Nobody saw it coming: surprisingly, the German government announced on 3 June 2020 the reduction of the value-added tax to 16 or 5%. Valid from July and limited to six months. An economical package with a “bang”. But what does this “bang” mean in its implementation?

Retailers are now talking about “immense effort” and “torture” (Handelsblatt, 5 June 2020); “VAT chaos” is already being predicted because all this is “hardly manageable” (welt.de, 6 June 2020). The programmes and systems used must be brought up to the standards applicable from July, prices must be recalculated by then, and stationary trade must re-label products in its stores. In January, everything has to be reversed.

A core function of the business

“This pretty much describes a core function of our business,” comments ClearVAT’s founder and CEO, Roman Maria Koidl. ClearVAT enables online merchants to sell their goods cross-border within the EU, considering the applicable value-added tax. “We have developed a VAT engine for this purpose that knows all the VAT rates and product exemptions that apply in Europe. Our VAT Engine dynamically keeps the associated online shops up to date”.

Even if they are only valid for six months, the reduced tax rates must be considered on the merchants’ invoices. Of course, this also applies to online traders in the EU who ship their goods to Germany. This is a great effort, which is punished with financial losses if implemented incorrectly.

ClearVAT’s VAT Engine, on the other hand, plays updates on applicable VAT rates directly into the merchant’s shop. Manual intervention is not necessary. In addition to the regular tax rates, to which the VAT Engine can assign more than 450,000 products, numerous exceptions and regional peculiarities must be considered. Should other EU countries follow Germany’s example, ClearVAT’s VAT Engine will deliver such temporary changes dynamically to connected merchant shops and systems.

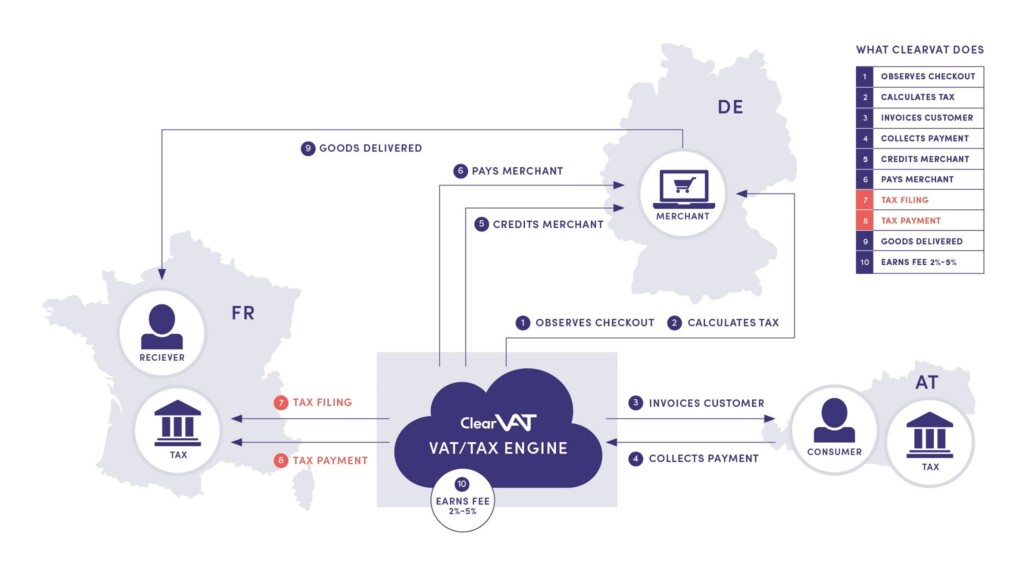

This is how ClearVAT works

ClearVAT provides e-commerce and mail-order companies with a plug-in for their shop systems. The plug-in enables the connection to ClearVAT’s VAT Engine, which includes information on the applicable tax rates and the assigned articles in the EU-27 and, in a first step, automatically compares these with the merchant’s inventory. The respective article is displayed on the retailer’s product page, including the VAT of the country where the customer is currently located (product: DISPLAY). The merchant thus fulfils the requirements of the Price Indication Ordinance (§1 para. 2 PAngV).

Threshold control monitors the currently valid thresholds where the merchant can apply the country of origin principle. If a threshold value is soon reached, information will be provided on the need for taxation in the destination country.

Example: A customer from Austria orders goods in a German online shop for his French friend.

Plug-in recognizes cross-border deliveries

The plug-in also recognizes whether the delivery is a cross-border delivery. If this is the case, ClearVAT then collects the main amount from the consumer, automatically pays the VAT to the respective tax authority in the country of destination, reimburses the merchant with the corresponding difference, less commission fee, and settles the invoice at flexible intervals (product: COLLECT & CLEAR).

A reconciliation engine handles all transactions. Incoming payments, therefore, can be reconciled manually. For major customers, there is the option of three-way integration: the merchant’s ERP system is also directly connected to SAP S4/Hana or ClearVAT. Therefore, nothing stands in the way of paperless document exchange and automated reconciliation of accounts.