Although the German economy was under massive pressure, it got off relatively lightly despite the corona pandemic. For 2023, however, the signs point to a storm. What should consumers in our country be prepared for? Helaba’s forecast is confident.

We are in crisis once again. But this time, it is different. For the first time, Germany is not only facing what is expected to be a mild recession. The gas and electricity prices will remain high after that, endangering the location’s competitiveness. This problem can only be solved in the medium term with a massive expansion of the energy supply for gas and electricity. New generation capacities are also necessary because of the climate protection-related electrification of industry, the vehicle fleet and heating systems.

Since the start of the Russian war of aggression in Ukraine, the ifo business climate has deteriorated significantly. The price explosion for gas, electricity and many raw materials is catapulting companies’ costs sky-high. Since these can only be passed on in part, production often becomes unprofitable.

At the same time, consumers and industrial buyers are holding back. These issues are concentrated in more than just Germany. The high inflation, partly due to a too-late reaction of important central banks, is a global phenomenon. Germany, as an important profiteer of international trade, is feeling this from the weak export development, also because the crisis is increasingly being fought with anti-globalisation measures.

The federal government is dampening the downturn with aid programmes. The three packages adopted have a volume of around 135 billion euros, or about 3 ½ % of economic output. The measures include:

- One-off payments for pensioners and students.

- The extension of housing benefit entitlement.

- The cold progression reduction.

In addition, there is the 200-billion-euro defence umbrella, which is intended to rescue companies in the energy industry on the one hand and to dampen gas prices on the other. This reduces uncertainty and contributes to economic improvement during 2023.

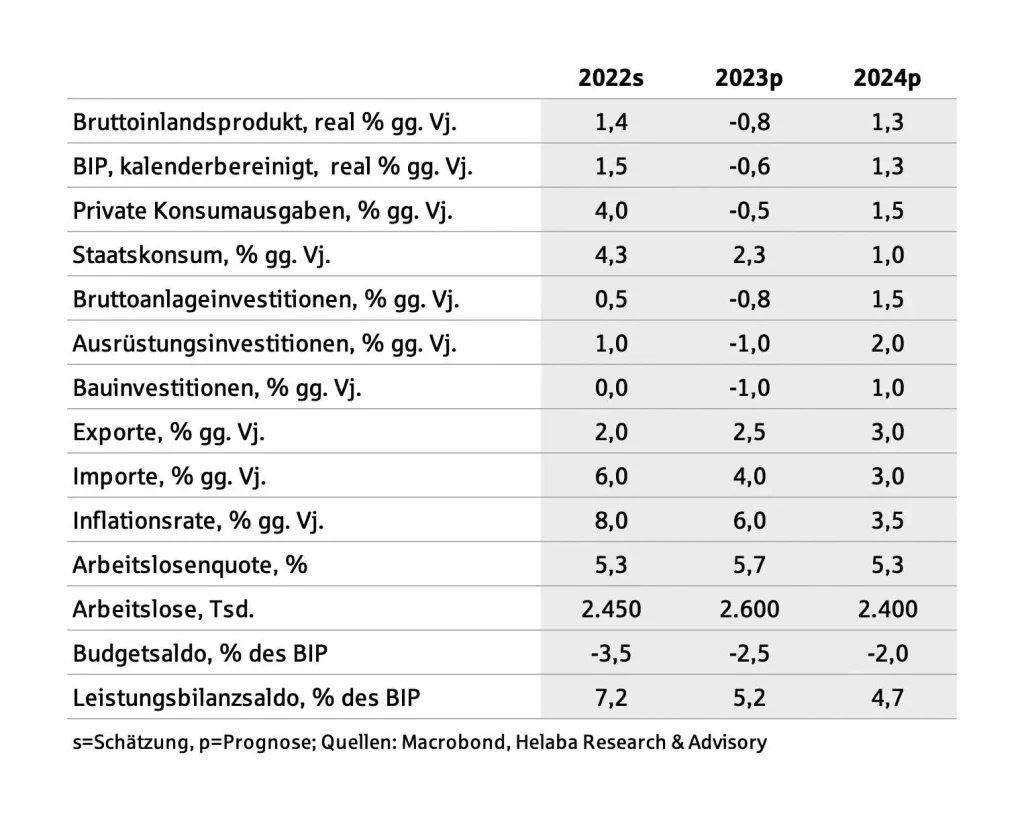

From spring onwards, the German economy should grow again. Nevertheless, an overall decline in the gross domestic product of 0.6% must be expected in 2023.

Inflation remains above 2 %

The gas price brake and the planned electricity equivalent will positively affect inflation rates at the beginning of 2023. However, this does not solve the inflation problem by a long shot. The high energy prices have long since “eaten into” the product groups on a broad scale. The significantly higher minimum wage since October 2022 and the increased wage settlements and demands add to the price pressure.

The increasing labour shortage and climate policy measures will lead to further price increases in the medium term. After an inflation rate of around 8% in 2022, another significant push of 6% is expected for 2023.

Declining real income of private households

Private consumption expenditure is estimated to have increased by 4% in 2022. The reason was the corona-related pent-up demand for many services. However, a trend reversal has already occurred during the year’s second half. Thus, retail sales are declining, and the general conditions have deteriorated.

Income increases cannot compensate for the high inflation, and the savings rate has fallen back to pre-2020 levels. Even though it is likely to decline further, the stimulus will be smaller. Employment has barely increased recently. However, the recent rise in unemployment is mainly because Ukrainians who have fled have been included in the unemployment statistics since June.

Even in 2023, collective wage agreements are unlikely to compensate for inflation with an increase of just under 5%. After the solid pandemic-related boost in monetary transfers, their growth will also be lower.

The incomes of the self-employed are even likely to fall, so that total disposable income will increase by an estimated 3.5% in nominal terms in 2023. This means a significant real contraction. Private consumption expenditure, however, is expected to fall by only 0.5%, as high savings will be released beforehand.

Equipment investment is estimated to have increased by 1% in 2022. However, they are still around 8% below the level before the Corona crisis. Economic uncertainty, declining corporate profits, and rising capital market interest rates initially lead to restraint in capital formation.

After all, the gas price brake for SMEs and industry will provide more certainty for energy costs, and companies will have to invest more in energy efficiency and digitalisation. Investments in machinery and equipment are thus likely to recover in 2023, although they will fall slightly on average for the year.

It remains to be said that although we are in for stormy times, they will remain bearable – as is usually the case with turbulence on a flight. Fasten your seatbelts!

Source: helaba.com