brick-and-mortar store is the most widely used sales channel for retailers. According to the ibi research study ‘Der Handel im Jahr 2021,’ some 78% of companies operate retail outlets, and more than half (55%) maintain online shops—another 16% plan to sell via online shops.

The share of retailers using an online marketplace is lower. But here, too, the signs are pointing to expansion. Some 15% of retailers are selling goods via eBay, and another 7% plan to do so. 17% sell through Amazon (4% planning to do so), 16% through another national marketplace (with another 11% planning to do so in the future). Local online marketplaces are used by only 8% of merchants, but 14% plan to use them in the future.

Faster market integration with a ready-made shop

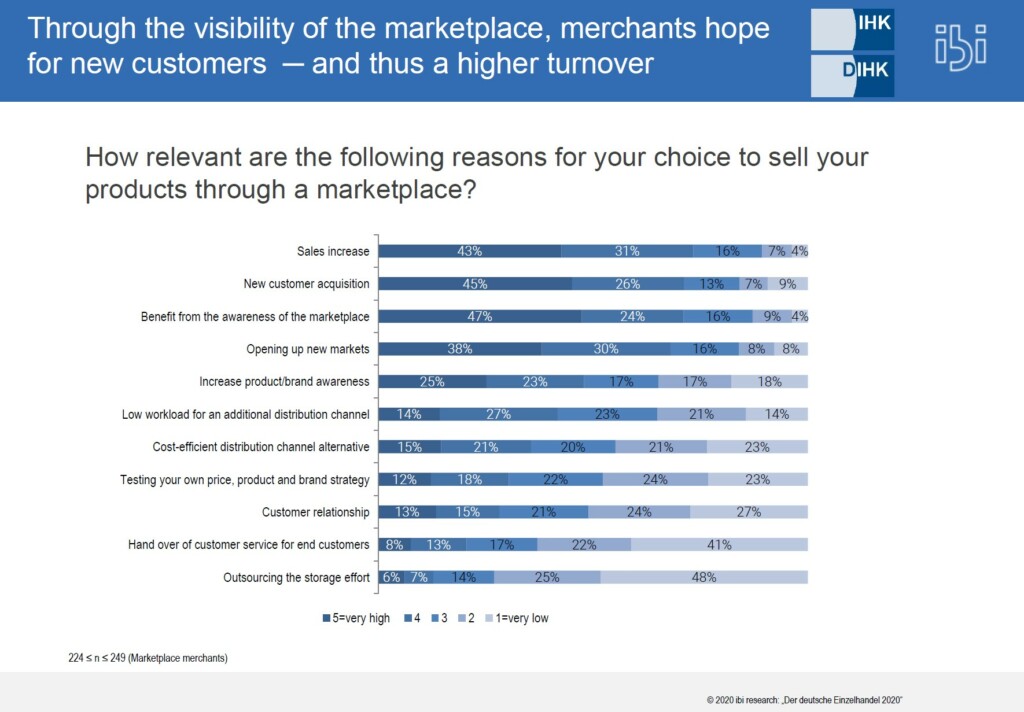

The popularity of online marketplaces makes them a good choice. For example, retailers who offer products via marketplaces aim to attract new customers and increase sales. Registration for a marketplace is also quick and easy. On the other hand, setting up an independent online shop requires planning and often a more significant investment. Many marketplaces offer a quick way to provide goods on an international scale.

Another fact that merchants need to be aware of, the new delivery thresholds have been applied in the EU since July 1, 2021. When a merchant exceeds EUR 10,000 in annual cross-border trade in the EU, he must pay VAT on these goods in the customer’s country. Our Merchant Dashboard offers a comprehensive overview. Merchants can see their turnover according to sales country and the respective shops and marketplaces.

Note on the studies used in this article:

The studies “Retailing in 2021” and “German Retailing in 2020” were published by ibi research, produced in Germany, and refer exclusively to the German retail sector.