The role of these tariffs goes beyond simply generating revenue for governments. Tariffs are essential in protecting domestic industries from foreign competition, administering trade agreements, and sometimes as levers for economic policy decisions. They can affect the flow of goods between nations, shape market dynamics and impact global supply chains, ultimately affecting consumers and producers.

Customs Clearance Procedures in the European Union

Understanding the intricacies of the European Union (EU) customs clearance procedures is essential to conducting business within this vast, varied, and economically powerful region. Comprising 27 member countries, the EU operates under a unified customs system that standardises procedures, promotes efficient trade, and secures the safety and security of its economic space.

The single EU customs system

Since the EU functions as a single market, goods can generally move freely between member states once they have cleared customs in one country. This streamlined process is the product of the Union Customs Code (UCC), a framework adopted in 2016 to modernise customs procedures, make them more accessible, and facilitate more effective customs controls.

Proper Declaration and Customs Clearance

For goods imported into the EU, a customs declaration must be lodged. This declaration provides key information about the nature, origin, and value of imported goods. It also indicates the chosen customs-approved treatment or use, for instance, whether the goods are to be released for free circulation or whether they are to be put under a special procedure, such as temporary storage or customs warehousing.

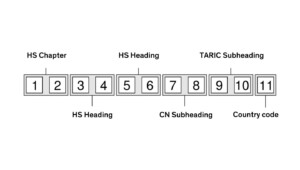

An important consideration is providing the correct commodity code, the Harmonised System (HS) code. This numerical identifier is recognised internationally and helps customs authorities determine the duties or controls applicable to the goods.

VAT and excise duties

In addition to customs duties, imported goods are subject to VAT. If they are goods such as alcohol, tobacco or energy products, they may be subject to excise duty. VAT and excise duty rates vary between EU Member States. They must be paid to the respective national authority.

Customs agents

Given the complexity of customs clearance procedures, many companies hire customs agents. These professionals are well-versed in EU regulations, can classify and declare goods, and liaise with customs officials on behalf of the importer or exporter. Agents can significantly ease the process of customs clearance, ensuring compliance and avoiding costly errors or delays.

Electronic customs systems

The EU has promoted electronic customs systems to increase efficiency, such as the Automated Import and Export System and the Import Control System (ICS).

Automated clearance

Automated systems speed up customs clearance by reducing manual data entry, minimising errors and accelerating the clearance process overall. The Automated Import and Export System (AES), for example, is an electronic declaration system that enables faster customs clearance and immediate release of goods. The Import Control System (ICS) is an EU-wide platform that enables the early filing and processing of security data on goods entering the EU (ICS).

Special regulations

Depending on the nature of the goods and the business operations, customs procedures and special regimes can be applied, which may result in duties relief or deferral. These include inward and outward processing, temporary admission, transit, customs warehousing, and free trade zones.

Regulation and Compliance

EU customs regulations are designed to prevent illegal trade, ensure security, protect consumers, and maintain fair trading conditions. Compliance with these regulations is monitored through customs controls. These controls include checks on goods, transport equipment, business records, and even premises used concerning goods.

Basics of Customs Tariffing

A customs tariff is a tax on goods traversing international borders. However, the simple definition belies a system of immense complexity and significance in international trade. Far from being merely a means of revenue generation for national governments, customs tariffs play a pivotal role in economic policy, impacting domestic industries, international relations, and market dynamics.

Customs tariffs adopt various structures, with the three most prevalent forms being ad valorem, specific, and compound tariffs. Each has its unique methodology and implications for international trade.

Ad Valorem Tariffs

Ad valorem tariffs, Latin for “according to value,” are calculated as a percentage of the customs value of the imported goods. They provide a proportional framework that scales with the commodity’s price, ensuring higher-value goods attract higher tariffs. This system aligns with the principles of fairness and ability-to-pay in taxation.

Specific Tariffs

In contrast, specific tariffs are a fixed fee levied on each unit of imported goods or per specific measure like weight or volume, independent of its price. This system is often used for commodities where value variation is less significant or is crucial to protect domestic producers from cheaper imports.

Compound Tariffs

Lastly, compound tariffs represent a blend of the types above, involving a fixed fee per unit and a percentage of the goods’ value. This dual-structure tariff provides greater flexibility and can better address complex trade scenarios.

The impact and purpose of these tariffs are manifold. On the one hand, they can protect domestic industries from foreign competition, fostering local production and employment. On the other, they can influence economic behaviour, such as discouraging the import of certain goods or encouraging trade with specific countries. Moreover, they serve as a crucial source of government revenue, particularly for developing economies.

However, tariffs also have their drawbacks. Higher costs of imported goods can translate to increased prices for consumers. They can potentially stifle competition, leading to less efficiency in the domestic market. Furthermore, they can provoke retaliatory actions from other countries, sparking trade wars that may have wide-ranging economic consequences.

The European Customs Tariffs

The European Union represents a unique entity in the global economic landscape. It operates as a single market with free movement of goods, services, capital, and labour, underpinned by a shared legal system that governs its internal policies.

The Common Customs Tariff: A Key Pillar of EU’s Trade Policy

At the heart of the EU’s trade policy is the Common Customs Tariff (CCT). This standardised system of duties applicable to goods imported into the EU’s Customs Union ensures uniform tariffs across all member states. The CCT is the EU’s primary tool for regulating trade with non-EU countries, protecting domestic industries, and generating revenue.

Role of the European Commission in Tariff Determination and Implementation

The European Commission, the EU’s executive arm, is crucial in determining and implementing the CCT. The Commission proposes tariff rates, subject to negotiation and agreement by member states in the Council of the EU, often following consultation with the European Parliament. Once agreed, the Commission is responsible for implementing the tariff alongside national customs authorities, who collect the duties at the point of import.

The Influence of the CCT on the EU’s Trade Policy

The CCT is a vital component of the EU’s trade policy, shaping the cost of imports and thus influencing consumer prices and market competition within the Union. It is also an essential tool in the EU’s international trade negotiations, with potential tariff reductions typically used as leverage in negotiations for trade agreements.

The EU’s Integrated Tariff: TARIC

Navigating the EU’s tariff schedule necessitates a comprehensive understanding of its Integrated Tariff (TARIC). This complex database provides crucial information about the duties and measures applicable to specific types of goods imported into the EU.

TARIC, an acronym derived from the French “Tarif Intégré de la Communauté,” is a multilingual database encompassing all tariff, commercial, and agricultural legislation measures. Its comprehensive nature allows for a transparent and predictable system of classification that facilitates international trade.

Navigating TARIC: Product Codes, Duty Rates, and Additional Codes

The TARIC system uses product codes, known as Combined Nomenclature (CN) codes, to identify and categorise goods. These 8-digit codes, which can be extended to 10 or 14 digits to provide further specificity, enable traders to determine the exact duty rates applicable to their goods. The TARIC database also includes additional codes to indicate other measures, such as anti-dumping duties or restrictions on certain goods.

Example:

For instance, let us assume a business wants to import leather handbags into the EU. The CN code for these products is 42022100. Upon entering this code into the TARIC database, the company can identify the customs tariff, which as of 2023 is 3.0% under the CCT, along with any additional charges or trade measures. This way, businesses can calculate the landed cost of their goods and make informed decisions.

Preferential Measures in EU Customs

Preferential measures in customs, specifically within the European Union (EU), present an opportunity for certain countries to enjoy reduced or zero customs duties when trading with EU member states. This fosters global trade and supports developing economies and countries with which the EU has special trade agreements. The following account details the essence of these preferential measures and the means to their application.

The Essence of Preferential Origin

Preferential measures in customs are tied to the concept of ‘preferential origin’. Goods are considered to have preferential origin if they fully comply with specific rules defined by the EU. These rules primarily focus on the location of production or processing, thereby enabling particular countries to enjoy reduced tariff barriers.

Proof of Preferential Origin

Exporters need to provide proof of preferential origin to benefit from preferential measures. This usually takes the form of a movement certificate (EUR.1 or EUR-MED) or a statement of origin for consignments below a specific value. It’s important to note that the proof of origin remains valid for 12 months from the issue date.

Verification Process

The EU carries out a verification process to ensure compliance with preferential measures and rules of origin. Suppose the customs authorities doubt the authenticity or correctness of a proof of origin. In that case, they may request verification from the exporting country.

The Impact of Trade Agreements on EU’s Tariffs

Trade agreements are pivotal in shaping the international flow of goods and services. Free Trade Agreements (FTAs) and Preferential Trade Agreements (PTAs) are particularly noteworthy, significantly affecting the customs tariffing landscape.

Understanding Free Trade Agreements and Preferential Trade Agreements

FTAs and PTAs are bilateral or multilateral agreements between countries that reduce or eliminate barriers to trade, including customs tariffs. While FTAs typically aim to reduce trade barriers across all sectors comprehensively, PTAs provide preferential access to certain goods from specific countries, often to support developing economies.

The EU’s Major FTAs and PTAs and Their Impact on Tariffs

The EU has an extensive network of FTAs and PTAs, including prominent agreements with Canada (CETA), Japan (EPA), and a series of agreements with developing countries under the Generalised Scheme of Preferences (GSP). These agreements reduce or eliminate tariffs on a wide range of goods, lowering the costs of imports for businesses and consumers within the EU. For instance, 98.6% of tariff lines for goods entering the EU from Canada are duty-free under CETA.

Brexit and Its Influence on the EU-UK Tariff Landscape

The United Kingdom’s departure from the European Union, commonly called Brexit, has sent significant ripples through international trade and customs tariffs.

Brexit formally occurred on January 31, 2020, ending the UK’s 47-year membership in the EU. This withdrawal has necessitated a complete reconfiguration of the trade relationship between the UK and the EU, including establishing new customs tariffs.

Post-Brexit Tariffs and Trade Relations

Following the end of the transition period in December 2020, a new Trade and Cooperation Agreement (TCA) was established, laying out the UK-EU relationship’s terms. Under this agreement, trade in goods between the two parties remains largely tariff-free, provided the goods meet the relevant rules of origin requirements.

Beyond the immediate impact on tariffs, Brexit has introduced new trade frictions, such as increased paperwork and checks at the border. This has led to additional costs for businesses and has disrupted trade flows, particularly in the early months following the end of the transition period.

Resolving Tariff Disputes: The Role of WTO and the EU

In global trade, tariffs fluctuate, and disputes can often arise. Understanding how to navigate these changes and resolve disagreements is paramount for businesses.

The Role of the WTO in Resolving Tariff Disputes

The World Trade Organization (WTO) plays a leading role in resolving tariff disputes. Its Dispute Settlement Mechanism is a well-established process through which WTO members can resolve trade disagreements. This process can result in the removal of trade barriers or, in some cases, the granting of compensation or retaliation rights.

The EU’s Response to Tariff Changes and Disputes

The European Commission is responsible for addressing tariff disputes and adapting to tariff changes within the EU. It negotiates with other countries at a multilateral level within the WTO or bilaterally within the framework of its numerous trade agreements. Moreover, it can impose protective measures, such as anti-dumping duties, to protect EU industries from unfair trade practices.

The Future of Tariffing and International Trade in the EU

The world of customs tariffing is set to evolve in response to geopolitical shifts, technological advancements, and changing economic priorities. The principles and mechanisms we have discussed will remain essential guideposts as the EU navigates these changes.

However, one thing is sure: the importance of customs tariffing in shaping the international trade landscape will remain undiminished. As businesses, policymakers, and scholars alike grapple with the challenges and opportunities of this complex system, understanding its workings will be more critical than ever.