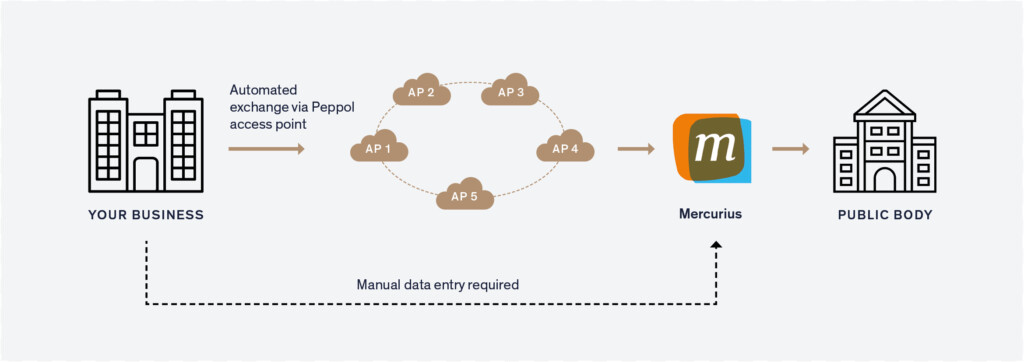

These electronic invoices aim to combat tax evasion by transparently transmitting all invoices to the competent authorities. All relevant invoices must therefore be issued and sent via PEPPOL, a European platform for data exchange with authorities.

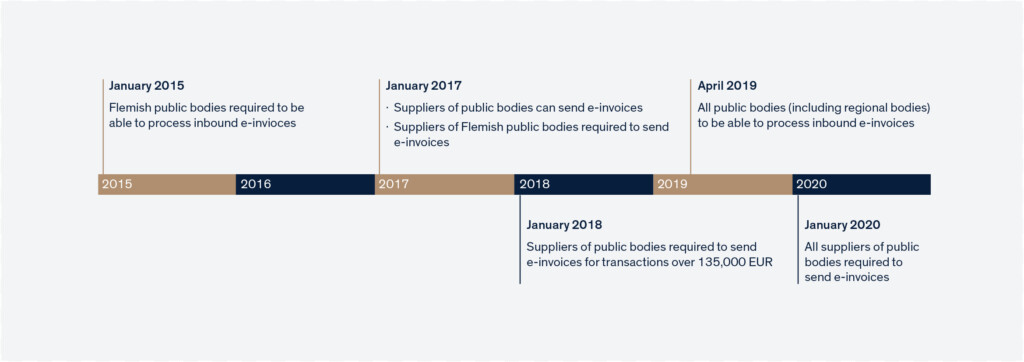

The mandatory e-invoice will be introduced gradually, depending on the estimated value of public contracts:

- For public contracts put out to tender on or after 1 November 2022 with an estimated value equal to or above the European threshold;

- For public contracts put out to tender on or after 1 May 2023 with an estimated value of EUR 30,000 or more (excluding VAT);

- On 1 November 2023, all other public contracts will follow, except for contracts below the threshold of EUR 3,000 (excluding VAT), which are, in principle, tax-exempt.

Source: bdo.be