As early as 1 January 2020, specifying the valid VAT identification number (VAT ID) of the recipient of a delivery (B2B) as part of a complete recapitulative statement is an explicit requirement for the tax exemption of intra-Community deliveries (regulated in the Quick Fixes to the EU VAT reform).

The supplier must ensure the client’s VAT ID is valid during delivery. In case of non-compliance, the tax exemption of the B2B transaction is not applicable.

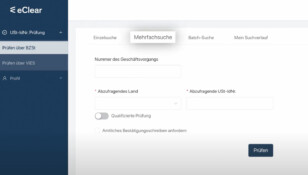

With the CheckVAT ID web application, individual and multiple VAT identification numbers can be checked simultaneously, and the results documented in an audit-proof manner.

„Any irregularities can be quickly coordinated with our partners.“

“By using CheckVAT ID, it is now effortless to regularly check all open orders. Any irregularities can be quickly coordinated with our partners,” says Christian Henkel, Vice President Finance at Ruhrpumpen GmbH. As one of the leading pump companies, Ruhrpumpen has installed over 70,000 pumping solutions in more than 90 countries worldwide. To comply with the verification and proof obligations for intra-community deliveries, Ruhrpumpen GmbH now relies on CheckVAT ID.

AHP Merkle is also utilising CheckVAT ID. The family-run company has been developing and designing hydraulic cylinders for demand worldwide since 1973. With sales offices in Italy, Portugal, or China, AHP Merkle uses CheckVAT ID to process its commercial transactions with European customers: “By using CheckVAT ID, we can check the VAT numbers of our European customers quickly and with little effort. The ability to check entire files is a real labour-saver,” confirm Lena Schopp and Claudia Meier, Dispatching Team.

„The ability to check entire files is a real labour-saver.“

CheckVAT ID can be used platform-independently without integration because the application runs browser-based. The data required for the check is obtained from the Federal Central Tax Office (BZSt), the European Commission’s VAT Information Exchange System (VIES) and the Federal Ministry of Finance in Austria (BMF). Single and multiple searches are possible, and the batch search allows extensive queries via CSV data upload. The audit results are kept audit-proof. They can be retrieved for ten years to provide documentation data.